- IBM's second-quarter earnings surpassed expectations, driven by AI services growth.

- Analysts predict a modest downside in stock price with a mixed consensus on performance.

- The estimated GF Value suggests a possible correction from current trading levels.

IBM (IBM, Financial) significantly exceeded market expectations in its second-quarter earnings report. Non-GAAP earnings per share came in at $2.80, which was $0.15 above analyst estimates. Additionally, IBM's revenue reached $17 billion, surpassing forecasts by $410 million, largely thanks to robust growth in its AI services segment.

Wall Street Analysts Forecast

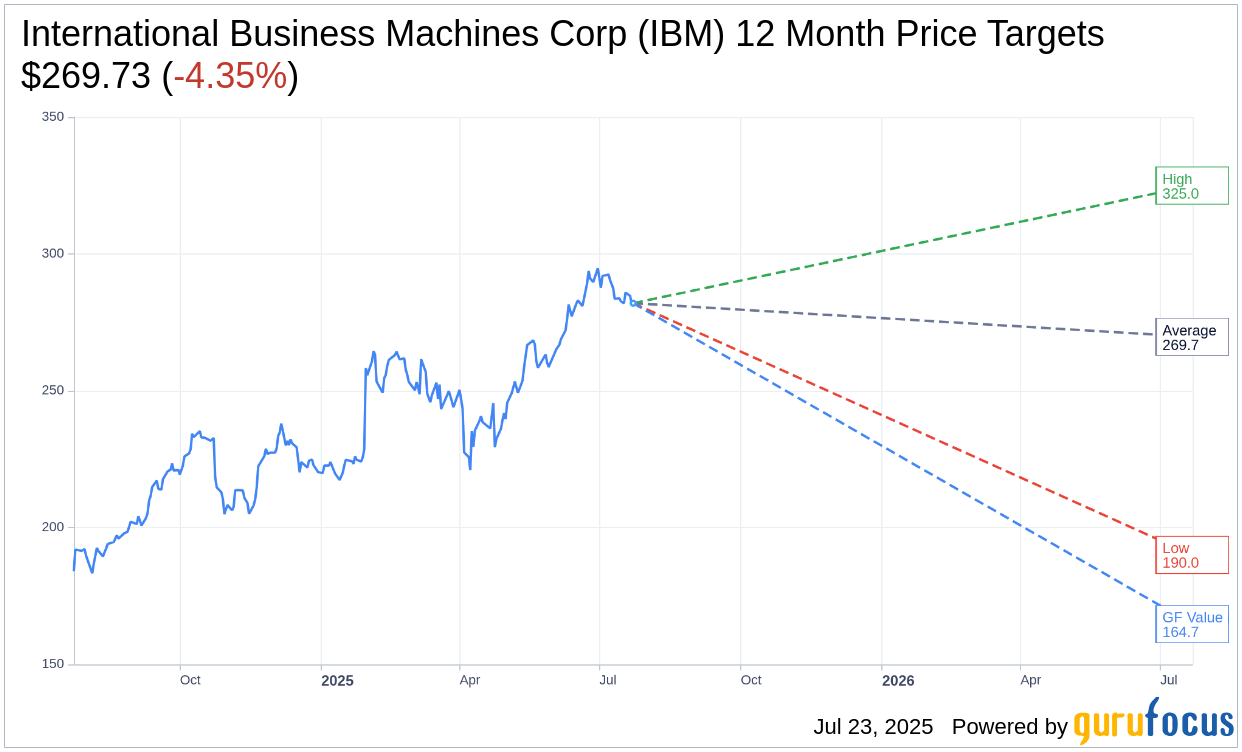

Analysts have set a one-year price target for International Business Machines Corp (IBM, Financial), averaging $269.73. This includes a high estimate of $325.00 and a low estimate of $190.00. The average target price suggests a potential downside of 4.35% from the current trading price of $282.01. For more in-depth estimate data, visit the International Business Machines Corp (IBM) Forecast page.

The current consensus recommendation from 23 brokerage firms for IBM is a 2.5, which equates to an "Outperform" rating. This rating is on a scale from 1 to 5, where 1 represents a Strong Buy and 5 signifies a Sell.

According to GuruFocus estimates, the projected GF Value for IBM in the coming year is $164.72. This estimate indicates a potential downside of 41.59% from the current price point of $282.01. The GF Value is a reflection of what the stock should potentially be trading at, calculated using historical trading multiples, past growth metrics, and future performance projections. More comprehensive data can be reviewed on the International Business Machines Corp (IBM, Financial) Summary page.