Warren Buffett (Trades, Portfolio)'s $655.67 billion conglomerate, Berkshire Hathaway Inc. (BRK.A, Financial)(BRK.B, Financial), disclosed its equity portfolio for the first quarter of 2021 on Monday.

Despite having more than $145 billion to spend on stocks, the renowned guru and his two portfolio managers, Ted Weschler and Todd Combs, did very little buying, adding to only four existing investments and initiating a new stake in Aon PLC (AON, Financial). While a significant increase was made to The Kroger Co. (KR, Financial) holding, Buffett also made small additions the Verizon Communications Inc. (VZ, Financial), Marsh & McLennan Companies Inc. (MMC, Financial) and RH (RH, Financial) positions.

In contrast, the value investor was a fairly active seller, paring back 11 positions. In addition to completely eliminating stakes in Suncor Energy Inc. (SU, Financial) and Synchrony Financial (SYF, Financial), Buffett and his team cut back the Wells Fargo & Co. (WFC, Financial) holding, which used to be one of the largest, by 98% and slashed the Chevron Corp. (CVX, Financial) position by slightly more than half.

Berkshire's five largest holdings, accounting for over half of the equity portfolio, are Apple Inc. (AAPL, Financial), Bank of America Corp. (BAC), American Express Co. (AXP), The Coca-Cola Co. (KO) and Kraft Heinz Co. (KHC).

The guru's $269.93 billion portfolio consisted of 47 stocks as of March 31. A majority of the portfolio was invested in technology stocks at 41.77%, while the financial services sector has a weight of 31.23% and the consumer defensive space represents 13.33%.

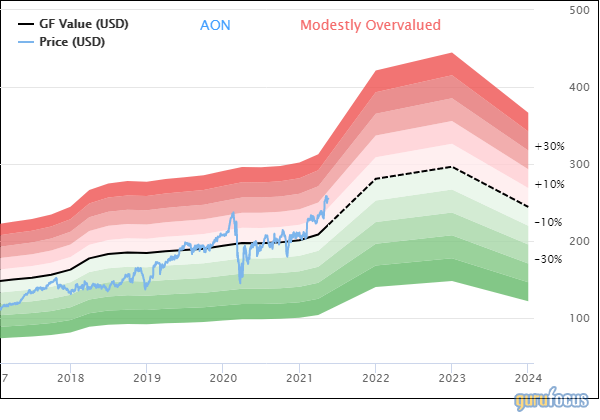

Aon

The guru invested in 4.09 million shares of Aon (AON, Financial), dedicating 0.35% of the equity portfolio to the stake. The stock traded for an average price of $220.25 per share during the quarter.

The British insurance company, which complements Berkshire's own insurance businesses, has a $57.59 billion market cap; its shares were trading around $255.20 on Tuesday with a price-earnings ratio of 27.89, a price-book ratio of 13.55 and a price-sales ratio of 5.19.

The GF Value Line shows the stock is modestly overvalued currently based on its historical ratios, past performance and future earnings projections.

Kroger

Increasing the holding by 52.26%, the value investor picked up 17.5 million shares of Kroger (KR, Financial). The trade had an impact of 0.23% on the equity portfolio. Shares traded for an average price of $34.16 each during the quarter.

Buffett now holds 51.06 million shares total, accounting for 0.68% of the equity portfolio. According to GuruFocus, he has gained an estimated 20.75% on the investment so far.

The grocery store chain, which is headquartered in Cincinnati, has a market cap of $28.44 billion; its shares were trading around $37.57 on Tuesday with a price-earnings ratio of 11.55, a price-book ratio of 2.97 and a price-sales ratio of 0.11.

According to the GF Value Line, the stock is modestly overvalued currently.

Chevron

In his largest transaction of the quarter with an impact of -0.78% on the equity portfolio, Buffett sold 24.8 million shares of Chevron (CVX, Financial). The stock traded for an average per-share price of $97.56 during the quarter.

After the 5.19% reduction, he now holds 23.6 million shares, which represent 0.92% of the equity portfolio. GuruFocus estimates Buffett has gained 24.08% on the investment since the third quarter of 2020.

The San Ramon, California-based oil and gas company has a $209.91 billion market cap; its shares were trading around $108.52 on Tuesday with a price-book ratio of 1.59 and a price-sales ratio of 2.14.

Based on the GF Value Line, the stock appears to be significantly overvalued.

Wells Fargo

Trimming the long-held stake by 98.71%, the Berkshire leader sold 51.7 million shares of Wells Fargo (WFC, Financial). The trade had an impact of -0.58% on the equity portfolio. During the quarter, the stock traded for an average price of $35.37 per share.

Buffett now holds 675,054 shares, accounting for 0.01% of the equity portfolio. According to GuruFocus, he has gained an estimated 62.21% on the investment.

The bank, which is headquartered in San Francisco, has a market cap of $198.92 billion; its shares were trading around $47.61 on Tuesday with a price-earnings ratio of 33.17, a price-book ratio of 1.19 and a price-sales ratio of 2.74.

The GF Value Line suggests the stock is currently fairly valued.

Synchrony Financial

Having held Synchrony Financial (SYF, Financial) since 2017, the Oracle of Omaha dumped all 20.12 million shares, impacting the equity portfolio by -0.26%. Shares traded for an average price of $38.53 each during the quarter.

GuruFocus estimates he gained 28.53% on the investment.

The Stamford, Connecticut-based financial services company has a $27.26 billion market cap; its shares were trading around $46.69 on Tuesday with a price-earnings ratio of 13.2, a price-book ratio of 2.18 and a price-sales ratio of 1.85.

According to the GF Value Line, the stock is significantly overvalued currently.

Suncor Energy

Impacting the equity portfolio by -0.09%, Buffett sold his 13.8 million remaining shares of Suncor Energy (SU, Financial). During the quarter, the stock traded for an average per-share price of $19.57 each.

GuruFocus data shows he lost 18.44% on the investment, which was established in the fourth quarter of 2018.

The Canadian energy company, which specializes in production of synthetic crude from oil sands, has a market cap of $35.98 billion; its shares were trading around $23.97 on Tuesday with a price-earnings ratio of 1,446.85, a price-book ratio of 1.2 and a price-sales ratio of 1.7.

Based on the GF Value Line, the stock appears to be fairly valued currently.

View all of Buffett's trades here.

Disclosure: No positions.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.