On June 30, 2025, BlackRock, Inc. (Trades, Portfolio) executed a substantial transaction involving Barrick Mining Corp, a leading player in the metals and mining industry. The firm added 49,338,616 shares to its holdings, marking a 133.22% increase in its position. This strategic move underscores BlackRock's confidence in Barrick's potential and its commitment to diversifying its investment portfolio. The transaction was executed at a price of $20.82 per share, bringing BlackRock's total holding in Barrick to 86,373,962 shares. This addition represents 0.04% of BlackRock's portfolio and 5.00% of Barrick's total shares.

BlackRock, Inc. (Trades, Portfolio): A Profile of the Investment Giant

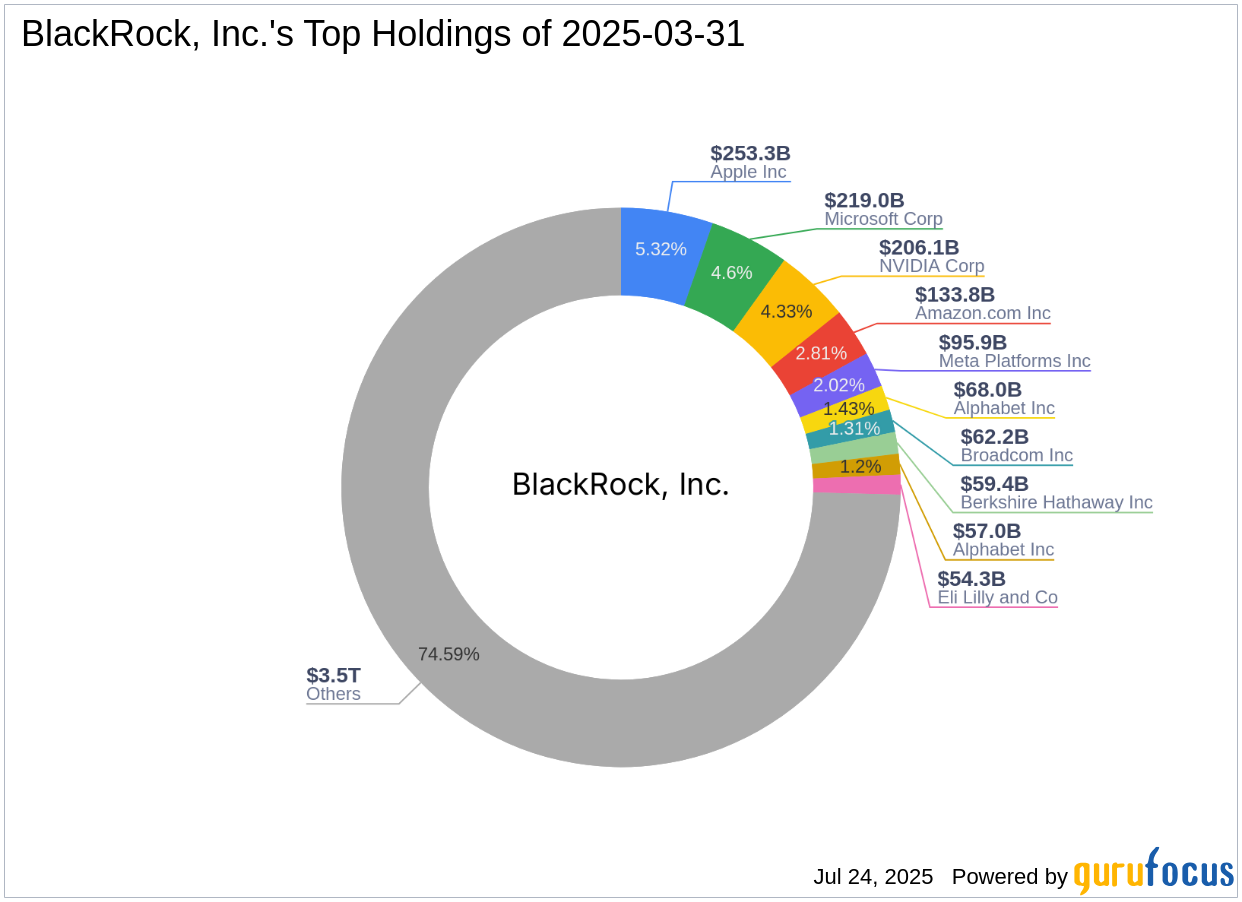

BlackRock, Inc. (Trades, Portfolio), headquartered at 50 Hudson Yards, New York, is a prominent investment firm renowned for its diversified portfolio. The firm is a major player in the financial services sector, with top holdings in leading technology companies such as Apple Inc., Amazon.com Inc., Meta Platforms Inc., Microsoft Corp., and NVIDIA Corp. With an equity value of $4,758.45 trillion, BlackRock's investment philosophy focuses on long-term growth and value creation. The firm's top sector investments are in technology and financial services, reflecting its strategic approach to capital allocation.

Overview of Barrick Mining Corp

Barrick Mining Corp, based in Toronto, is one of the world's largest gold miners, with operations spanning 19 countries. The company has a market capitalization of $36.96 billion and is involved in both gold and copper mining. In 2024, Barrick produced nearly 3.9 million attributable ounces of gold and about 430 million pounds of copper. The company has a robust reserve base, with approximately two decades of gold reserves and significant copper reserves. Barrick's strategic acquisitions, such as the purchase of Randgold in 2019 and the joint venture with Newmont, have strengthened its position in the industry.

Financial Metrics and Valuation of Barrick Mining Corp

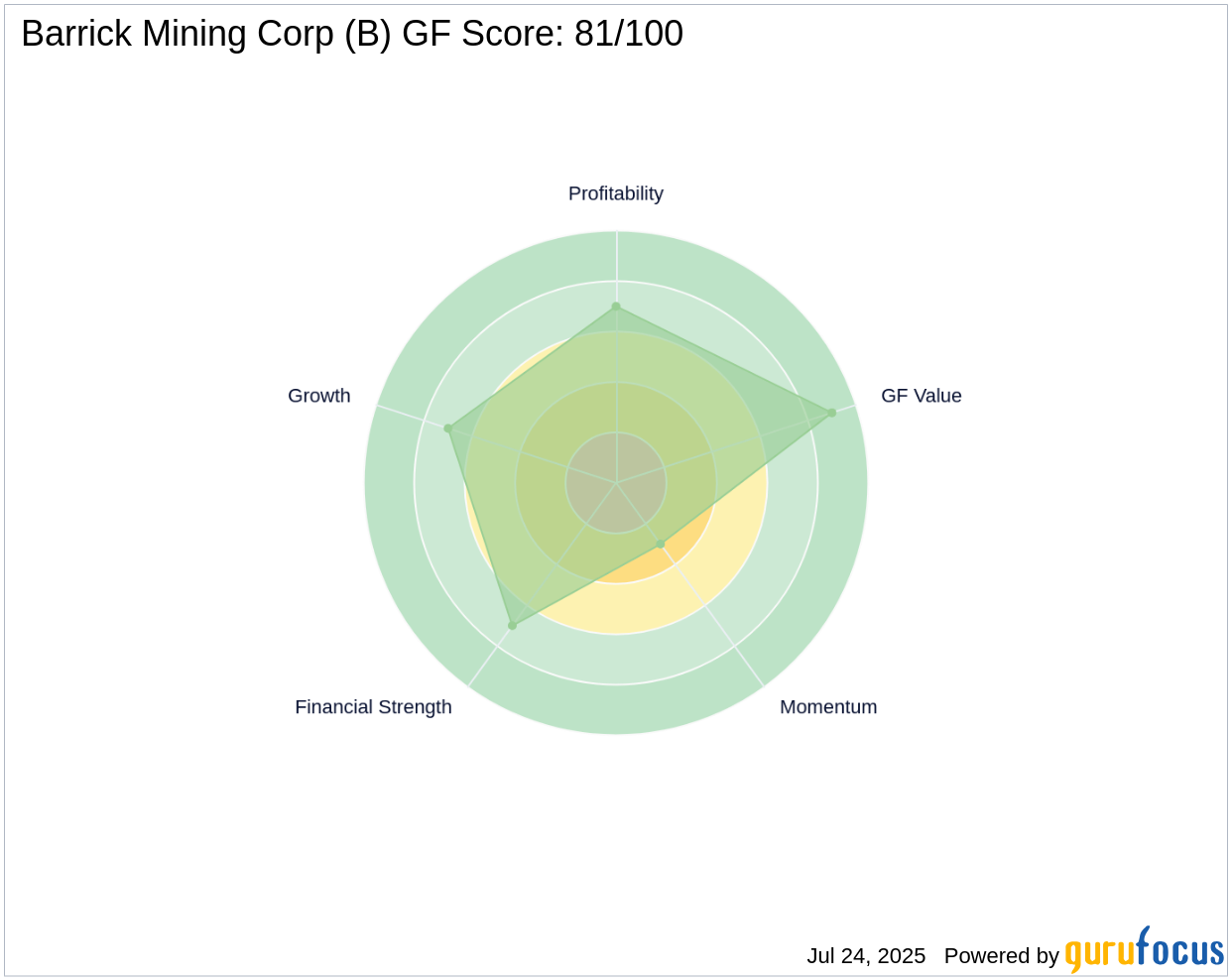

Barrick Mining Corp is currently fairly valued with a GF Value of $20.91 and a price-to-GF Value ratio of 1.03. The company has a GF Score of 81/100, indicating good outperformance potential. Barrick's financial strength is reflected in its Balance Sheet Rank of 7/10 and Profitability Rank of 7/10. The company's interest coverage ratio stands at 12.65, demonstrating its ability to meet interest obligations. Additionally, Barrick's Altman Z score of 2.07 suggests a stable financial position.

Performance and Growth Indicators

Barrick has shown a year-to-date price change of 35.32% and a significant IPO price change of 3,562.71%. The company has a balanced growth profile, with a 3-year revenue growth of 6.80% and an EBITDA growth of 3.50%. Despite a slight decline in operating margin growth at -0.10%, Barrick's overall growth prospects remain strong. The company's Growth Rank is 7/10, indicating a solid potential for future expansion.

Other Notable Investors in Barrick Mining Corp

First Eagle Investment (Trades, Portfolio) Management, LLC holds the largest share percentage in Barrick Mining Corp, highlighting its confidence in the company's growth potential. Other notable investors include John Rogers (Trades, Portfolio) and Mario Gabelli (Trades, Portfolio), who also hold positions in the company. These investors' involvement underscores Barrick's attractiveness as a valuable investment opportunity in the metals and mining sector.

Transaction Analysis and Impact

The recent acquisition by BlackRock, Inc. (Trades, Portfolio) is a testament to the firm's strategic investment approach and its belief in Barrick Mining Corp's potential. This transaction not only strengthens BlackRock's position in the metals and mining sector but also enhances its portfolio diversification. With Barrick's strong financial metrics and growth indicators, this investment is poised to contribute positively to BlackRock's long-term value creation strategy. As of July 24, 2025, all data and rankings are accurate, providing a comprehensive view of the transaction's impact on both BlackRock and Barrick Mining Corp.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: