Insight into Smead Value Fund (Trades, Portfolio)'s Recent Investment Decisions

Smead Value Fund (Trades, Portfolio) recently submitted its N-PORT filing for the second quarter of 2025, revealing strategic investment decisions made during this period. Smead Capital Management, the adviser to the Smead Value Fund (Trades, Portfolio), caters to a diverse clientele, including individuals, advisors, family offices, and institutions worldwide. The fund primarily invests in U.S. large-cap companies and offers various share classes, including Investor Share Class (SMVLX) and A Share Class (SVFAX). Managed by Lead Portfolio Manager Bill Smead and Co-Portfolio Manager Cole Smead, CFA, the fund focuses on long-term capital appreciation through concentrated positions, typically holding 25-30 companies. Smead's investment philosophy emphasizes eight criteria, including economic need, competitive advantage, profitability, and shareholder-friendly management.

Summary of New Buy

Smead Value Fund (Trades, Portfolio) added a total of one stock to its portfolio, with the most significant addition being Diamondback Energy Inc (FANG, Financial). The fund acquired 940,548 shares, which now account for 3.03% of the portfolio, with a total value of $126.55 million.

Key Position Increases

Smead Value Fund (Trades, Portfolio) also increased its stakes in a total of five stocks. Notably, the fund increased its position in Cenovus Energy Inc (TSX:CVE, Financial) by 2,799,926 shares, bringing the total to 14,595,036 shares. This represents a 23.74% increase in share count and a 0.88% impact on the current portfolio, with a total value of C$192,282,040. The second-largest increase was in Western Alliance Bancorp (WAL, Financial), with an additional 185,513 shares, bringing the total to 1,280,986. This adjustment signifies a 16.93% increase in share count, with a total value of $92,756,200.

Summary of Sold Out

During the second quarter of 2025, Smead Value Fund (Trades, Portfolio) completely exited one holding: Berkshire Hathaway Inc (BRK.B, Financial). The fund sold all 172,002 shares, resulting in a -1.65% impact on the portfolio.

Key Position Reduces

Smead Value Fund (Trades, Portfolio) reduced its position in 24 stocks, with significant changes including a reduction in American Express Co (AXP, Financial) by 327,912 shares, resulting in a -29.34% decrease in shares and a -1.85% impact on the portfolio. The stock traded at an average price of $271.38 during the quarter, returning 18.63% over the past three months and 4.57% year-to-date. Additionally, the fund reduced its position in Devon Energy Corp (DVN, Financial) by 2,625,662 shares, resulting in a -55.06% reduction in shares and a -1.78% impact on the portfolio. The stock traded at an average price of $32.64 during the quarter, with returns of 8.37% over the past three months and 3.64% year-to-date.

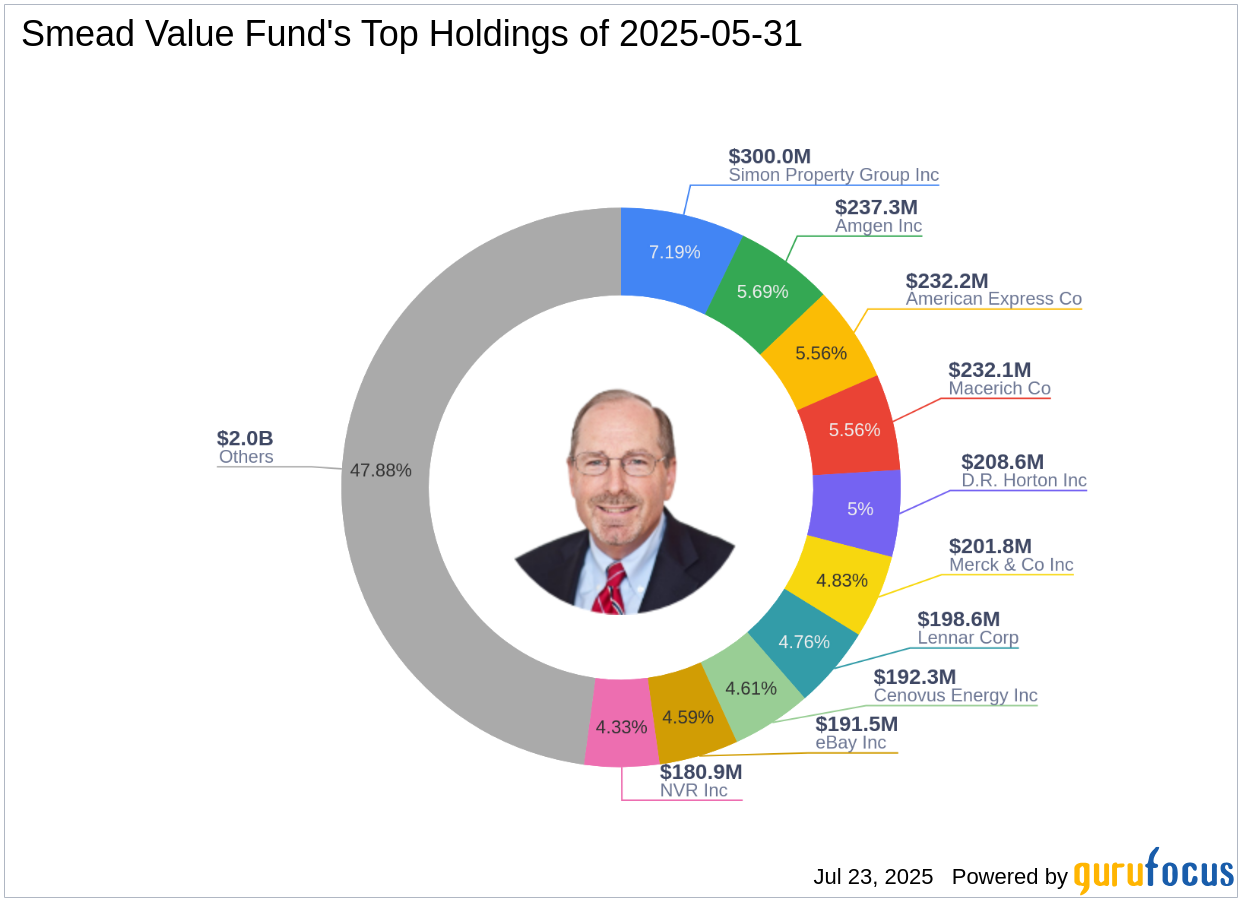

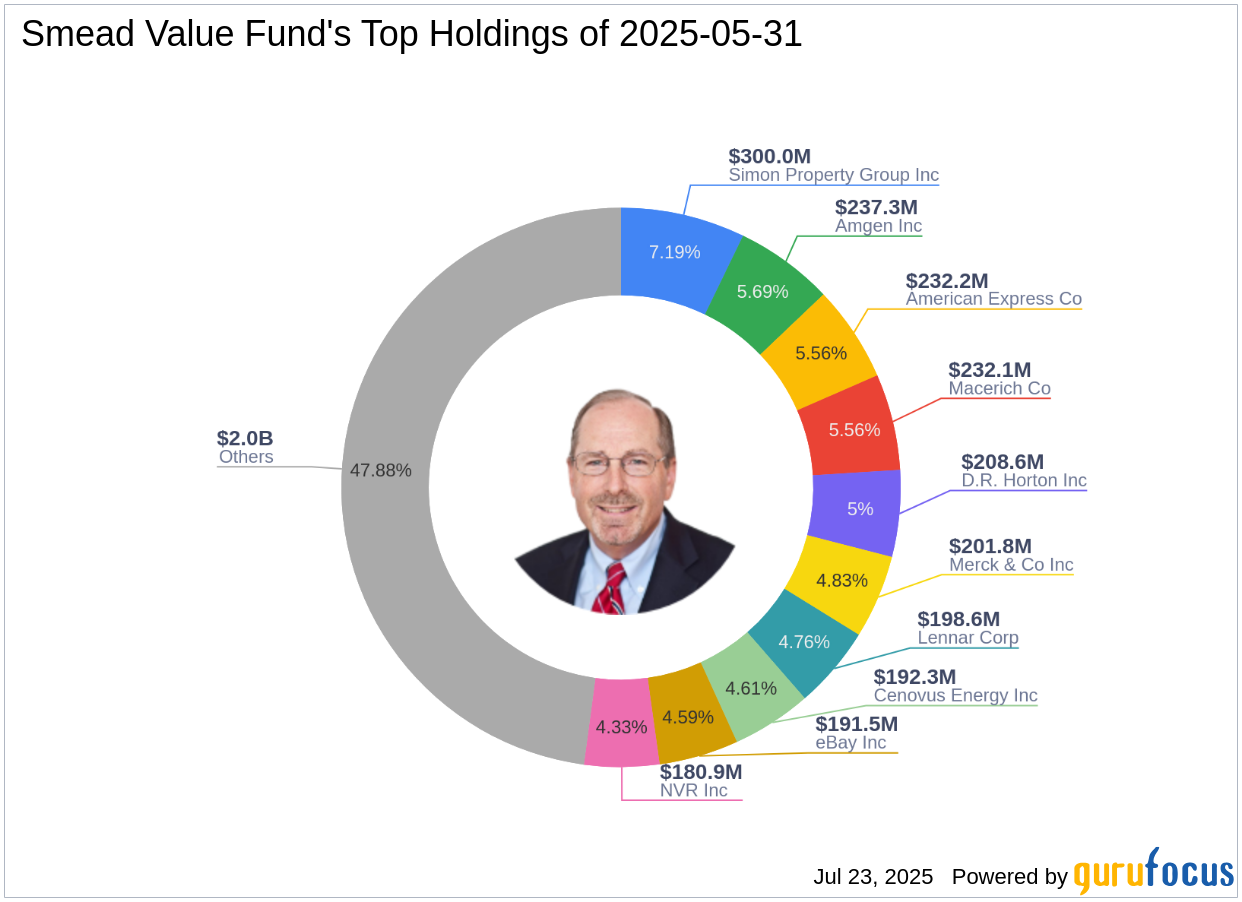

Portfolio Overview

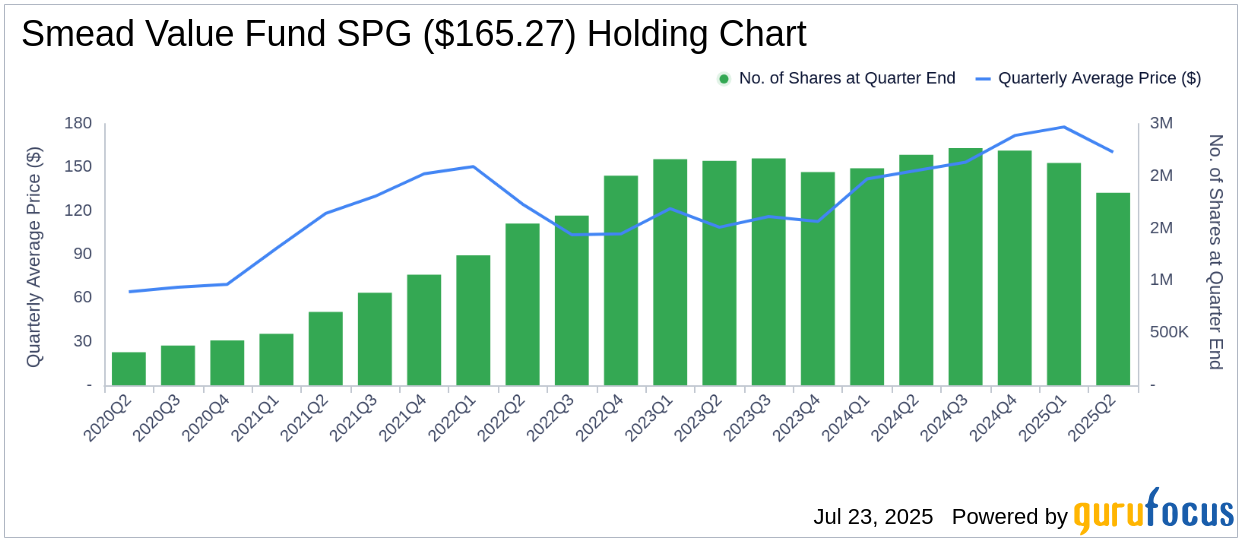

As of the second quarter of 2025, Smead Value Fund (Trades, Portfolio)'s portfolio comprised 30 stocks. The top holdings included 7.19% in Simon Property Group Inc (SPG, Financial), 5.69% in Amgen Inc (AMGN, Financial), 5.56% in American Express Co (AXP, Financial), 5.56% in Macerich Co (MAC, Financial), and 5% in D.R. Horton Inc (DHI, Financial).

The fund's holdings are primarily concentrated in nine of the eleven industries: Consumer Cyclical, Energy, Financial Services, Real Estate, Healthcare, Industrials, Consumer Defensive, Technology, and Communication Services.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.