We are adding InterOil Corporation (IOC, Financial) as a short to our ValueHuntr Portfolio, with the certainly that the price IOC is currently traded in the market is nowhere near the company’s intrinsic value. We believe that the huge price increase the stock has experienced in recent months is due to over-hyped press releases, which have deceived investors into believing that the company is worth its market value.

Overview

InterOil Corporation engages in the exploration and production of oil and gas properties in Papua New Guinea. The company owns four petroleum prospecting licenses covering approximately 8.7 million net acres, as well as two petroleum retention licenses located in Papua New Guinea. Though the company has produced hundreds of press releases related to their “explorations”, the company has not found a single pint of oil. Despite this, the company is trading at 9X book value, with a market capitalization of $3.5 billion, which is comparable to exploration companies in the region withproven reserves.

Hyped Press Releases

According to Barry Minkow, founder of the Fraud Discovery Institute, the recent 132% increase in IOC stock price is due to hyped/untruthful press releases. An analysis of the company’s recent press releases shows that a clever play on words has the company flying high on the stock market.

A December 1, 2009 press release touted:

“The Antelope field confirms Papua New Guinea as a world class gas resource base in close proximity to the largest and most developed LNG market in the world.”

InterOil’s December 10, 2009 press release boasted about government approval to construct a liquefied natural gas plant in Papua New Guinea:

“This approval is another major milestone in advancing the monetization and commercialization of our resources we have established at the world class Elk/Antelope fields.”

The truth, however, is that InterOil has “undiscovered resources”, which cannot possibly be assumed to be company assets. Furthermore, calling a field “world class” isn’t the same thing as actually knowing how much of a natural resource exists there. InterOil is capitalizing on the confusion between undiscovered resources (which are unknown quantities) and discovered resources.

Apparently all it takes for management to trick investors into buying up IOC stock is pretending they have officially discovered and certified resources, which the company is not even close to having.

Not only has the company produced over 200 press releases updating investors about the “exploration progress”, but it has somehow managed to get away with extremely vague releases. For instance, the latest press release is 2 sentences long, and reads:

“InterOil Corporation today announced confirmation of indications of oilin the Antelope-2 well in Papua New Guinea. The Company is continuing to test whether the zone contains commercial quantities of oil and will announce the results of these tests when the evaluation has been completed”.

So it would seem that the company is confirming a finding in their exploration. However, it seems that they are instead confirming that there are “indications” that there may be oil at their drilling site. But then again, if there are no “indications of oil”, why would the company start drilling in the first place?

Possible Earnings Manipulation

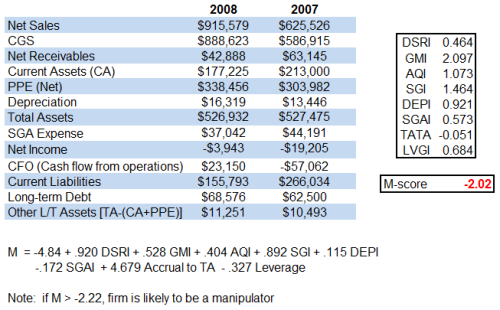

We use the Beneish model to evaluate the degree to which earnings of InterOil Corp. have been manipulated.

The Beneish M-Score is a statistical model that uses financial ratios and eight variables to identify whether a company has manipulated its earnings. The variables are constructed from the data in the company’s financial statements.

The eight variables are:

1. DSRI – Days’ sales in receivable index

2. GMI – Gross margin index

3. AQI – Asset quality index

4. SGI – Sales growth index

5. DEPI – Depreciation index

6. SGAI – Sales and general and administrative expenses index

7. LVGI – Leverage index

8. TATA – Total accruals to total assets

Once calculated, the eight variables are combined together to achieve an M-Score for the company. An M-Score of less than -2.22 suggests that the company will not be a manipulator. An M-Score of greater than -2.22 signals that the company is likely to be a manipulator.

With an M-Score of -2.02, our model indicates that InterOil is likely to be a manipulator. Variables with largest M-Score effect are the gross margin index (GMI) and the sales growth index (SGI).

Email Threats

Susuve Laumaea, Senior Manager for Media Relations at InterOil, has sent threatening emails to Barry Minkow, founder of the Fraud Discovery Institute. Among other things, she writes:

“You are a scum of the earth, a creepy-crawlie who should have been locked away and the key thrown away too so that you rot away like the dung heap you are. You are a coward of the highest order….I can’t use you as crocodile feed because you are too poisonous … those alligators will die eating you, cooked or uncooked.”

The emails can be viewed HERE.

Undisclosed Press Releases

According to the Fraud Discovery Institute, several press releases were never disclosed publicly, which violates SEC regulations. For undisclosed press releases see HERE.

Conclusion

We believe the recent 132% increase in InterOil stock price is completely disconnected from the reality of the business, and without merit. Though nothing is certain, we believe that the probability of price manipulation through vague/untruthful press releases is high. Therefore, we are adding IOC to theValueHuntr Portfolio as our first short in the portfolio.

ValueHuntr

http://valuehuntr.com/

Overview

InterOil Corporation engages in the exploration and production of oil and gas properties in Papua New Guinea. The company owns four petroleum prospecting licenses covering approximately 8.7 million net acres, as well as two petroleum retention licenses located in Papua New Guinea. Though the company has produced hundreds of press releases related to their “explorations”, the company has not found a single pint of oil. Despite this, the company is trading at 9X book value, with a market capitalization of $3.5 billion, which is comparable to exploration companies in the region withproven reserves.

Hyped Press Releases

According to Barry Minkow, founder of the Fraud Discovery Institute, the recent 132% increase in IOC stock price is due to hyped/untruthful press releases. An analysis of the company’s recent press releases shows that a clever play on words has the company flying high on the stock market.

A December 1, 2009 press release touted:

“The Antelope field confirms Papua New Guinea as a world class gas resource base in close proximity to the largest and most developed LNG market in the world.”

InterOil’s December 10, 2009 press release boasted about government approval to construct a liquefied natural gas plant in Papua New Guinea:

“This approval is another major milestone in advancing the monetization and commercialization of our resources we have established at the world class Elk/Antelope fields.”

The truth, however, is that InterOil has “undiscovered resources”, which cannot possibly be assumed to be company assets. Furthermore, calling a field “world class” isn’t the same thing as actually knowing how much of a natural resource exists there. InterOil is capitalizing on the confusion between undiscovered resources (which are unknown quantities) and discovered resources.

Apparently all it takes for management to trick investors into buying up IOC stock is pretending they have officially discovered and certified resources, which the company is not even close to having.

Not only has the company produced over 200 press releases updating investors about the “exploration progress”, but it has somehow managed to get away with extremely vague releases. For instance, the latest press release is 2 sentences long, and reads:

“InterOil Corporation today announced confirmation of indications of oilin the Antelope-2 well in Papua New Guinea. The Company is continuing to test whether the zone contains commercial quantities of oil and will announce the results of these tests when the evaluation has been completed”.

So it would seem that the company is confirming a finding in their exploration. However, it seems that they are instead confirming that there are “indications” that there may be oil at their drilling site. But then again, if there are no “indications of oil”, why would the company start drilling in the first place?

Possible Earnings Manipulation

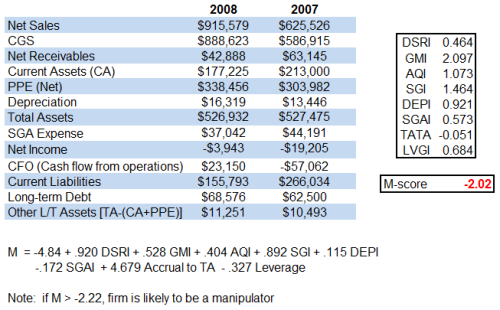

We use the Beneish model to evaluate the degree to which earnings of InterOil Corp. have been manipulated.

The Beneish M-Score is a statistical model that uses financial ratios and eight variables to identify whether a company has manipulated its earnings. The variables are constructed from the data in the company’s financial statements.

The eight variables are:

1. DSRI – Days’ sales in receivable index

2. GMI – Gross margin index

3. AQI – Asset quality index

4. SGI – Sales growth index

5. DEPI – Depreciation index

6. SGAI – Sales and general and administrative expenses index

7. LVGI – Leverage index

8. TATA – Total accruals to total assets

Once calculated, the eight variables are combined together to achieve an M-Score for the company. An M-Score of less than -2.22 suggests that the company will not be a manipulator. An M-Score of greater than -2.22 signals that the company is likely to be a manipulator.

With an M-Score of -2.02, our model indicates that InterOil is likely to be a manipulator. Variables with largest M-Score effect are the gross margin index (GMI) and the sales growth index (SGI).

Email Threats

Susuve Laumaea, Senior Manager for Media Relations at InterOil, has sent threatening emails to Barry Minkow, founder of the Fraud Discovery Institute. Among other things, she writes:

“You are a scum of the earth, a creepy-crawlie who should have been locked away and the key thrown away too so that you rot away like the dung heap you are. You are a coward of the highest order….I can’t use you as crocodile feed because you are too poisonous … those alligators will die eating you, cooked or uncooked.”

The emails can be viewed HERE.

Undisclosed Press Releases

According to the Fraud Discovery Institute, several press releases were never disclosed publicly, which violates SEC regulations. For undisclosed press releases see HERE.

Conclusion

We believe the recent 132% increase in InterOil stock price is completely disconnected from the reality of the business, and without merit. Though nothing is certain, we believe that the probability of price manipulation through vague/untruthful press releases is high. Therefore, we are adding IOC to theValueHuntr Portfolio as our first short in the portfolio.

ValueHuntr

http://valuehuntr.com/