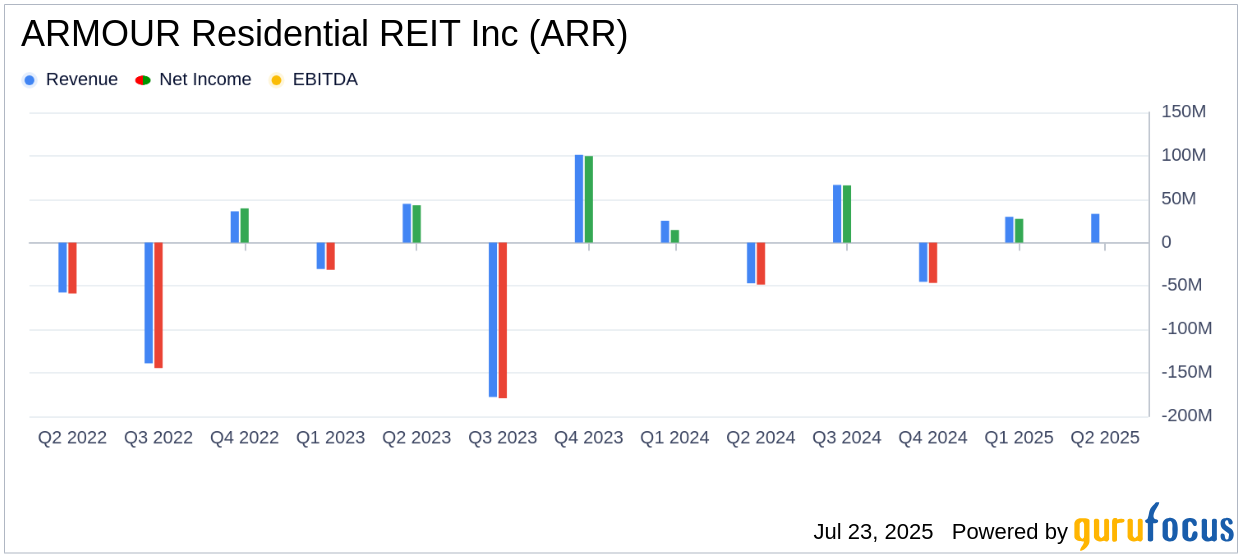

On July 23, 2025, ARMOUR Residential REIT Inc (ARR, Financial) released its 8-K filing detailing its unaudited financial results for the second quarter of 2025. ARMOUR Residential REIT Inc operates in the U.S., investing primarily in fixed rate residential, adjustable rate, and hybrid adjustable rate residential mortgage-backed securities (MBS) issued or guaranteed by U.S. Government-sponsored enterprises or guaranteed by Ginnie Mae. The company also invests in U.S. Treasury Securities and money market instruments.

Q2 2025 Financial Performance

ARMOUR Residential REIT Inc reported a GAAP net loss of $(78.6) million, translating to a loss of $(0.94) per common share, which fell short of the analyst estimate of $0.20 earnings per share. The company's net interest income stood at $33.1 million, while distributable earnings available to common stockholders were $64.9 million, or $0.77 per common share. This non-GAAP measure provides a more stable view of earnings, which is crucial for dividend stability.

Financial Achievements and Challenges

Despite the net loss, ARMOUR Residential REIT Inc achieved a significant milestone by raising $104.6 million through an at-the-market offering program, issuing 6,303,710 shares of common stock. This capital raise is vital for maintaining liquidity and supporting future investments. However, the company's book value per common share decreased to $16.90 from $18.59 at the end of the previous quarter, reflecting a total economic return of (5.22)% for Q2 2025.

Key Financial Metrics

The company's portfolio totaled $15.4 billion, with 94.1% in Agency MBS, 3.9% in U.S. Treasury Securities, and 2.0% in To Be Announced (TBA) Securities. The debt to equity ratio was 7.72:1, indicating a high level of leverage, which is typical for REITs but also poses risks in volatile interest rate environments. The economic net interest spread was 1.82%, derived from an economic interest income of 4.78% and an economic interest expense of 2.96%.

Income Statement and Balance Sheet Highlights

| Metric | Q2 2025 | Q1 2025 |

|---|---|---|

| GAAP Net Loss | $(78.6) million | Not Provided |

| Net Interest Income | $33.1 million | Not Provided |

| Book Value per Share | $16.90 | $18.59 |

Analysis and Commentary

The decrease in book value per share and the net loss highlight the challenges ARMOUR Residential REIT Inc faces in the current economic climate, particularly with fluctuating interest rates impacting mortgage-backed securities. The company's strategy to raise capital and maintain liquidity is crucial for navigating these challenges. The high leverage ratio, while common in the industry, requires careful management to mitigate risks associated with interest rate changes.

The Company's external manager waived a portion of its contractual management fee at the rate of $1.65 million per quarter for each of Q2 2025 and Q1 2025," highlighting efforts to manage costs effectively.

ARMOUR Residential REIT Inc's focus on maintaining a stable dividend through distributable earnings is a positive aspect for investors seeking income stability. However, the company's performance underscores the importance of monitoring interest rate trends and their impact on the REIT's portfolio and financial health.

Explore the complete 8-K earnings release (here) from ARMOUR Residential REIT Inc for further details.