John Hussman (Trades, Portfolio)'s Hussman Strategic Advisors Inc. sold shares of the following stocks during the first quarter, which ended on March 31.

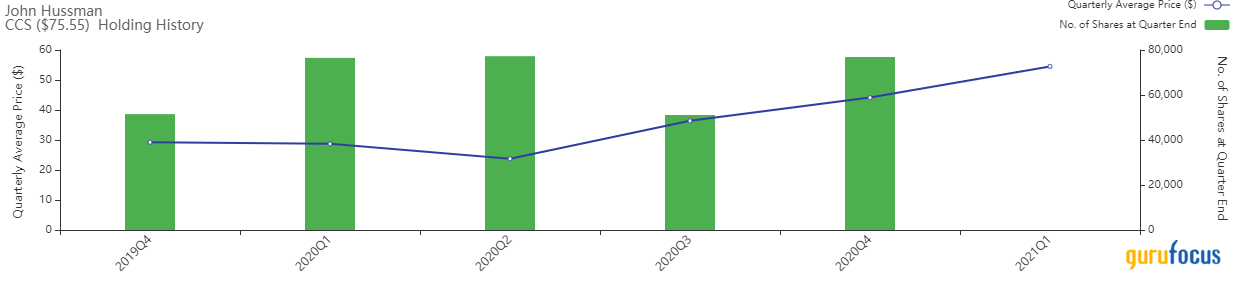

Century Communities

The firm's Century Communities Inc. (CCS, Financial) position was closed, impacting the portfolio by -0.88%.

The U.S. construction company has a market cap of $2.55 billion and an enterprise value of $3.32 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 17.95% and return on assets of 7.69% are outperforming 75% of companies in the homebuilding and construction industry. Its financial strength is rated 5 out of 10 with a cash-debt ratio of 0.34.

The largest guru shareholder of the company is Hotchkis & Wiley with 0.33% of outstanding shares, followed by Chuck Royce (Trades, Portfolio) with 0.32%.

Michaels Companies

The firm exited its holding in The Michaels Companies Inc. (MIK, Financial), impacting the portfolio by -0.70%.

The arts and crafts specialty retailer has a market cap of $3.14 billion and an enterprise value of $36.15 billion.

The arts and crafts specialty retailer has a market cap of $3.14 billion and an enterprise value of $36.15 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on assets of 7.07% is outperforming 81% of companies in the retail, cyclical industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.28 is below the industry median of 0.56.

The largest guru shareholders of the company include Ken Heebner (Trades, Portfolio) with 1.88% of outstanding shares, Larry Robbins (Trades, Portfolio) with 1.35% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.37%.

Malibu Boats

The firm closed its position in Malibu Boats Inc. (MBUU, Financial). The trade had an impact of -0.67% on the portfolio.

The company, which manufactures power boats, has a market cap of $1.80 billion and an enterprise value of $1.95 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 27.32% and return on assets of 0.13% are outperforming 95% of companies in the vehicles and parts industry. Its financial strength is rated 6 out of 10 with a cash-debt ratio of 0.14.

The largest guru shareholder of the company is Simons' firm with 4.63% of outstanding shares, followed by Royce with 0.64% and Joel Greenblatt (Trades, Portfolio) with 0.03%.

2U

The firm curbed its position in 2U Inc. (TWOU, Financial) by 75%, impacting the portfolio by -0.65%.

The company, which provides educational technology services, has a market cap of $2.90 billion and an enterprise value of $2.77 billion.

GuruFocus gives the company a profitability and growth rating of 3 out of 10. The return on equity of -27.48% and return on assets of -16.16% are underperforming 89% of companies in the education industry. Its financial strength is rated 5 out of 10 with a cash-debt ratio of 1.38.

The largest guru shareholders of the company include Catherine Wood (Trades, Portfolio) with 18.30% of outstanding shares, Pioneer Investments (Trades, Portfolio) with 0.58% and PRIMECAP Management (Trades, Portfolio) with 0.24%.

Super Micro Computer

The firm exited its position in Super Micro Computer Inc. (SMCI, Financial), impacting the portfolio by -0.63%.

The company, which provides high-performance server technology services, has a market cap of $1.66 billion and an enterprise value of $1.61 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on assets of 4.71% is outperforming 64% of companies in the hardware industry. Its financial strength is rated 7 out of 10 with a cash-debt ratio of 4.53.

The largest guru shareholder of the company is Howard Marks (Trades, Portfolio) with 5.63% of outstanding shares, followed by Richard Pzena (Trades, Portfolio) with 1.97% and Hotchkis & Wiley with 0.44%.

Dick's Sporting Goods

Hussman's firm curbed the position in Dick's Sporting Goods Inc. (DKS, Financial) by 74.42%, impacting the portfolio by -0.62%.

The company, which retails athletic apparel, footwear and equipment for sports, has a market cap of $7.49 billion and an enterprise value of $8.98 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 27.07% and return on assets of 7.17% are outperforming 81% of companies in the retail, cyclical industry. Its financial strength is rated 5 out of 10 with a cash-debt ratio of 0.53.

The largest guru shareholders of the company include Simons' firm with 0.52% of outstanding shares, Heebner with 0.34% and Jeremy Grantham (Trades, Portfolio) with 0.09%.

Disclosure: I do not own any stocks mentioned.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

Also check out: