Southeastern Asset Management recently disclosed its portfolio updates for the first quarter of 2021, which ended on March 31.

Founded by Mason Hawkins (Trades, Portfolio) in 1975, the Memphis, Tennessee-based firm manages the Longleaf Partners Funds. The firm employs a fundamental, bottom-up appraisal process based in in-house research in order to select a concentrated portfolio of quality investments that have strong balance sheets, good management teams and attractive valuations.

Based on its investment criteria, the firm's biggest buys for the quarter were Biogen Inc. (BIIB, Financial) and Alibaba Group Holding Ltd. (BABA, Financial), while its most notable sells were DuPont de Nemours Inc. (DD, Financial) and General Electric Co. (GE, Financial).

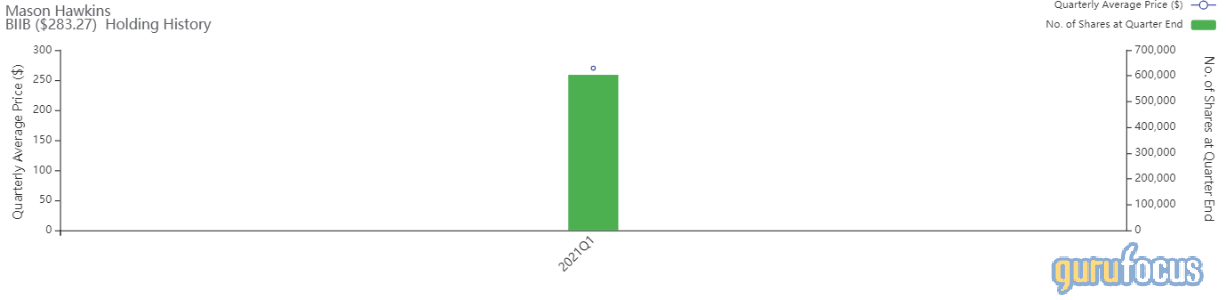

Biogen

The firm established a new position in Biogen (BIIB, Financial) worth 603,890 shares, which had a 3.61% impact on the equity portfolio. During the quarter, shares traded for an average price of $269.82.

Biogen is a biotech company based in Cambridge, Massachusetts that primarily researches and develops therapies for neurological and neurodegenerative diseases, including multiple sclerosis and leukemia.

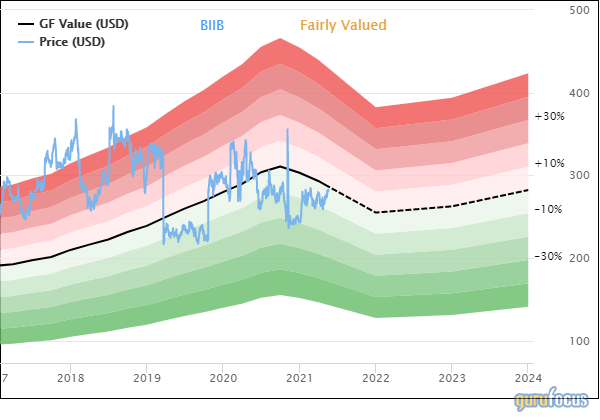

On May 18, shares of Biogen traded around $282.69 for a market cap of $42.56 billion and a price-earnings ratio of 14.83. According to the GuruFocus Value chart, the stock is fairly valued.

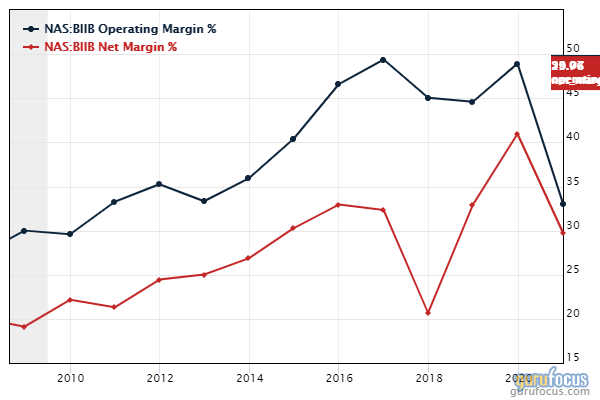

The company has a financial strength rating of 6 out of 10 and a profitability rating of 9 out of 10. While the cash-debt ratio of 0.33 is lower than 70% of industry peers, the Altman Z-Score of 4 suggests financial stability. The operating margin and net margin have generally been in an uptrend over the past decade, but dropped in 2020 to their present values of 33.07% and 29.76%.

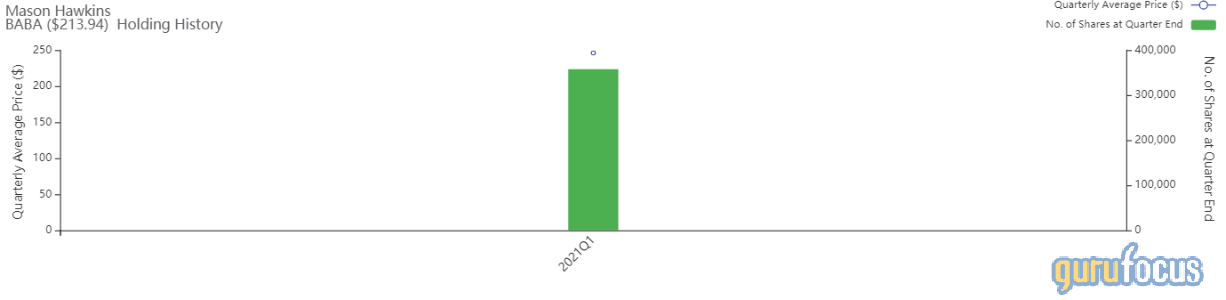

Alibaba Group Holding

The firm also established a new holding of 357,571 shares in Alibaba Group Holding (BABA, Financial), impacting the portfolio by 1.73%. Shares traded for an average price of $245.98 during the quarter.

Alibaba is a Chinese multinational conglomerate with holdings in e-commerce, retail, internet and technology assets, among many others. By volume, Alibaba is the largest e-commerce company in the world, with millions of merchants and hundreds of millions of users.

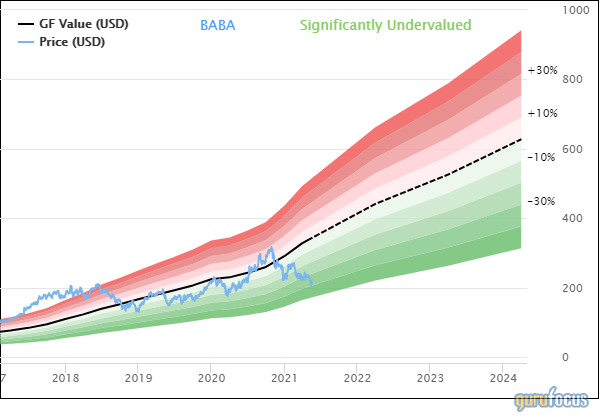

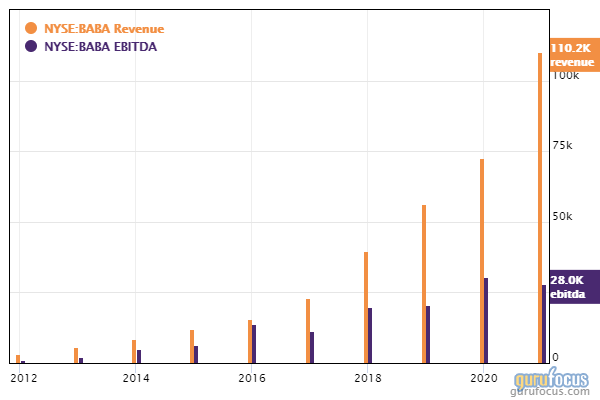

On May 18, shares of Alibaba traded around $214.99 for a market cap of $580.31 billion and a price-earnings ratio of 24.97. According to the GF Value chart, the stock is significantly undervalued.

The company has a financial strength rating of 8 out of 10 and a profitability rating of 8 out of 10. The Piotroski F-Score of 5 out of 9 and Altman Z-Score of 5.02 both suggest a fortress-like balance sheet. The three-year revenue growth rate is 38.2%, while the three-year Ebitda growth rate is 10.1%.

DuPont de Nemours

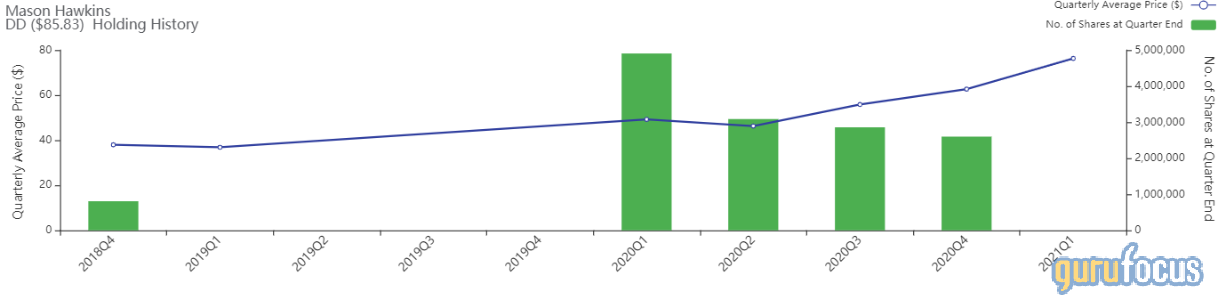

The firm sold out of its 2,599,162-share stake in DuPont de Nemours (DD, Financial), which had a -4.13% impact on the equity portfolio. During the quarter, shares traded for an average price of $76.28.

DuPont de Nemours is an American chemicals company that was formed from the 2017 merger of Dow Chemical and Dupont and the subsequent spinoffs of Dow Inc. (DOW) and Corteva Inc. (CTVA). The company makes a variety of chemicals, pharmaceuticals, synthetic fibers, petroleum-based fuels, building materials, cosmetic chemicals, packaging and agricultural chemicals.

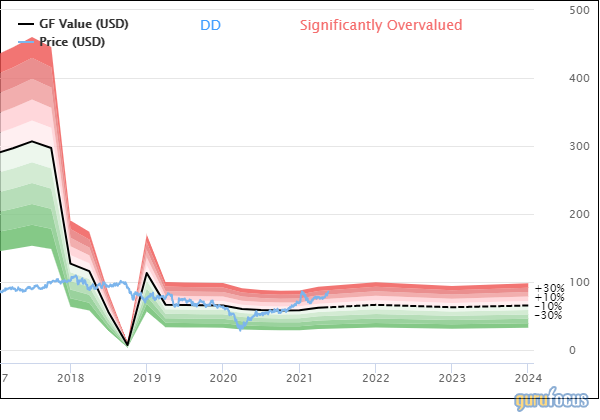

On May 18, shares of DuPont de Nemours traded around $85.84 for a market cap of $45.68 billion. According to the GF Value chart, the stock is significantly overvalued.

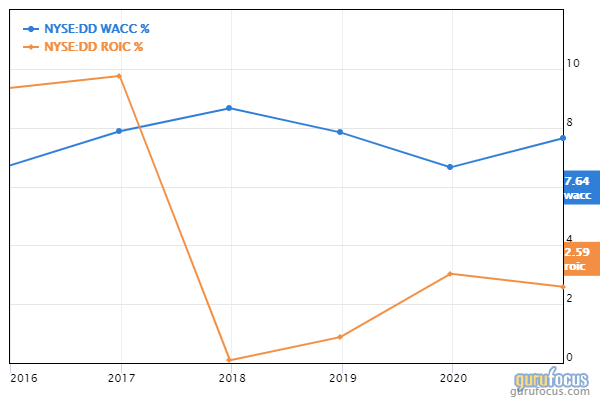

The company has a financial strength rating of 5 out of 10 and a profitability rating of 6 out of 10. The interest coverage ratio of 2.53 indicates the company could be near financial distress, but the Piotroski F-Score of 7 out of 9 is typical of a financially stable company. The return on invested capital is consistently lower than the weighted average cost of capital, indicating the company is destroying value as it grows.

General Electric

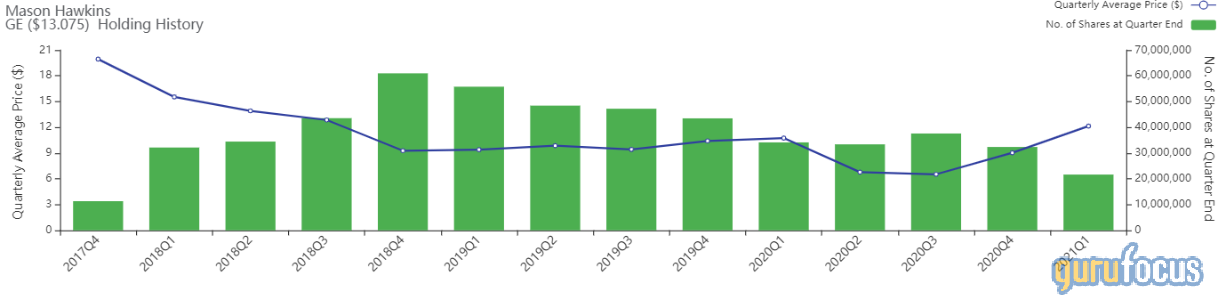

The firm reduced its General Electric (GE, Financial) investment by 10,717,718 shares, or 33.1%, for a remaining holding of 21,657,820 shares. The trade had a -2.59% impact on the portfolio. Shares traded for an average price of $12.14 during the quarter.

Headquartered in Boston, General Electric is a large-scale multinational conglomerate that operates businesses in a variety of sectors, including home appliances, aviation, health care, financial services and energy.

On May 18, shares of General Electric traded around $13.07 for a market cap of $114.74 billion. According to the GF Value chart, the stock is significantly overvalued.

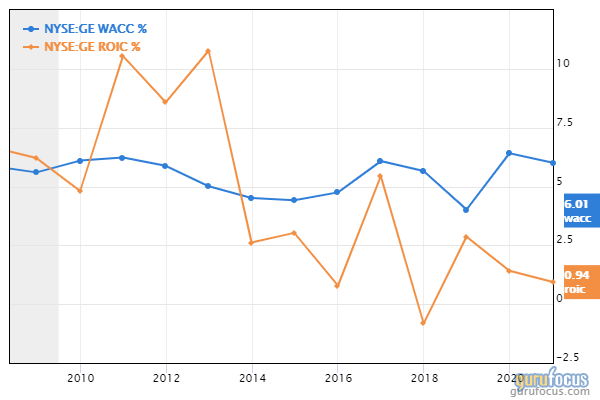

The company has a financial strength rating of 4 out of 10 and a profitability rating of 5 out of 10. The Piotroski F-Score of 3 out of 9 and Altman Z-Score of 1.44 indicate the company could face liquidity issues in the near future. The ROIC is consistently lower than the WACC, indicating the company is destroying value as it grows.

Portfolio overview

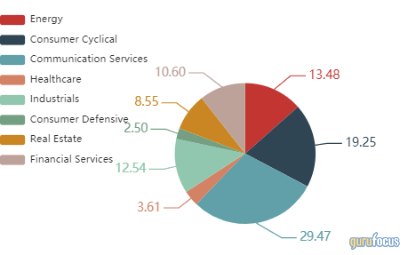

As of the quarter's end, Southeastern's equity portfolio contained 24 common stock holdings valued at a total of $4.68 billion. The firm established three new positions, sold out of four other holdings and added to or reduced several other investments for a turnover of 7% for the quarter.

The top holdings at the quarter's end were Lumen Technologies Inc. (LUMN, Financial) with 17.74% of the equity portfolio, CNX Resources Corp. (CNX, Financial) with 9.29% and Mattel Inc. (MAT, Financial) with 6.88%. In terms of sector weighting, the firm was most invested in communication services, consumer cyclical and energy.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

Also check out: