Yacktman Asset Management (Trades, Portfolio), an Austin, Texas-based asset management firm, disclosed this week that its top four buys during the second quarter included a new holding in Weatherford International PLC (WFRD, Financial) and boosts to its positions in Canadian Natural Resources Ltd. (CNQ, Financial), PepsiCo Inc. (PEP, Financial) and Amerco Inc. (UHAL, Financial).

Led by Chief Investment Officer Stephen Yacktman, the firm seeks long-term growth appreciation through a disciplined investment strategy that combines growth and value investing. Yacktman seeks companies that have a good business, shareholder-oriented management and low purchase price.

As of June 30, Yacktman’s $10.31-billion equity portfolio contains 64 stocks, with one new position and a turnover ratio of 6%. The top four sectors in terms of weight are consumer defensive, communication services, financial services and technology, with weights of 23.90%, 18.29%, 16.23% and 12.39%, respectively.

Weatherford International

Yacktman purchased 7,202,005 shares of Weatherford International (WFRD, Financial), giving the position a 1.27% weight in the equity portfolio. Shares averaged $17.11 during the second quarter; the stock is significantly overvalued based on Wednesday’s price-to-GF-Value ratio of 1.79.

GuruFocus ranks the Houston-based energy company’s financial strength 4 out of 10 on several warning signs, which include interest coverage and debt-to-Ebitda ratios underperforming more than 85% of global competitors.

Canadian Natural Resources

The firm purchased 6,072,612 shares of Canadian Natural Resources (CNQ, Financial), boosting the position by 90.65% and impacting the equity portfolio by 2.14%. Shares averaged $33.55 during the second quarter; the stock is fairly valued based on Wednesday’s price-to-GF-Value ratio of 1.04.

GuruFocus ranks the Calgary, Alberta-based energy company’s profitability 6 out of 10 on the back of profit margins and returns outperforming more than 65% of global competitors.

Other gurus with holdings in Canadian Natural Resources include Yacktman Fund (Trades, Portfolio), Yacktman Focused Fund (Trades, Portfolio) and Pioneer Investments (Trades, Portfolio).

PepsiCo

Yacktman purchased 1,162,115 shares of PepsiCo (PEP, Financial), expanding the position by 35.04% and impacting the equity portfolio by 1.67%. Shares averaged $145.60 during the second quarter; the stock is fairly valued based on Wednesday’s price-to-GF-Value ratio of 1.01.

GuruFocus ranks the Purchase, New York-based food and beverage company’s profitability 8 out of 10 on several positive investing signs, which include a three-star business predictability rank and profit margins and returns outperforming more than 77% of global competitors.

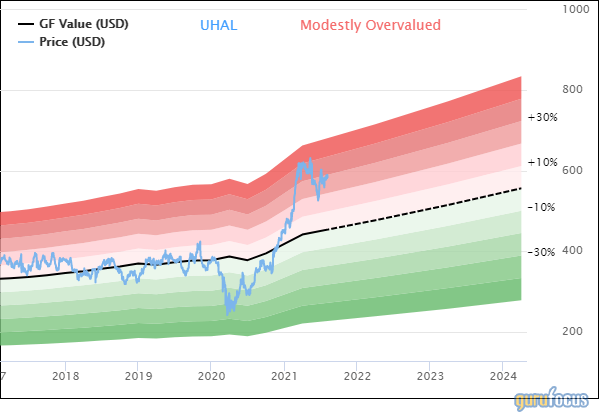

Amerco

Yacktman purchased 193,552 shares of Amerco (UHAL, Financial), increasing the position by 76.17% and impacting the equity portfolio by 1.11%. Shares averaged $586.79 during the second quarter; the stock is modestly overvalued based on Wednesday’s price-to-GF-Value ratio of 1.29.

Amerco operates a fleet of trucks, trailers and towing devices under the U-Haul brand, targeting do-it-yourself household movers. GuruFocus ranks the Reno, Nevada-based company’s profitability 8 out of 10 on several positive investing signs, which include a 3.5-star business predictability rank, a high Piotroski F-score of 7 and an operating margin that outperforms more than 90% of global competitors.

Also check out:- Yacktman Asset Management Undervalued Stocks

- Yacktman Asset Management Top Growth Companies

- Yacktman Asset Management High Yield stocks, and

- Stocks that Yacktman Asset Management keeps buying

- Yacktman Focused Fund Undervalued Stocks

- Yacktman Focused Fund Top Growth Companies

- Yacktman Focused Fund High Yield stocks, and

- Stocks that Yacktman Focused Fund keeps buying