Third Avenue Value Fund (Trades, Portfolio) has revealed its portfolio for the second quarter, which ended April 30. Top trades for the fund include reductions in Capstone Mining Corp. (TSX:CS, Financial), Lundin Mining Corp. (TSX:LUN, Financial) and Interfor Corp. (TSX:IFP, Financial) alongside selling out of its Weyerhaeuser Co. (WY, Financial) holding. The fund made one new buy during the quarter into Genting Singapore Ltd. (SGX:G13, Financial).

The fund's strategy was launched in 1990 under the leadership of the late Martin J. Whitman. The high-conviction strategy seeks to invest in undervalued securities across industries, regions and market capitalizations. Fundamental analysis is used to identify stocks trading below their intrinsic value that compound asset values at double-digit rates. The strategy's flexible mandate takes a global, all-cap equities approach and allows for opportunistic investments in credit securities across the capital structure.

Portfolio overview

At the end of the quarter, the fund’s portfolio contained 31 stocks, with one new holding. It was valued at $591 million and has seen a turnover rate of 3%. Top holdings included Bank of Ireland Group PLC (LSE:BIRG, Financial), Capstone Mining, Interfor, Lundin and Deutsche Bank AG (XTER:DBK).

By weight, the top three sectors represented are basic materials (27.92%), financial services (23.78%) and industrials (17.53%).

Capstone Mining

The fund cut back its second-largest holding, Capstone Mining (TSX:CS, Financial), during the quarter by 46.18%. The 7.61 million shares sold during the quarter traded at an average price of 3.97 Canadian dollars ($3.21). The sale had an overall impact of -3.13% on the portfolio and GuruFocus estimates the total gain of the holding at 227.64%.

Capstone Mining is a company that mines, explores and develops mineral properties in the Americas. Specifically, the group has operating mines in the U.S., Mexico and Canada alongside development projects in Chile and Canada. Capstone's main focus is copper, but the company also produces zinc, lead, molybdenum, silver and gold.

On June 29, the stock was trading at CA$5.18 per share with a market cap of CA$2.13 billion. According to the GF Value Line, the shares are trading at a significantly overvalued rating.

GuruFocus gives the company a financial strength rating of 7 out of 10, a profitability rank of 4 out of 10 and a valuation rank of 3 out of 10. There is currently one severe warning sign issued for declining revenue per share. The company has struggled with profitability over the last decade with the weighted average cost of capital regularly exceeding the return on invested capital.

Lundin Mining

Another of the fund’s top holdings to be pulled back during the quarter was Lundin Mining (TSX:LUN, Financial). The sale of 1.10 million shares cut the holding by 29.87%. The shares traded at an average price of CA$14.05 during the quarter. GuruFocus estimates the fund has gained 17.07% on the holding during its lifetime and the sale had an overall impact of -1.95% on the equity portfolio.

Lundin Mining is a diversified Canadian base metals mining company with operations in Brazil, Chile, Portugal, Sweden and the U.S. It primarily produces copper, zinc, gold and nickel.

As of June 29, the stock was trading at CA$11.18 per share with a market cap of CA$8.26 billion. Share prices have declined consistently through 2021, bringing the GF Value Line rating down from significantly overvalued to modestly overvalued.

GuruFocus gives the company a financial strength rating of 6 out of 10, a profitability rank of 6 out of 10 and a valuation rank of 6 out of 10. There are currently no severe warning signs issued for the company. Strong operating and net margins aid in the company’s profitability rank despite a medium warning sign issued due to the weighted average cost of capital exceeding the weighted average cost of capital.

Interfor

The fund’s Interfor (TSX:IFP, Financial) holding was reduced by 23.51% with the sale of 449,520 shares during the second quarter. The shares rose to an average price of CA$28.86 during the quarter, well above the average price paid per share. The portfolio saw an -1.66% change from the sale and the fund has gained an estimated 1.18% according to GuruFocus.

Interfor produces and sells lumber, timber and other wood products. The company operates sawmills to convert timber into lumber, logs, wood chips and other wood products for sale. The company also harvests timber for its sawmills on forest land owned by the Canadian government. Interfor pays the Canadian government stumpage fees based on the number of trees it harvests. The company's primary customers are in the construction and renovation industries. The majority of revenue is generated from the sale of lumber in the U.S.

The stock was trading at CA$29.32 per share with a market cap of CA$1.91 billion on June 29. The GF Value Line gives the shares a modestly overvalued rating.

GuruFocus gives the company a financial strength rating of 7 out of 10, a profitability rank of 6 out of 10 and a valuation rank of 8 out of 10. There are currently no severe warning signs issued for the company. While Interfor’s cash-to-debt ratio of 1.47 is poor on an internal basis, it ranks the company better than 77.78% of competitors in the forest products industry.

Weyerhaeuser

After half a decade of reductions, the fund sold out of its Weyerhaeuser (WY, Financial) holding. The remaining 251,680 shares were sold throughout the quarter at an average price of $35.76. GuruFocus estimates the fund drew out a minimal gain of 0.11% throughout the lifetime of the holding and the sale had a -1.55% impact on the portfolio overall.

Weyerhaeuser ranks among the world's largest forest product companies. Following the 2016 sale of its pulp business to International Paper, Weyerhaeuser operates three business segments: timberlands, wood products, and real estate. Weyerhaeuser is structured as a real estate investment trust and is not required to pay federal income taxes on earnings generated by timber harvest activities. Earnings from its wood products segment are subject to federal income tax. Weyerhaeuser acquired fellow timber REIT Plum Creek in 2016.

On June 29, the stock was trading at $34.32 per share with a market cap of $25.75 billion. According to the GF Value Line, the stock is trading at a fairly valued rating.

GuruFocus gives the company a financial strength rating of 5 out of 10, a profitability rank of 7 out of 10 and a valuation rank of 9 out of 10. There are currently good warning signs issued for the company for strong debt coverage and an expanding operating margin. Weyerhaeuser has maintained positive revenue and net income, excluding 2019, throughout the last decade thanks to a consistent demand for building supplies.

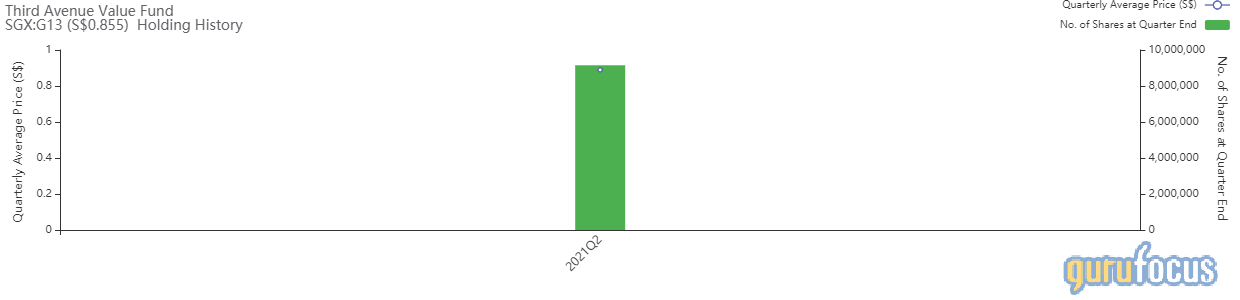

Genting Singapore

The fund established one new holding during the quarter in Genting Singapore (SGX:G13, Financial). The position was created with the purchase of 9.15 million shares that traded at an average price of 89 Singaporean cents (66 cents). The purchase had a 1% positive impact on the equity portfolio and GuruFocus estimates the fund has lost 3.93% on the holding since it was purchased.

Genting Singapore is engaged in the development and operation of integrated resort destinations. Its operations include gaming, hospitality and leisure and entertainment facilities. It owns Resorts World Sentosa in Singapore, one of the largest integrated resort destinations in Asia, which offers a casino, Adventure Cove Waterpark, S.E.A. Aquarium (one of the world's largest oceanariums), Universal Studios Singapore theme park, hotels and Michelin-starred restaurants.

Genting Singapore is engaged in the development and operation of integrated resort destinations. Its operations include gaming, hospitality and leisure and entertainment facilities. It owns Resorts World Sentosa in Singapore, one of the largest integrated resort destinations in Asia, which offers a casino, Adventure Cove Waterpark, S.E.A. Aquarium (one of the world's largest oceanariums), Universal Studios Singapore theme park, hotels and Michelin-starred restaurants.

On June 29, the stock was trading at 86 Singaporean cents per share with a market cap of S$10.32 billion. The GF Value Line shows the stock trading at a significantly overvalued rating.

GuruFocus gives the company a financial strength rating of 8 out of 10, a profitability rank of 6 out of 10 and a valuation rank of 1 out of 10. There are currently three severe warning signs issued for a declining gross margin, declining operating margin and declining revenue per share. The company saw cash flows take an abrupt dive in 2020 when the pandemic shut down a significant portion of the economy.