Key Highlights:

- IBM's Q2 earnings exceeded expectations, with EPS surpassing estimates by $0.15.

- Despite strong results, IBM shares dipped in after-hours trading.

- Analysts see potential downside in the stock price despite a positive outlook.

IBM (NYSE: IBM) delivered robust financial results for the second quarter, posting a non-GAAP earnings per share (EPS) of $2.80, exceeding analyst expectations by $0.15. The company also reported revenue of $17 billion, outperforming projections by $410 million. However, despite these encouraging figures, IBM shares experienced a decline during after-hours trading, reflecting investor caution.

Wall Street Analysts Forecast

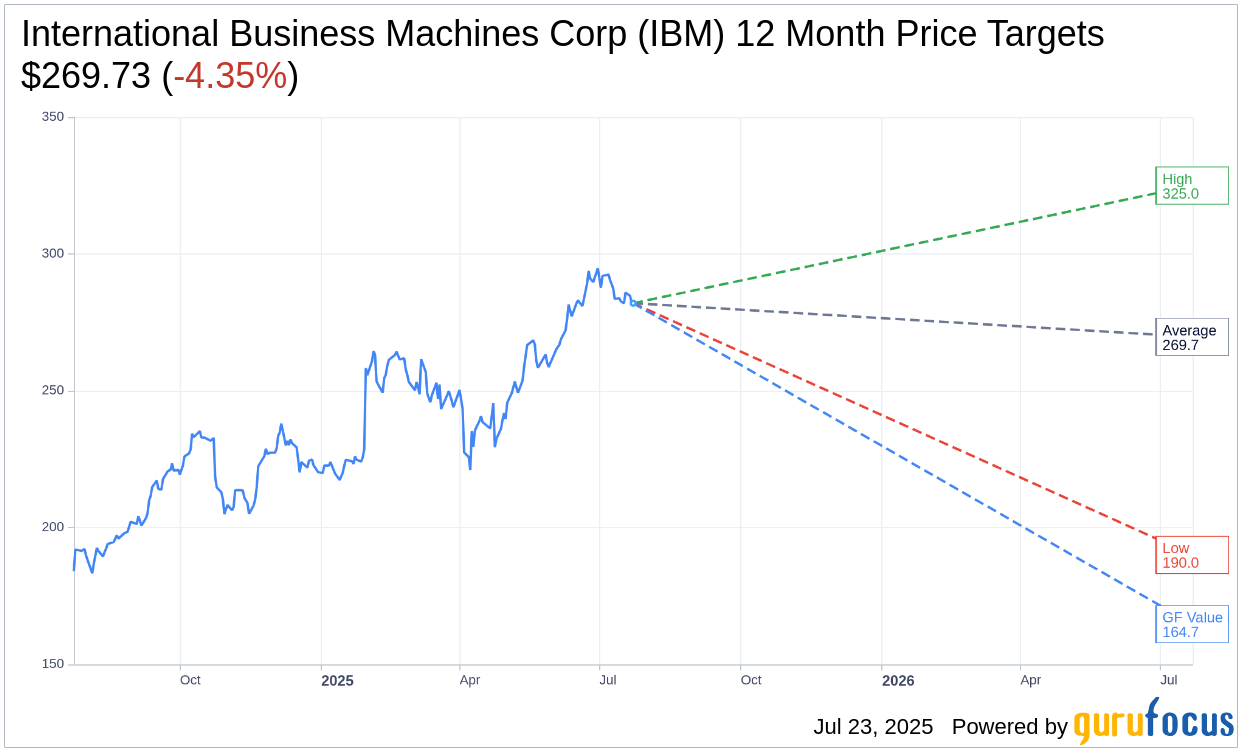

Analyst sentiment toward IBM remains mixed. According to the one-year price targets set by 18 industry analysts, the average target price for IBM stands at $269.73, with projections ranging from a high of $325.00 to a low of $190.00. This average target indicates a potential downside of 4.35% from the current stock price of $282.01. For further insights into these projections, visit the IBM Forecast page.

Moreover, consensus recommendations from 23 brokerage firms suggest an "Outperform" status for IBM, with an average rating of 2.5 on a scale where 1 equates to a Strong Buy and 5 equates to a Sell. This reflects a cautiously optimistic view among analysts regarding IBM's future performance.

Considering the GF Value metric by GuruFocus, the one-year estimate for IBM's fair value is projected at $164.72. This suggests a significant downside of 41.59% from its current trading price of $282.01. The GF Value represents GuruFocus' assessment of the stock's fair trading value, determined through historical trading multiples, past business growth, and anticipated business performance. For a comprehensive analysis, visit the IBM Summary page.