According to the All-In-One Screener, the top five streaming services owned by gurus include Amazon.com Inc. (AMZN, Financial)’s Prime Video, NBCUniversal’s Peacock under Comcast Corp. (CMCSA, Financial), The Walt Disney Co. (DIS, Financial)’s Disney+, Netflix Inc. (NFLX, Financial) and WarnerMedia’s HBO and HBO Max, which fall under the AT&T Inc. (T, Financial) banner.

For companies whose services existed before the pandemic, like Netflix and Disney, the pandemic offered a helpful boost to subscriber numbers. For others, streaming services helped to offset the losses incurred from struggling theme parks and shortened professional sports seasons.

Amazon’s Prime Video

Amazon's (AMZN, Financial) Prime Video sits in a unique place at the top of the list as the company has racked up over 200 million global subscribers to its Prime services. These customers gain access to special offers and fast shipping from the retail and web services giant. Amazon’s first-quarter report claimed that the video platform had seen 175 million Prime members watching in the last year and streaming hours rising 70% year over year.

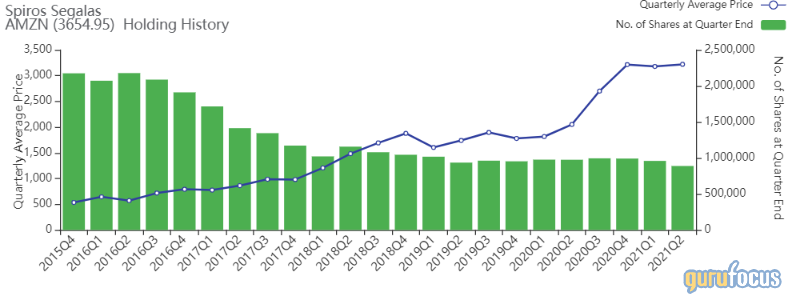

Based on the screen, Amazon has 46 different gurus currently holding shares. These gurus include the likes of Spiros Segalas (Trades, Portfolio), Catherine Wood (Trades, Portfolio), Ken Fisher (Trades, Portfolio), Philippe Laffont (Trades, Portfolio) and John Hussman (Trades, Portfolio).

On July 6, Amazon was trading at a staggering $3,679.50 per share with a market cap of $1.86 trillion. According to the GF Value Line, the stock is trading at a fair value rating.

NBCUniversal Peacock

NBCUniversal’s Peacock, under the ownership of Comcast (CMCSA, Financial), has racked up 42 million signups to the platform in less than a year’s time. The platform has helped the company to offset lower advertising revenue and has also brought on new licensing agreements with exclusive content. The exclusive content also led to an increase of content licensing revenue by 14.1% in the company’s first quarter.

Peacock’s parent company is owned by 40 different gurus, including the T Rowe Price Equity Income Fund (Trades, Portfolio), Steven Romick (Trades, Portfolio), Fisher, Tom Gayner (Trades, Portfolio) and Diamond Hill Capital (Trades, Portfolio).

As of July 6, the stock was trading at $57.63 per share with a market cap of $264.77 billion. The GF Value Line shows the stock trading at a modestly overvalued rating.

Disney+

Disney’s (DIS, Financial) Disney+ streaming service saw subscribers skyrocket well in excess of 100% over the last year to 103.6 million. Ownership of Hulu and ESPN has brought an additional subscriber base of 55.4 million members. The different services draw in anywhere from $3.99 to $81.43 in revenue on an average monthly basis per paid subscriber.

Disney is owned by the likes of the Yacktman Focused Fund (Trades, Portfolio), Laffont, Fisher, Gayner and Diamond Hill for a total of 35 guru owners.

The stock was trading at $173.60 per share with a market cap of $315.27 billion on July 6. The shares are significantly overvalued according to the GF Value Line.

Netflix

Netflix (NFLX, Financial) remains the champion of the streaming wars touting 208 million subscribers, up 14% year over year at the end of the first quarter of 2021. The company grew their average revenue per membership by 6% year over year, leading to record level operating profits.

Netflix saw an influx of guru buys through the end of 2020 and the 24 guru owners include Segalas, Wood, Fisher, Laffont and Baillie Gifford (Trades, Portfolio).

On July 6, the stock was trading at $541.64 per share with a market cap of $240.16 billion. Despite the large rise in share prices over the last year, the GF Value still gives the company a fair value rating overall.

WarnerMedia's HBO and HBO Max

WarnerMedia’s HBO and HBO Max, under parent company AT&T (T, Financial), occupy another unique position in the list of guru streaming service holdings. The company saw its own piece of the growth pie over the last year, landing at a total of nearly 64 million subscribers that grew revenue to $8.5 billion.

The company announced plans in May to combine its services with Discovery Inc. (DISCA) to create a standalone global entertainment company. Under the terms of the deal, AT&T shareholders will receive stock representing 71% of the new company and Discovery shareholders will own 29%.

AT&T ownership landed fifth overall as it occupies positions in 17 guru portfolios. Guru owners include Kahn Brothers (Trades, Portfolio), Murray Stahl (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio), Jim Simons (Trades, Portfolio)' Renaissance Technologies and Mark Hillman (Trades, Portfolio).

As of July 6, the stock was trading at $29.02 per share with a market cap of $207.20 billion. According to the GF Value Line, the shares are trading at a fair value rating.

Also check out:- Ken Fisher Undervalued Stocks

- Ken Fisher Top Growth Companies

- Ken Fisher High Yield stocks, and

- Stocks that Ken Fisher keeps buying

- T Rowe Price Equity Income Fun Undervalued Stocks

- T Rowe Price Equity Income Fun Top Growth Companies

- T Rowe Price Equity Income Fun High Yield stocks, and

- Stocks that T Rowe Price Equity Income Fun keeps buying