Summary:

- General Dynamics (GD, Financial) posted impressive Q2 2025 results, showcasing strong financial performance.

- Analysts predict a slight downside in GD's stock with a balanced perspective on future growth.

- The company maintains a robust position with significant order bookings and an "Outperform" status.

General Dynamics (GD) has delivered outstanding Q2 2025 results, marking a notable financial achievement. The company's earnings per share were reported at $3.74, bolstered by revenues that soared to $13 billion. A 13% increase in operating earnings to $1.3 billion highlights the company's operational efficiency and strategic prowess. Moreover, General Dynamics recorded a commendable book-to-bill ratio of 2.2, with order bookings exceeding $28 billion, underscoring its industry strength.

Wall Street Analysts Forecast

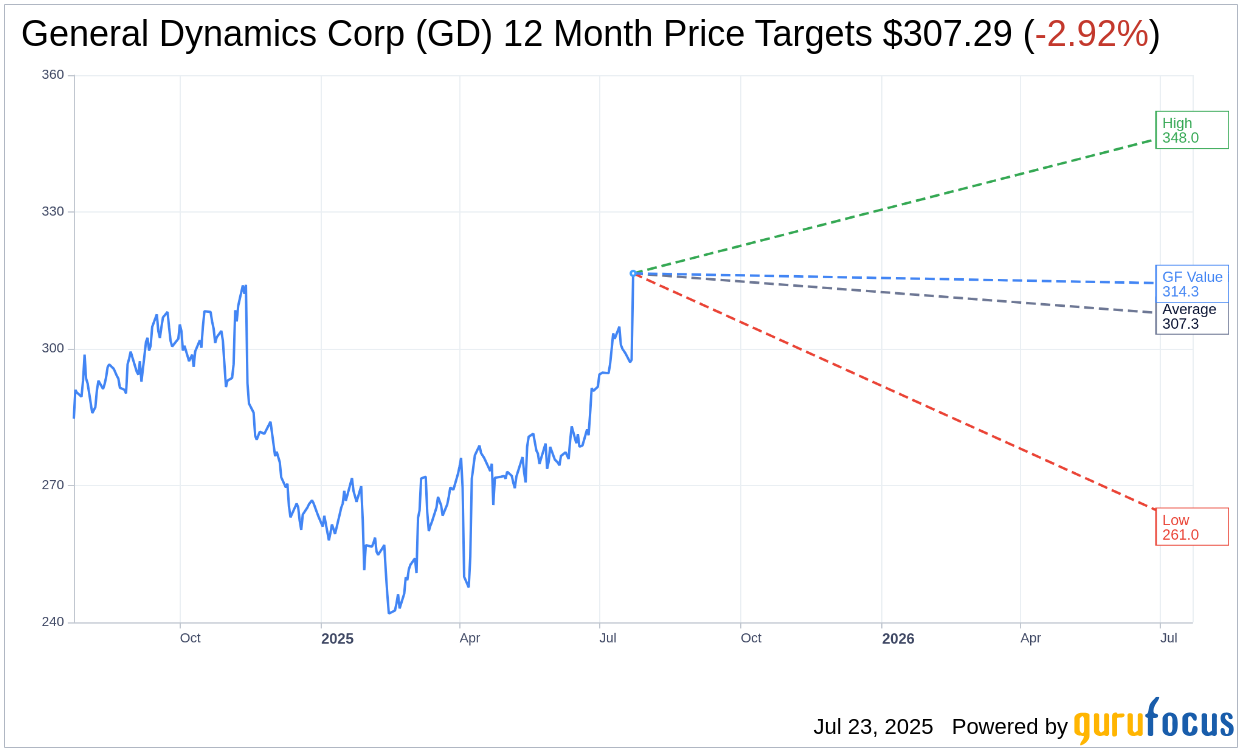

Wall Street analysts have set one-year price targets for General Dynamics Corp (GD, Financial), with an average price of $307.29. These projections range from a high estimate of $348.00 to a low of $261.00. This average target suggests a potential downside of 2.92% compared to the current stock price of $316.54. Investors can explore more detailed estimate data on the General Dynamics Corp (GD) Forecast page.

The consensus among 24 brokerage firms positions General Dynamics Corp's (GD, Financial) average brokerage recommendation at 2.5, indicating an "Outperform" status. This rating is based on a scale where 1 signifies a Strong Buy, and 5 represents a Sell, reflecting positive sentiment around the stock.

According to GuruFocus estimates, the one-year GF Value for General Dynamics Corp (GD, Financial) is projected at $314.26. This suggests a slight downside of 0.72% from the current price of $316.54. The GF Value is a calculated estimate reflecting the fair market value of the stock, derived from historical trading multiples, past business growth, and future performance projections. For further detailed insights, visit the General Dynamics Corp (GD) Summary page.