Summary Highlights:

- IBM's shares dipped 5% post-earnings despite surpassing expectations and raising its cash flow outlook.

- AI business revenue has surged remarkably, supported by upcoming Power11 server launches.

- Analysts foresee varied future prospects with target prices ranging widely, coupled with a consensus "Outperform" rating.

IBM's Financial Performance: A Closer Look

IBM (IBM, Financial) experienced a nearly 5% decline in its stock during after-hours trading, a surprising turn of events given the company exceeded both its earnings and revenue projections. Additionally, IBM raised its full-year cash flow outlook, signaling confidence in its financial trajectory. Despite these positive metrics, the company's software sales grew by 10%, falling short of the anticipated $7.49 billion, which impacted the stock's performance.

The company's AI business revenue tells a more optimistic story, skyrocketing to over $7.5 billion compared to $1.5 billion in Q1. This surge is underpinned by the imminent release of new Power11 servers designed to optimize AI application performance. IBM's consulting and infrastructure divisions also reported growth, contributing to the notable increase in non-GAAP EPS, now at $2.80.

Wall Street Analysts' Forecast and Insights

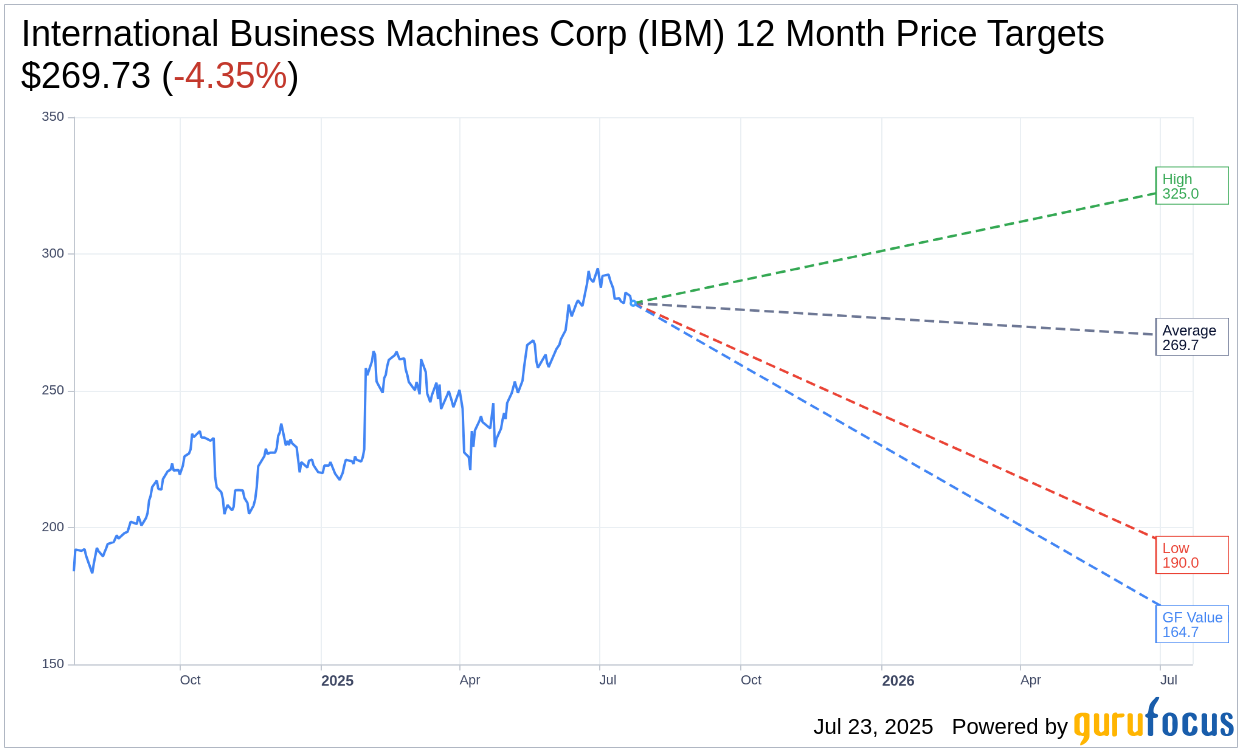

Market analysts have set one-year price targets for International Business Machines Corp (IBM, Financial), with 18 analysts providing an average target price of $269.73. Projections vary significantly, with a high estimate of $325.00 and a low of $190.00. The average target suggests a downside of 4.35% from the current price of $282.01. For more in-depth forecast data, visit the International Business Machines Corp (IBM) Forecast page.

IBM maintains an "Outperform" consensus from 23 brokerage firms, with an average recommendation rating of 2.5 on a scale where 1 signifies a Strong Buy and 5 indicates a Sell. This suggests confidence among analysts in IBM's ability to deliver solid performance despite recent stock volatility.

Evaluating GF Value and Projected Stock Movement

According to GuruFocus estimates, IBM's estimated GF Value in one year is $164.72, pointing to a potential downside of 41.59% from its current trading price of $282.01. The GF Value represents an estimation of the fair market value based on historical trading multiples, previous business growth, and future performance projections. For a comprehensive view, more detailed figures are available on the International Business Machines Corp (IBM, Financial) Summary page.