Discovery Inc. (DISCA, Financial) (DISCK, Financial) recently announced a merger with AT&T Inc.'s (T, Financial) WarnerMedia to form a standalone media company, shaking the streaming media and telecom worlds.

The combination would result in a content powerhouse providing Discovery with the scale and resources necessary to compete with giants like Walt Disney Co. (NYSE:DIS) and Netflix Inc. (NFLX, Financial). Moreover, Discovery's entry into the streaming landscape with Discovery+ is providing the company with subscription revenue as well as ad revenue. Overall, we believe the company has a strong post-deal upside and is an excellent stock at current levels.

The mega-merger

Earlier this month, the company revealed that AT&T will merge its media division, WarnerMedia, with Discovery to create a standalone global media conglomerate that will combine the likes of HBO, Warner Bros. and CNN. As per the agreement, AT&T will receive $43 billion in a combination of cash, debt securities and WarnerMedia's retention of certain debt. Moreover, AT&T shareholders will be getting 71% of the new company, while Discovery shareholders will own 29% of the conglomerate.

This move will most certainly allow the companies to take on the likes of Netflix and Walt Disney as it brings several popular media brands, like HBO, DC Comics, CNN, Discovery Channel, TLC, Animal Planet and others, under a single roof.

Notably, the HBO platform has around 64 million subscribers worldwide while Discovery+, which launched in January, is currently sitting at 15 million. The company's management says the merger will bring together 200,000 hours of content. Apart from that, there is expected to be significant cost synergies to the extent of nearly $3 billion over the years with respect to technology and marketing spends. Overall, we have enough reason to believe there is a significant upside potential that can arise from this merger and take the company on to a spectacular growth trajectory.

Discovery+ upside

Discovery has entered a new growth phase with the introduction of Discovery+, which offers better monetization through higher average revenue per user and convenient-to-use offerings. The subscription service managed to attract a total of 15 million total paying subscribers within just four months after launching in the U.S. and has plenty of opportunities of international expansion ahead. The company's addressable market has grown significantly from pay-TV to now include mobile and broadband.

Discovery+ is gradually gaining momentum and its ARPU is already more than three times that of the company's wholesale portfolio. Its contribution helped Discovery reach the top line of $2.79 billion for the first quarter of 2021, surpassing the analyst consensus estimate of $2.77 billion. It is also worth highlighting that the company recently launched itself on Comcast Corp.'s (CMCSA, Financial) Xfinity Flex and will soon be on X1. Management also remains focused on deepening the company's relationship with Amazon.com Inc. (AMZN, Financial) around the world with availability on Prime video channels in the U.S. As television viewership is experiencing a downturn, Discovery not having an attractive product for cord-cutters was a big headwind for the company, but with the launch of Discovery+, the company may be on a new path to success.

Final thoughts

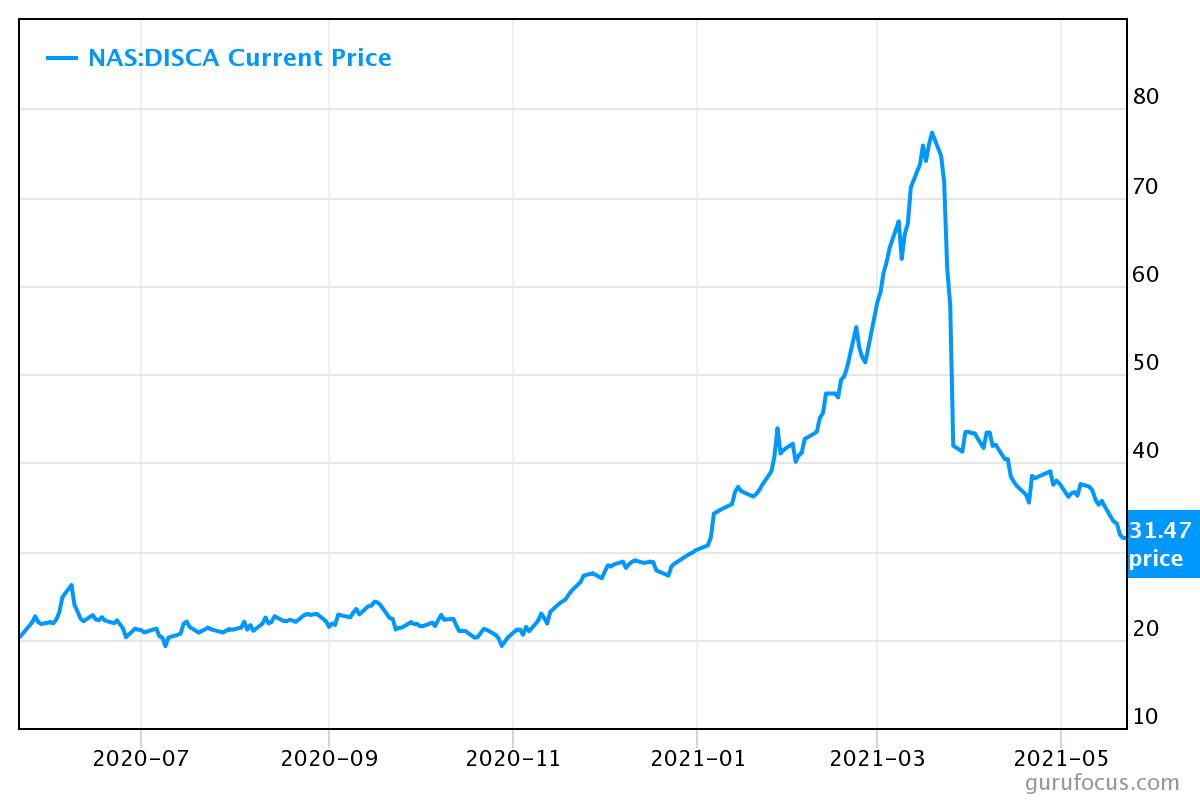

We can see a massive drop in the share price of Discovery that took place earlier this year. One of the biggest contributors to the crash was the implosion of Bill Hwang's Archegos Capital Management, leading to a huge selloff. However, I believe the market is not valuing Discovery fairly at its current enterprise-value-to-Ebitda multiple of 4.58, which is probably the lowest among streaming companies across the globe. The recent merger with AT&T can bring a huge upside to the company's streaming platform, which has already started gaining traction. Although the newly merged company will also have $56 billion in net debt ($43 billion from AT&T and $13 billion in net debt from Discovery), it has the ability to generate strong free cash flows from the company's legacy business.

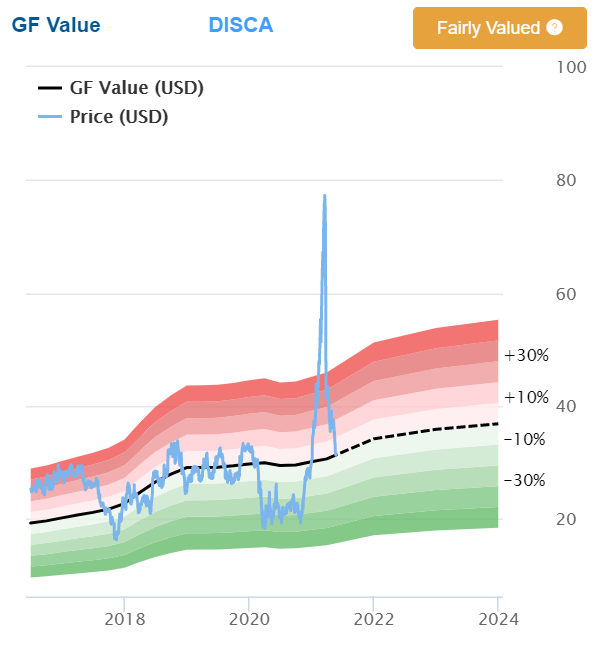

The GF Value chart indicates Discovery is fairly valued and I believe that there is significant scope for multiple expansion. The company is trading at a price-sales ratio of 1.96 and a price-to-free cash flow of 9.26, which are both very low. Moreover, if management is able to realize the $3 billion worth of cost synergies, it would lead to a huge bottom-line expansion. Overall, I believe Discovery could be an excellent investment opportunity in the current situation and the bigger beneficiary from the deal as compared to AT&T.

Disclosure: No positions.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.