- ARMOUR Residential REIT reports Q2 2025 earnings below expectations, with significant valuation changes.

- Analysts adjust price targets, implying a modest upside potential for the stock.

- Investor sentiment remains cautious, with a consensus "Hold" recommendation.

ARMOUR Residential REIT (ARR, Financial) recently announced its financial performance for the second quarter of 2025, revealing a non-GAAP earnings per share of $0.77. This result fell short of market expectations by $0.06, signaling challenges in their recent operations. The company's book value per share also took a hit, declining from $18.59 to $16.90. The quarter closed with a total economic return of -5.22%, reflecting ongoing pressures in the market.

Wall Street Analysts' Forecast

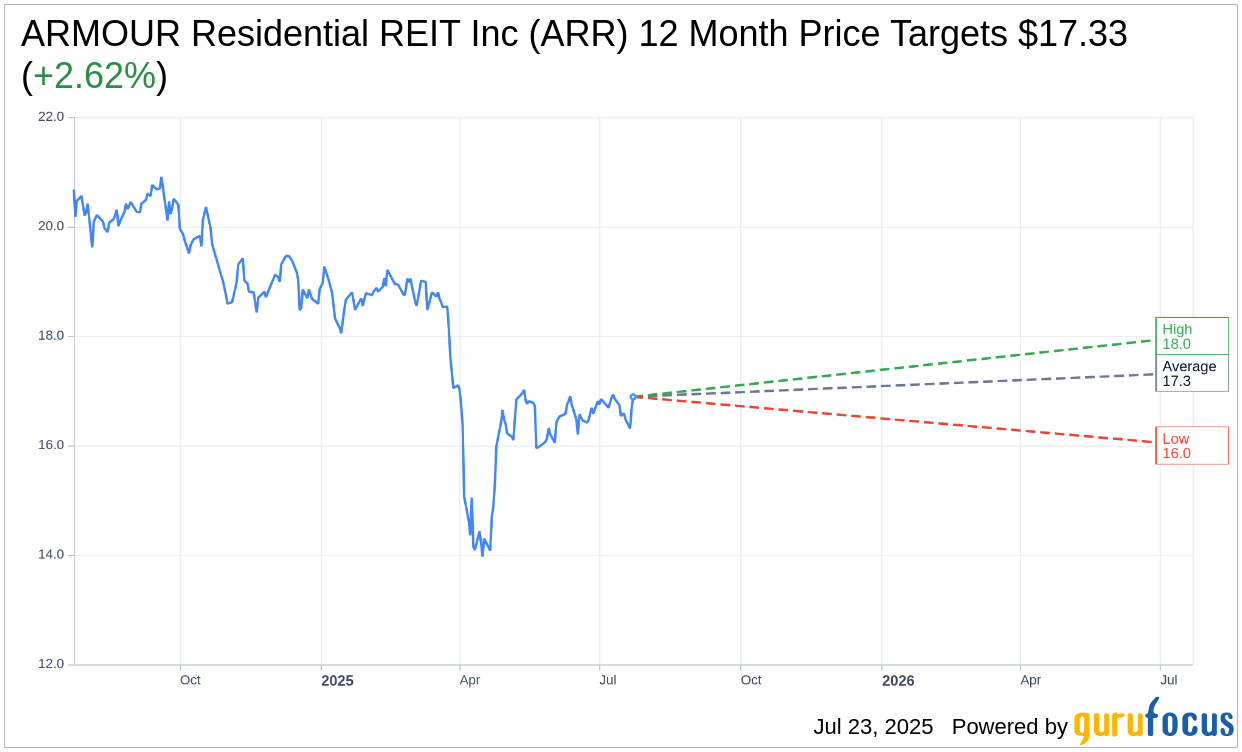

ARMOUR Residential REIT Inc (ARR, Financial) has garnered attention from analysts, resulting in one-year price targets from 3 different experts. The average target price is set at $17.33, with projections as high as $18.00 and as low as $16.00. This pricing spectrum suggests a potential upside of 2.62% from the current trading price of $16.89. For a comprehensive view of these estimates, you can explore more on the ARMOUR Residential REIT Inc (ARR) Forecast page.

The sentiment from the financial community, compiled from 6 brokerage firms, rates ARMOUR Residential REIT Inc (ARR, Financial) with an average recommendation of 2.7. This positions the stock in a "Hold" category on the rating scale, which ranges from 1, indicating Strong Buy, to 5, indicating Sell. Investors should remain attentive to these indicators as they navigate the current market landscape.