- IBM surpasses revenue expectations: The tech giant reports a strong Q2, with revenue climbing 7.6% year-over-year.

- Mixed analyst forecasts: Analysts offer varied price targets, with an average suggesting a slight downside.

- Outperform recommendation: Brokerage firms largely rate IBM as outperforming despite share price decline predictions.

IBM's Strong Second-Quarter Performance and Future Projections

IBM (NYSE: IBM) has unveiled its second-quarter financial results, showcasing a commendable performance that surpassed market expectations. The company reported a non-GAAP earnings per share (EPS) of $2.80, exceeding forecasts by $0.15. IBM's revenue for the quarter reached $17 billion, representing a 7.6% increase year-over-year and surpassing expectations by $410 million. Despite a 2% decline in share price, IBM remains optimistic, projecting over $13.5 billion in free cash flow for the year.

Wall Street Analysts Forecast

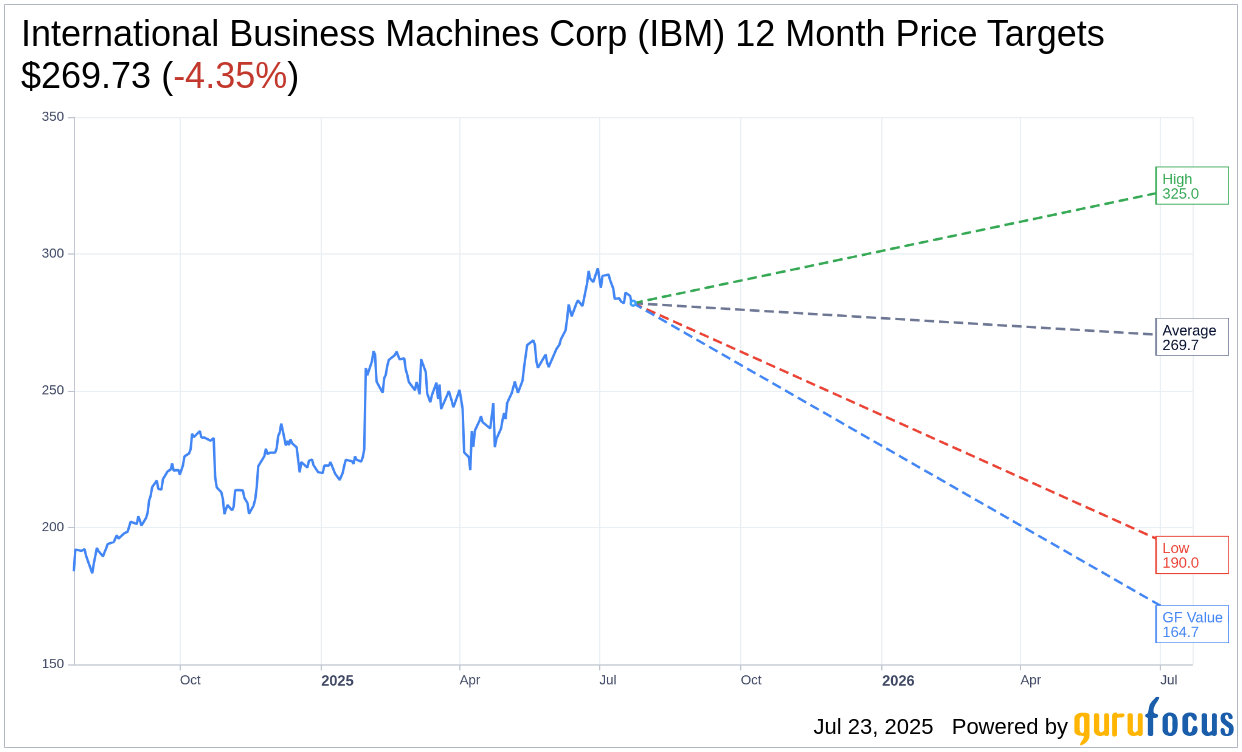

Industry analysts have offered their projections for IBM, presenting a range of one-year price targets. The average target price is set at $269.73, with estimates ranging from a high of $325.00 to a low of $190.00. This average target indicates a potential downside of 4.35% from the current stock price of $282.01. Investors can explore more detailed projections on the International Business Machines Corp (IBM, Financial) Forecast page.

The consensus from 23 brokerage firms gives IBM an average brokerage recommendation of 2.5, equating to an "Outperform" rating. This rating scale ranges from 1 to 5, with 1 indicating a Strong Buy and 5 suggesting a Sell.

GuruFocus Valuation Insights

According to GuruFocus estimates, the estimated GF Value for IBM over the next year is $164.72, suggesting a downside of 41.59% from the current trading price of $282.01. The GF Value represents GuruFocus’ assessment of the stock's fair value, determined through an analysis of historical trading multiples, past growth, and future performance projections. For more extensive data and insights, visit the International Business Machines Corp (IBM, Financial) Summary page.