This is the third article in our Guru Insider Research series. We have found that aggregated insider trading activities can predict the market and help investors locate the market bottoms during market crashes. The question we like to answer here: Can aggregated insider trading activities in a sector predict the future market return in this sector? These are the links to the previous two articles

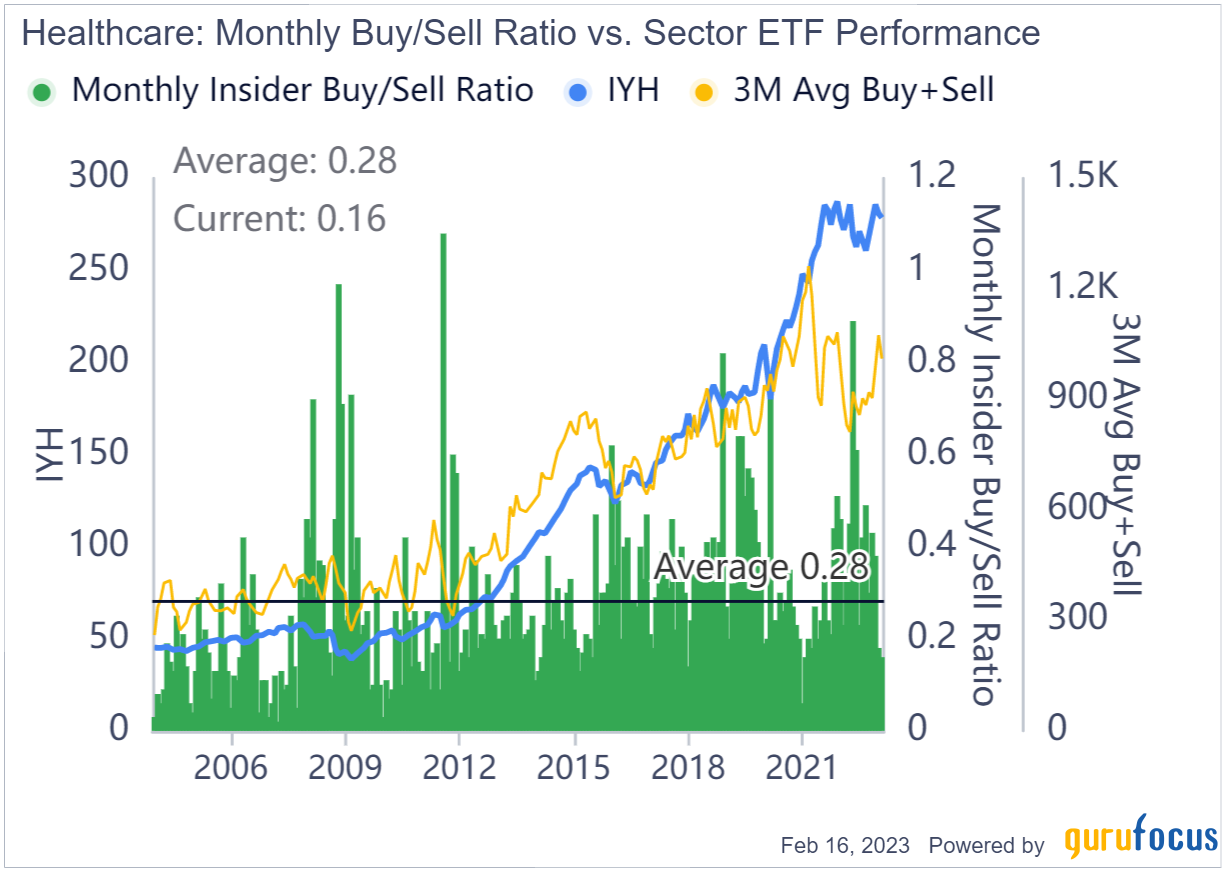

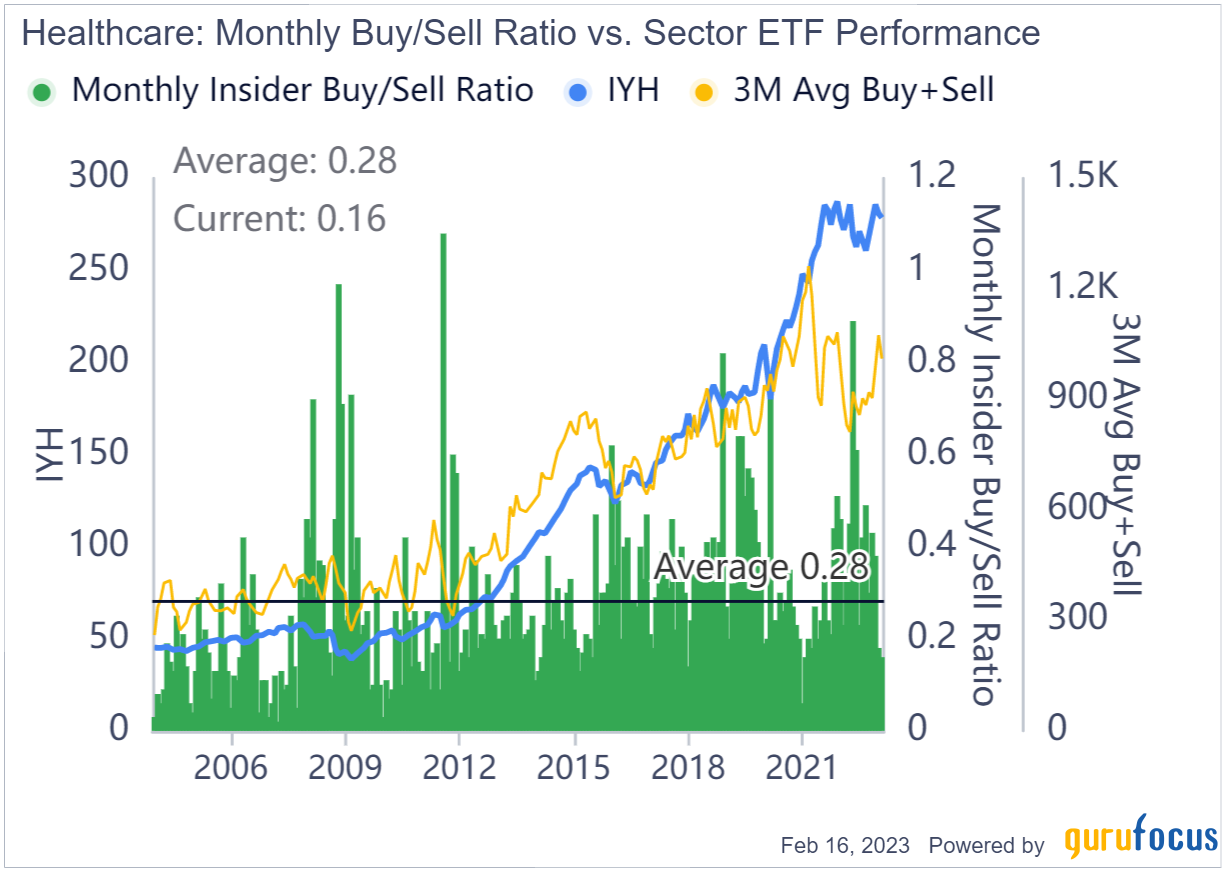

As shown in the broad market, the ratios of aggregated buys to sells in different sectors show that this ratio can predict the returns in the sectors, too. These are the ratios and the corresponding sector ETFs from 2004 to current.

We can see that the ratios of the aggregated insiders buying over selling do reflect their confidence in the future sector returns, and the ratios reach maximum when the best buying opportunities come. GuruFocus developed other features for idea generations and broad market indications based on the insider activities. In the meantime, you can access insider related features:

We can see that the ratios of the aggregated insiders buying over selling do reflect their confidence in the future sector returns, and the ratios reach maximum when the best buying opportunities come. GuruFocus developed other features for idea generations and broad market indications based on the insider activities. In the meantime, you can access insider related features:

- Guru Insider Research (I): The Summary of Previous Research Results

- Guru Insider Research (II): Can Aggregated Insider Trading Activities Predict the Market?

| ETF | Sectors |

|---|---|

| SPY | Broad Market |

| XLE | Oil & Gas |

| IYM | Basic Materials |

| IYJ | Industrials |

| IYK | Consumer Goods |

| IYH | Health Care |

| IYC | Consumer Services |

| IYZ | Telecommunications |

| IDU | Utilities |

| IYF | Financials |

| IYW | Technology |

As shown in the broad market, the ratios of aggregated buys to sells in different sectors show that this ratio can predict the returns in the sectors, too. These are the ratios and the corresponding sector ETFs from 2004 to current.

Sector: Oil & Gas

Sector: Basic Materials

Sector: Industrials

Sector: Consumer Defensive

Sector: Health Care

Sector: Consumer Cyclical

Sector: Telecommunication Services

Sector: Utilities

Sector: Financial Services

Sector: Technology

Sector: Real Estate

We can see that the ratios of the aggregated insiders buying over selling do reflect their confidence in the future sector returns, and the ratios reach maximum when the best buying opportunities come. GuruFocus developed other features for idea generations and broad market indications based on the insider activities. In the meantime, you can access insider related features:

We can see that the ratios of the aggregated insiders buying over selling do reflect their confidence in the future sector returns, and the ratios reach maximum when the best buying opportunities come. GuruFocus developed other features for idea generations and broad market indications based on the insider activities. In the meantime, you can access insider related features: