On July 23, 2025, CSX Corp (CSX, Financial) released its 8-K filing detailing its second quarter 2025 financial results. The company, a leading Class I railroad operating in the Eastern United States, reported a revenue of $3.57 billion, which fell short of the analyst estimate of $3.58345 billion. However, the earnings per share (EPS) of $0.44 exceeded the estimated EPS of $0.42. CSX Corp (CSX) generated approximately $14.5 billion in revenue in 2024, operating over 21,000 miles of track and transporting a diverse range of goods including coal, chemicals, intermodal containers, and automotive cargo.

Performance and Challenges

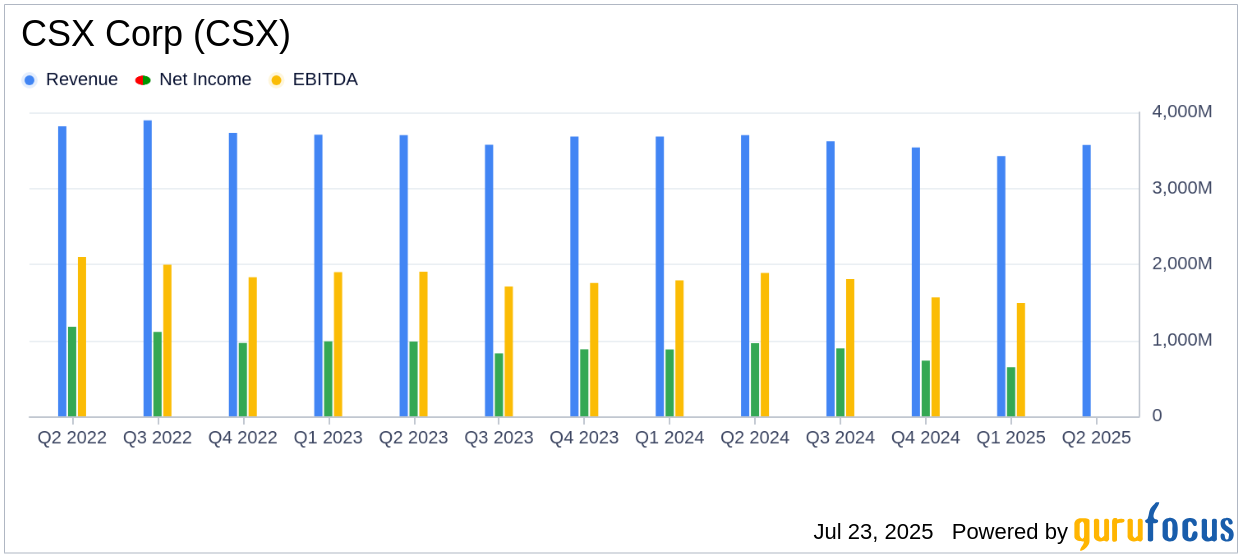

CSX Corp (CSX, Financial) reported a decrease in operating income to $1.28 billion, down from $1.45 billion in the same quarter last year. The net income also declined to $829 million from $963 million year-over-year. The total volume of shipments remained flat compared to the second quarter of 2024, although it increased by 4% sequentially. The company faced challenges such as lower export coal prices, reduced fuel surcharges, and a decline in merchandise volume, which contributed to the 3% year-over-year decrease in revenue.

Financial Achievements and Industry Importance

Despite the revenue challenges, CSX Corp (CSX, Financial) achieved an EPS of $0.44, surpassing the analyst estimate of $0.42. This achievement is significant for the transportation industry, as it highlights the company's ability to manage costs and improve efficiency even in a challenging market environment. The operating margin for the quarter was 35.9%, a decrease of 320 basis points year-over-year but an improvement of 550 basis points sequentially.

Key Financial Metrics

CSX Corp (CSX, Financial) reported a revenue of $3.57 billion for the quarter, a decrease from the previous year. The operating income was $1.28 billion, reflecting an 11% decline compared to the same period in 2024. The company's EPS of $0.44 represents a 10% decrease from the prior year but a 29% increase from the previous quarter. These metrics are crucial for evaluating the company's financial health and operational efficiency.

“The skill and commitment of CSX’s railroaders enabled us to deliver significant sequential improvements in network fluidity and cost efficiency that are apparent in our financial results,” said Joe Hinrichs, president and chief executive officer.

Analysis and Outlook

CSX Corp (CSX, Financial) demonstrated resilience in the face of revenue challenges by exceeding EPS expectations. The company's focus on improving network fluidity and cost efficiency contributed to its financial performance. However, the decline in revenue and operating income highlights the ongoing challenges in the transportation industry, particularly in select industrial markets. The company's commitment to completing major infrastructure projects positions it for future growth opportunities.

Explore the complete 8-K earnings release (here) from CSX Corp for further details.