Wallace Weitz (Trades, Portfolio), head of Weitz Investment Management, disclosed his second-quarter portfolio earlier this week.

When picking stocks, the guru's Omaha, Nebraska-based firm combines Benjamin Graham's principles of price sensitivity and insistence on margin of safety with a conviction that qualitative factors that allow the company to control its future can be more important than statistical metrics like book value and earnings.

In his second-quarter letter for the Hickory Fund, Weitz observed that over the past year, “predictions of a powerful economic rebound were reflected by the strong performance in equity markets,” which were carried out by both corporate earnings and economic data. He added that these strong results have resulted in new questions about inflation and the ongoing Covid-19 pandemic.

“We, too, wrestle with such ‘macro’ questions, but our analysis on such issues inevitably leads back to our core principals,” Weitz wrote. “Namely, by focusing our research efforts on quality businesses, we seek to identify companies capable of compounding business value for years to come, regardless of the ‘macro’ environment. Further, by acquiring shares in such companies at a discount to our business value estimates, we hope to capture additional return as others see what we see, or to create a cushion in case the future does not line up exactly with our view (whether for company -specific or ‘macro’ factors). We believe this process, which we describe as Quality at a Discount (QuaD) investing, helps deliver portfolios built for all seasons.”

Keeping these considerations in mind, Weitz was active on both the buy and sell sides of the trading ledger. He entered two new positions during the quarter, which were Roper Technologies Inc. (ROP, Financial) and MarketAxess Holdings Inc. (MKTX, Financial). Other notable trades for the quarter included the divestment of the Summit Materials Inc. (SUM, Financial) and Box Inc. (BOX, Financial) holdings and an addition to the Dun & Bradstreet Holdings Inc. (DNB, Financial) stake.

Roper Technologies

Weitz invested in 61,000 shares of Roper Technologies (ROP, Financial), allocating 1.22% of the equity portfolio to the position. The stock traded for an average price of $441.14 per share during the quarter.

The Sarasota, Florida-based technology company, which manufactures software and engineered products for niche markets, has a $51.02 billion market cap; its shares were trading around $483.95 on Wednesday with a price-earnings ratio of 48.2, a price-book ratio of 4.6 and a price-sales ratio of 8.58.

The GF Value Line suggests the stock is modestly overvalued currently based on historical ratios, past performance and future earnings projections.

The valuation rank of 1 out of 10 supports this assessment since the share price and price ratios are all approaching 10-year highs.

Roper’s financial strength was rated 4 out of 10 by GuruFocus on the back of adequate interest coverage. Although assets are building up at a higher rate than revenue is growing, the high Altman Z-Score of 3.37 suggests the company is in good standing. The return on invested capital has fallen below the weighted average cost of capital, however, indicating struggles with creating value as the company grows.

The company’s profitability fared better with an 8 out of 10 rating. Despite the declining operating margin, the company is supported by strong returns on equity, assets and capital that outperform over half of its competitors and a moderate Piotroski F-Score of 4, meaning its conditions are typical for a stable business. Roper’s predictability rank of five out of five stars is on watch despite recording steady earnings and revenue growth. According to GuruFocus, companies with this rating return an average of 12.1% annually.

Of the gurus invested in Roper, Chuck Akre (Trades, Portfolio)’s firm has the largest stake with 1.58% of outstanding shares. Other guru shareholders include Frank Sands (Trades, Portfolio), Pioneer Investments, Ron Baron (Trades, Portfolio), the MS Global Franchise Fund, Mario Gabelli (Trades, Portfolio), Steven Cohen (Trades, Portfolio), Ken Fisher (Trades, Portfolio) and Jim Simons (Trades, Portfolio)’ Renaissance Technologies.

MarketAxess

The investor picked up 37,800 shares of MarketAxess (MKTX, Financial), dedicating 0.75% of the equity portfolio to the holding. Shares traded for an average price of $476.86 each during the quarter.

The financial services company headquartered in New York, which operates an electronic trading platform for the institutional credit market and provides market data and post-trade services, has a market cap of $17.96 billion; its shares were trading around $472.60 on Wednesday with a price-earnings ratio of 62.44, a price-book ratio of 17.58 and a price-sales ratio of 25.5.

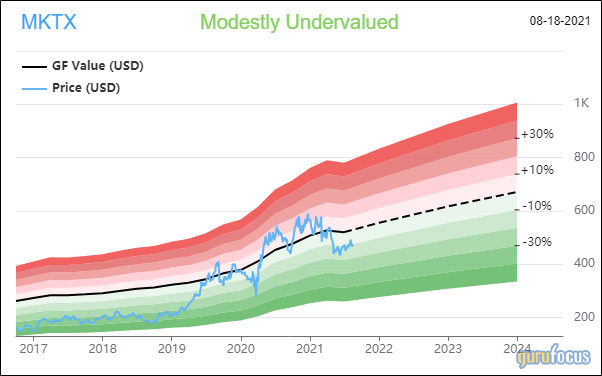

According to the GF Value Line, the stock is modestly undervalued currently.

The valuation rank of 1 out of 10, however, is more in favor of overvaluation even though the price-book and price-sales ratios are closing in on one-year lows.

In his quarterly letter, Weitz noted that MarketAxess is a strong example of their QuaD approach in action. He sees “a long runway for growth” for the company as “electronification” becomes more prominent in its core markets.

GuruFocus rated MarketAxess’ financial strength 8 out of 10 on the back of solid interest coverage and decent debt-related ratios. The robust Altman Z-Score of 23.57 also indicates the company is in good standing even though assets area building up at a faster rate than revenue is growing. Good value creation is occurring since the WACC is overshadowed by the ROIC.

The company’s profitability also fared well with a 9 out of 10 rating, driven by an expanding operating margin, strong returns that outperform a majority of industry peers and a moderate Piotroski F-Score of 5. Consistent earnings and revenue growth contributed to MarketAxess’ five-star predictability rank.

With a 4.67% stake, Baillie Gifford (Trades, Portfolio) is the company’s largest guru shareholder. PRIMECAP Management (Trades, Portfolio), Baron, Simons’ firm, Pioneer, Jerome Dodson (Trades, Portfolio), Ray Dalio (Trades, Portfolio), Murray Stahl (Trades, Portfolio), Chuck Royce (Trades, Portfolio) and Caxton Associates (Trades, Portfolio) also own the stock.

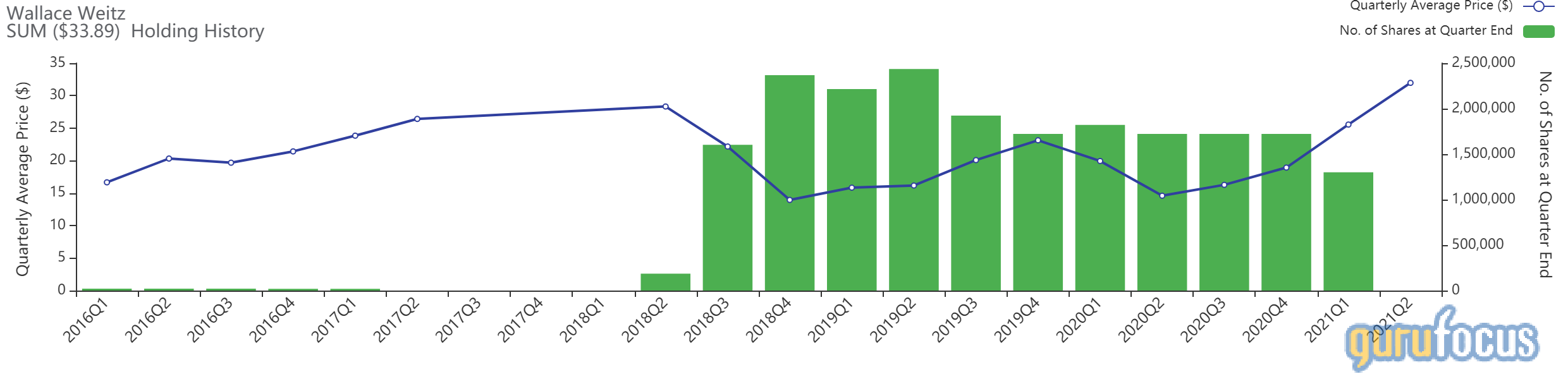

Summit Materials

The guru divested of his 1.3 million remaining Summit Materials (SUM, Financial) shares, impacting the equity portfolio by -1.63%. The stock traded for an average per-share price of $31.97 during the quarter.

GuruFocus estimates he gained 34.72% on the investment, which was established in the second quarter of 2018.

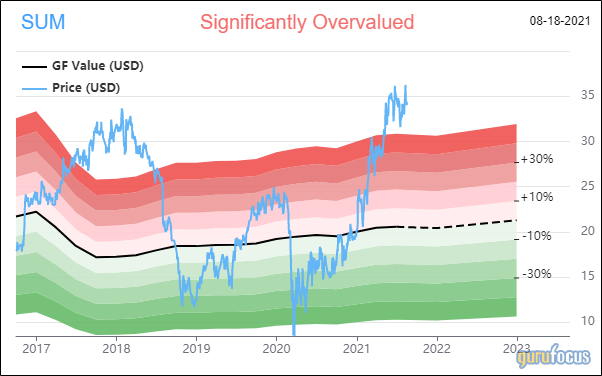

The Denver-based materials company, which supplies aggregates, cement, ready-mix concrete and asphalt, has a $4.04 billion market cap; its shares were trading around $34.34 on Wednesday with a price-earnings ratio of 24.8, a price-book ratio of 2.39 and a price-sales ratio of 1.63.

Based on the GF Value Line, the stock appears to be significantly overvalued currently.

Summit Materials’ financial strength was rated 4 out of 10 by GuruFocus. In addition to weak interest coverage, the low Altman Z-Score of 1.92 indicates the company is under some pressure since assets are building up at a faster rate than revenue is growing. The WACC also eclipses the ROIC, meaning the company is struggling to create value.

The company’s profitability did not fare much better, scoring a 5 out of 10 rating. Although the operating margin is in decline, returns outperform over half of its competitors. Summit also has a high Piotroski F-Score of 8, indicating business conditions are healthy.

Louis Moore Bacon (Trades, Portfolio) has the largest stake in Summit among the gurus with 0.16% of its outstanding shares. Lee Ainslie (Trades, Portfolio) is also a shareholder.

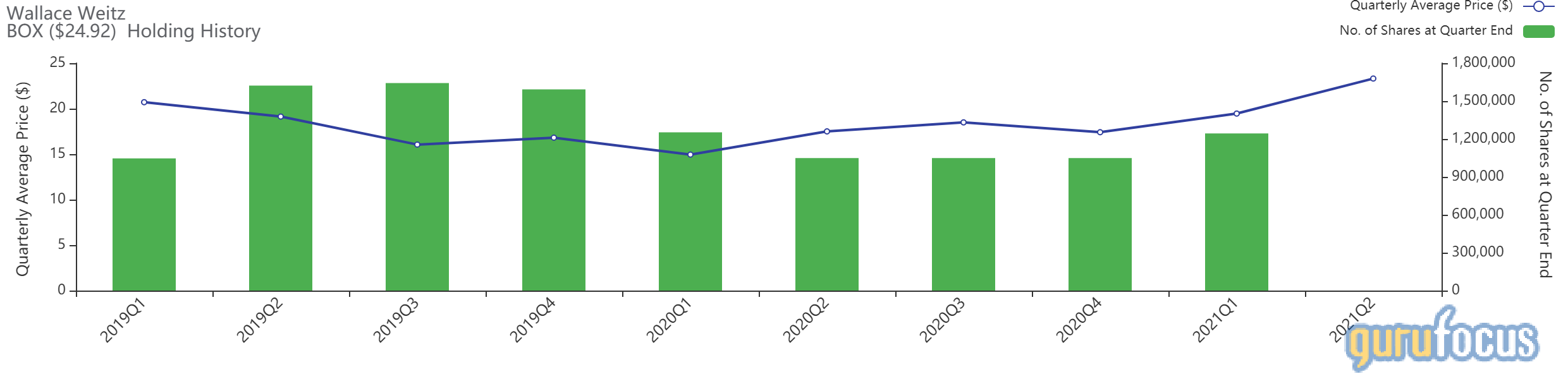

Box

With an impact of -1.27% on the equity portfolio, Weitz sold all 1.24 million remaining Box (BOX, Financial) shares. During the quarter, the stock traded for an average price of $23.31 per share.

GuruFocus data shows he gained an estimated 4.55% on the investment.

The cloud-based content management platform, which is headquartered in Redwood City, California, has a market cap of $3.93 billion; its shares were trading around $25.44 on Wednesday with a price-book ratio of 33.11 and a price-sales ratio of 5.09.

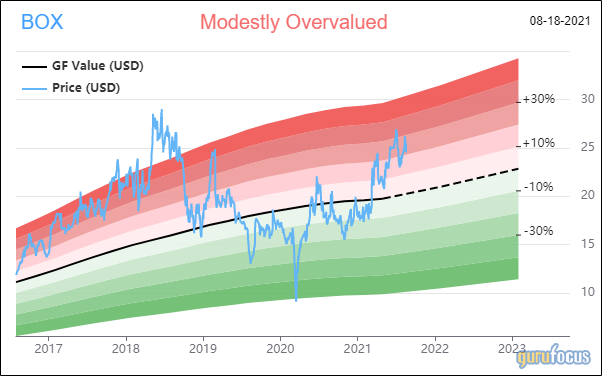

The GF Value Line suggests the stock is modestly overvalued currently.

GuruFocus rated Box’s financial strength 3 out of 10. The Altman Z-Score of 1.26 warns the company could be at risk of bankruptcy if it does not improve its liquidity. Assets are also building up at a faster rate than revenue is growing, indicating it may be becoming less efficient, while revenue per share growth has slowed over the past 12 months.

The company’s profitability scored a 2 out of 10 rating. Despite good operating margin expansion, Box’s returns are negative and underperform a majority of industry peers. It is also supported by a moderate Piotroski F-Score of 5.

Of the gurus invested in Box, Simons’ firm now has the largest stake with 0.68% of its outstanding shares. Other guru shareholders are Paul Tudor Jones (Trades, Portfolio), Pioneer, Ainslie, Joel Greenblatt (Trades, Portfolio) and Baillie Gifford (Trades, Portfolio).

Dun & Bradstreet

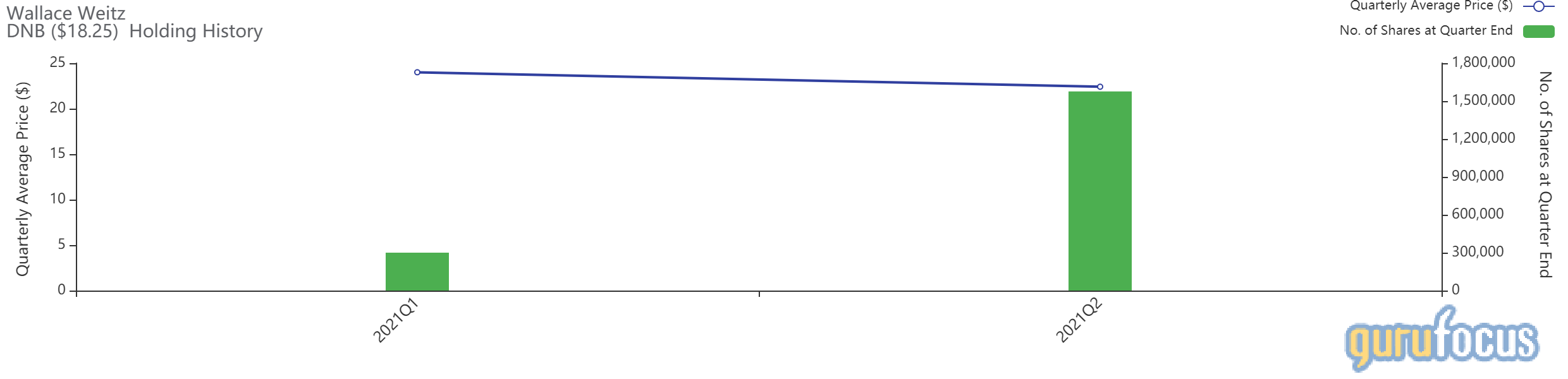

Impacting the equity portfolio by 1.17%, Weitz boosted his Dun & Bradstreet (DNB, Financial) stake by 425.33%, buying 1.27 million shares. The shares traded for an average price of $22.41 each during the quarter.

The investor now holds 1.57 million shares total, which account for 1.44% of the equity portfolio. He has lost an estimated 19.63% on the investment so far based on GuruFocus data.

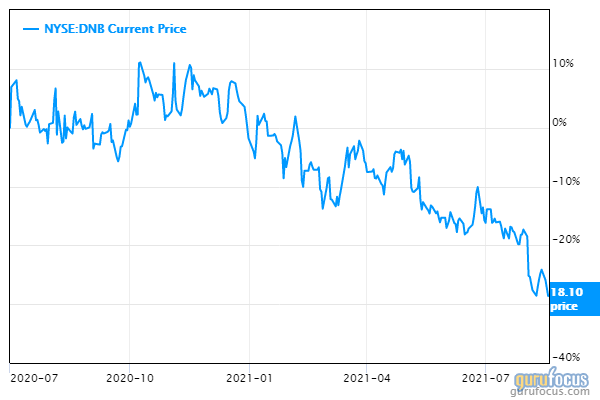

The Short Hills, New Jersey-based company, which provides commercial data, analytics and insights for businesses, has a $7.82 billion market cap; its shares were trading around $18.10 on Wednesday with a forward price-earnings ratio of 17.5, a price-book ratio of 2.2 and a price-sales ratio of 3.99.

Since its initial public offering in July 2020, the stock has tumbled nearly 30%. Its price ratios are closing in on multiyear lows.

In his quarterly letter, Weitz noted the company is another good example of the firm’s QuaD approach. Under its new leadership, Dun & Bradstreet “has moved quickly to modernize its technology, improve its sales and contracting practices, invest in new data and capabilities that enhance its value to customers, and evaluate potential acquisitions that can boost each of these efforts.”

Dun & Bradstreet’s financial strength and profitability were both rated 3 out of 10 by GuruFocus. In addition to poor interest coverage, the Altman Z-Score of 0.86 warns the company could be in danger of bankruptcy. The ROIC is also being surpassed by the WACC, indicating struggles with creating value.

While the operating margin is outperforming over half of the company’s competitors, its returns are negative and underperforming compared to other players.

With 0.37% of outstanding shares, Weitz is Dun & Bradstreet’s largest guru shareholder. Larry Robbins (Trades, Portfolio), Simons’ firm, Jones and George Soros (Trades, Portfolio) also see value in the stock.

Additional trades and portfolio composition

During the quarter, Weitz also added to the CoStar Group Inc. (CSGP, Financial), Amazon.com Inc. (AMZN, Financial) and Black Knight Inc. (BKI, Financial) holdings while trimming a number of other investments, including Berkshire Hathaway Inc. (BRK.B, Financial), Oracle Corp. (ORCL, Financial), ACI Worldwide Inc. (ACIW, Financial) and AutoZone Inc. (AZO, Financial).

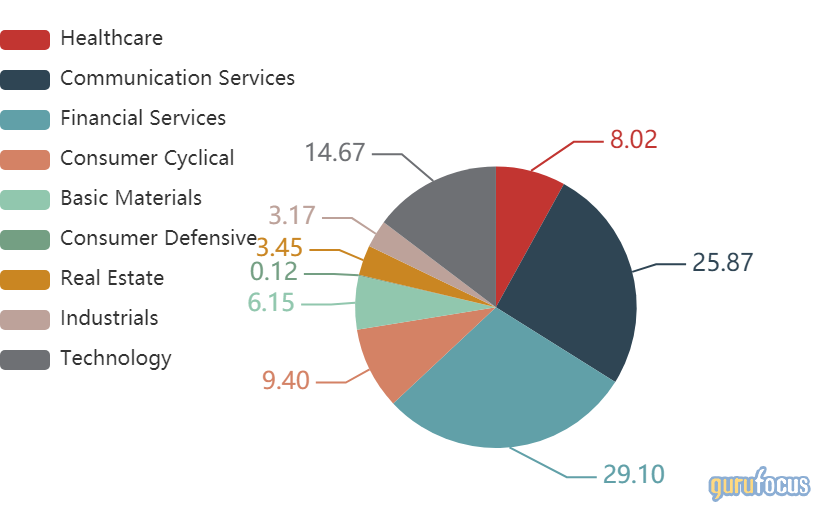

Roughly half of the guru’s $2.35 billion equity portfolio, which is made up of 57 stocks, is invested in the financial services and communication services sectors.

The Partners III Opportunity Fund returned 7.57% in 2020, underperforming the S&P 500’s 18.4% return.

Also check out: