Quick Overview:

- IBM's second-quarter 2025 results showcase a strong performance with $17 billion in revenue.

- Red Hat's revenue surges by 14%, and IBM's GenAI business valuation reaches $7.5 billion.

- Experts predict IBM's annual revenue growth exceeding 5%.

IBM's Impressive Financial Performance

International Business Machines (IBM, Financial) has reported noteworthy second-quarter results for 2025, with revenues climbing to an impressive $17 billion. A key contributor to this growth was Red Hat, achieving a remarkable 14% increase, alongside significant advancements in the artificial intelligence sector. IBM's GenAI business has now been valued at a substantial $7.5 billion, showcasing its strong foothold in the AI industry. The company maintains a positive outlook, forecasting revenue growth surpassing 5% for the fiscal year.

Wall Street Analysts' Insights

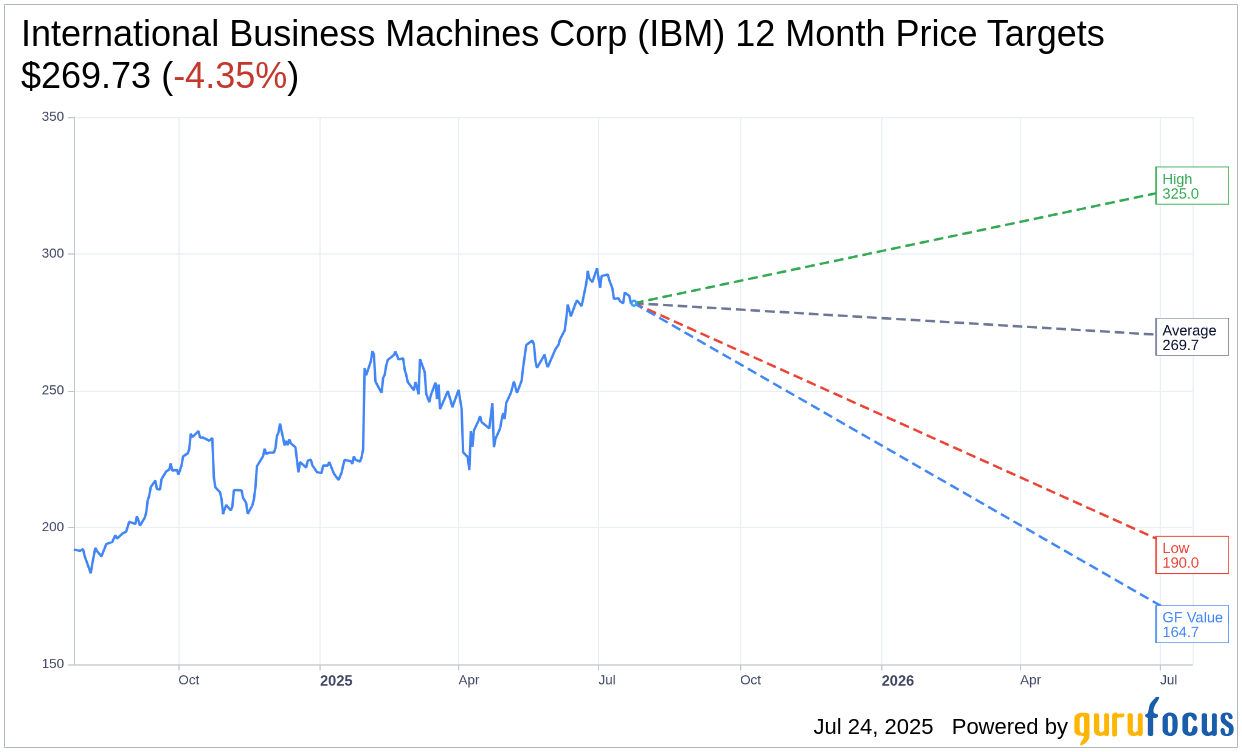

According to data from 18 industry analysts, the average one-year price target for IBM stands at $269.73. While the high estimate reaches $325.00, the low estimate is $190.00. This average target suggests a potential downside of 4.35% from the current trading price of $282.01. For further details on these projections, visit the International Business Machines Corp (IBM, Financial) Forecast page.

The consensus recommendation from 23 brokerage firms currently rates IBM at 2.5, translating to an "Outperform" status. On this scale, a rating of 1 denotes a Strong Buy, whereas a 5 signifies Sell.

Evaluating IBM's GF Value

Using GuruFocus estimates, IBM's projected GF Value for the next year is estimated at $164.72, indicating a potential downside of 41.59% from its present price of $282.01. The GF Value is a calculated figure reflecting the fair value based on historical performance, past business growth, and future prospects. To delve deeper into these figures, please refer to the International Business Machines Corp (IBM, Financial) Summary page.