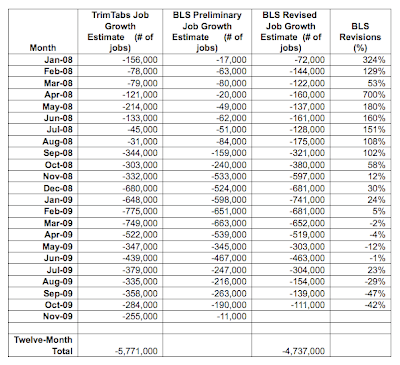

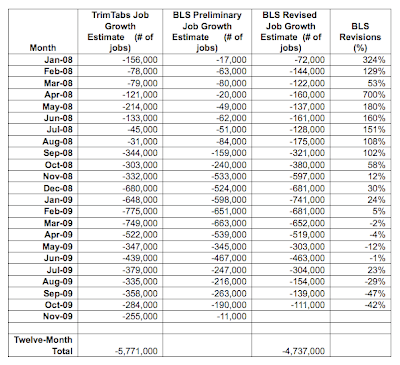

As we mentioned in a blog entry Thursday, there has been a great discrepency between initial monthly payroll data provided by the US government's Bureau of Labor Statistics and TrimTabs. Either months later or after annual revisions, the BLS data falls much closer in line with the estimates provided by TrimTabs. As we celebrate the November "great" jobs report, TrimTabs is scoffing and saying the BLS is off by a quarter million Americans. (oops) So about a year from now this "great" jobs report should be revised back down to reality but not before we can talk green shoots for a few months more. I've copied the chart we posted Thursday below, but with the November data inside (h/t BusinessInsider)

If you were not reading about 60 days ago, keep in mind the last annual revision to data by the government (mostly due to the use of the pathetic birth / death model of small business creation / contraction) had overstated job creation by roughly 850,000. In other words, due to poor economic modeling the government had overstated job creation by an average of 70,000 a month. I'd assume we will see the same thing in 2010 when they do this year's revision. Let us repeat that *eventually* the government seems to get it right, with the understanding that "eventually" can be 1-2 years down the road. But the stock market, with the attention span of a 3 year old toddler, changes value in the hundreds of billions - if not trillions - based on the original data set. Which is almost always wrong... often by a magnitude of 30, 40, 50%. But this is Caesars New York City... a virtual reality.....as we love to say, the market is not about reality, but our perception of reality.

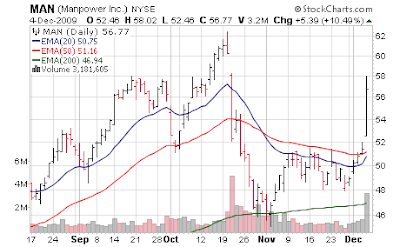

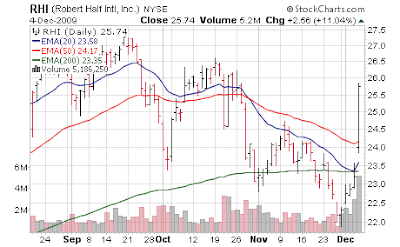

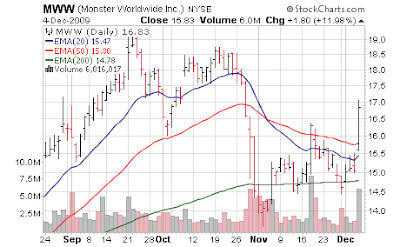

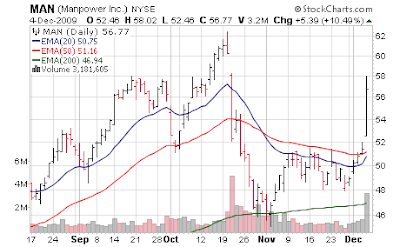

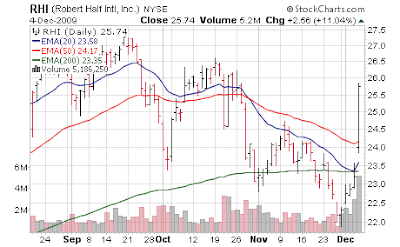

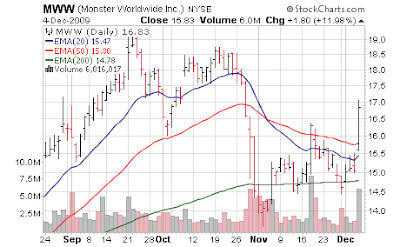

To that point, employment agency stocks shot out of a cannon Friday. (full list at TickerSpy)

What is even more interesting for the more recent data, is the BLS *did* revise recent data (Sep/Oct 2009), but instead of down, revised it up! Sept 09 from -263K to -139K and Oct 09 from -190K to -111K.

Is there directional improvemnet? Yes - there has to be. There are only so many jobs to be lost with 1/3rd of our job base now government or psuedo government. If you throw enough trillions (that you don't have) you can "solve" anything. The "stimulus" plan of spring 2009 was essentially a handout to states which kept job losses at the state/city level supressed far below what they would have been without a federal government bailout. And in the next stimulus "jobs creation" plan to be announced in the coming month or two will be another round of state/city bailouts which will shield more jobs from budget realities. So with hundreds of billions going to protect that segment of society, you can only face reality in the private sector - and the blood letting there has been historic. Last point, we soon will add 1M+ workers in (wait for it....) government to do the 2010 census, so that will make data in the coming 6 months look far better than it would in a non census year. I only tell you that so you can ignore it, because the stock market will :)

Here is what Charles Biderman of TrimTabs had to say:

Some other points of discrepency:

Trader Mark

http://www.fundmymutualfund.com/

If you were not reading about 60 days ago, keep in mind the last annual revision to data by the government (mostly due to the use of the pathetic birth / death model of small business creation / contraction) had overstated job creation by roughly 850,000. In other words, due to poor economic modeling the government had overstated job creation by an average of 70,000 a month. I'd assume we will see the same thing in 2010 when they do this year's revision. Let us repeat that *eventually* the government seems to get it right, with the understanding that "eventually" can be 1-2 years down the road. But the stock market, with the attention span of a 3 year old toddler, changes value in the hundreds of billions - if not trillions - based on the original data set. Which is almost always wrong... often by a magnitude of 30, 40, 50%. But this is Caesars New York City... a virtual reality.....as we love to say, the market is not about reality, but our perception of reality.

To that point, employment agency stocks shot out of a cannon Friday. (full list at TickerSpy)

What is even more interesting for the more recent data, is the BLS *did* revise recent data (Sep/Oct 2009), but instead of down, revised it up! Sept 09 from -263K to -139K and Oct 09 from -190K to -111K.

Is there directional improvemnet? Yes - there has to be. There are only so many jobs to be lost with 1/3rd of our job base now government or psuedo government. If you throw enough trillions (that you don't have) you can "solve" anything. The "stimulus" plan of spring 2009 was essentially a handout to states which kept job losses at the state/city level supressed far below what they would have been without a federal government bailout. And in the next stimulus "jobs creation" plan to be announced in the coming month or two will be another round of state/city bailouts which will shield more jobs from budget realities. So with hundreds of billions going to protect that segment of society, you can only face reality in the private sector - and the blood letting there has been historic. Last point, we soon will add 1M+ workers in (wait for it....) government to do the 2010 census, so that will make data in the coming 6 months look far better than it would in a non census year. I only tell you that so you can ignore it, because the stock market will :)

Here is what Charles Biderman of TrimTabs had to say:

- TrimTabs employment analysis, which uses real-time daily income tax deposits from all U.S. taxpayers to compute employment growth, estimated that the U.S. economy shed 255,000 jobs in November. This past month’s results were an improvement of only 10.2% from the 284,000 jobs lost in October.

- Meanwhile, the Bureau of Labor Statistics (BLS) reported that the U.S. economy lost an astonishingly better than expected 11,000 jobs in November. In addition, the BLS revised their September and October results down a whopping 203,000 jobs, resulting in a 45% improvementover their preliminary results.

- Something is not right in Kansas! Either the BLS results are wrong, our results are in error, or the truth lies somewhere in the middle.

- We believe the BLS is grossly underestimating current job losses due to their flawed survey methodology. Those flaws include rigid seasonal adjustments, a mysterious birth/death adjustment, and the fact that only 40% to 60% of the BLS survey is complete by the time of the first release and subject to revision.

- Seasonal adjustments are particularly problematic around the holiday season due to the large number of temporary holiday-related jobs added to payrolls in October and November which then disappear in January.

- In November, the BLS revised their September and October job losses down a surprising 44.5%, or 203,000 jobs. In the twelve months ending in October, the BLS revised their job loss estimates up or down by a staggering 679,000 jobs, or 13.0%. Until this past month, these revisions brought the BLS’ revised estimates to within a couple percent of TrimTabs’ original estimates.

Some other points of discrepency:

- Automatic Data Processing reported on Wednesday that 169,000 jobs were lost in November. (Mark's note: keep in mind, ADP data which is released 48 hours before the BLS data has often been inaccurate as well)

- The Institute of Supply Management (ISM) Non-Manufacturing Survey reported that the majority of companies surveyed were still shedding employees. (Mark's note: this was the ISM Services data we noted earlier in the week, showing contraction - this is the majority of our economy at >80%)

- The ISM Manufacturing Survey reported weaker employment conditions in November.

- Weekly unemployment claims were 457,000 in the week ended November 27, 2009. While last week’s results were below the important psychological level 500,000, the weekly claims are still uncomfortably high and point to a contracting labor market. (Mark's note: as we pointed out in the same Thursday story, many people are simply being reshuffled into the emergency extension programs, to the tube of 265,000 just last week alone)

- The Monster Employment Index declined in November.

Trader Mark

http://www.fundmymutualfund.com/