Key Highlights:

- TD Bank (TD, Financial) is set to increase in-office work for staff, aligning with other Canadian banks.

- Analysts predict a slight downside in stock value, with an average price target of $72.49.

- The stock currently holds an "Outperform" recommendation from major brokerage firms.

Toronto-Dominion Bank (TD) is gearing up to bolster its in-office work policy, mandating executives to be present four days a week by October 6. This requirement will extend to all employees beginning November 3, reflecting similar trends among other prominent Canadian banks.

Wall Street Analysts' Forecast

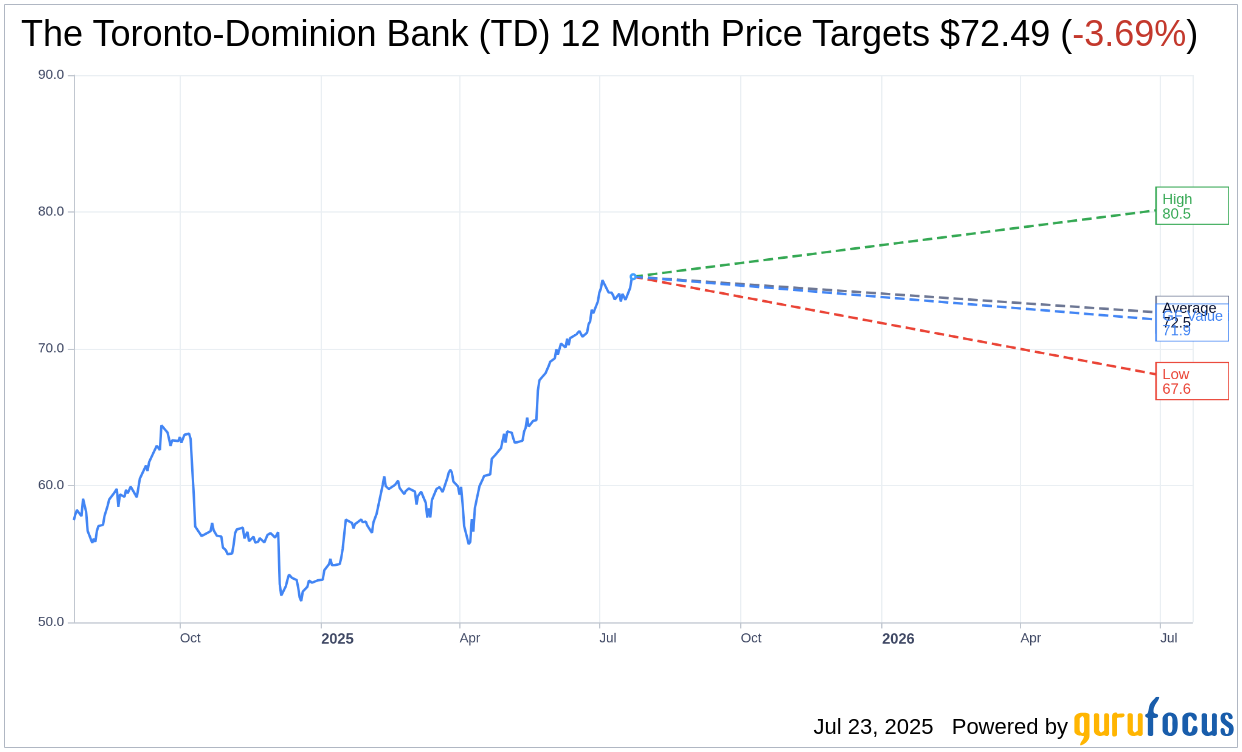

According to projections from six analysts, the one-year price target for The Toronto-Dominion Bank (TD, Financial) averages at $72.49. This estimate suggests a potential high of $80.46 and a low of $67.64. The calculated average indicates a slight downside of 3.69% from its current trading price of $75.27. For a more in-depth analysis, investors can refer to the detailed data on the The Toronto-Dominion Bank (TD) Forecast page.

Meanwhile, insights from 12 brokerage firms reveal that The Toronto-Dominion Bank's (TD, Financial) average brokerage recommendation currently stands at 2.3, which corresponds to an “Outperform” status. This rating is based on a scale where 1 signifies a Strong Buy, and 5 indicates a Sell.

Further, according to GuruFocus estimates, the GF Value for The Toronto-Dominion Bank (TD, Financial) in the upcoming year stands at $71.92. This figure implies a projected downside of 4.44% from its current stock price of $75.265. The GF Value represents GuruFocus' estimation of a stock's fair trading value, derived from historical trading multiples, past business growth, and future business performance forecasts. To explore additional data, visit the The Toronto-Dominion Bank (TD) Summary page.