Carl Icahn (Trades, Portfolio), board chairman of Icahn Enterprises LP (IEP, Financial), disclosed this week that during the second quarter, his firm shuttered its holdings in Herbalife Nutrition Ltd. (HLF, Financial) and Tenneco Inc. (TEN, Financial) and trimmed its positions in Occidental Petroleum Corp. (OXY, Financial) and Delek US Holdings Inc. (DK, Financial). With the proceeds, the firm added more shares of Icahn Enterprises.

Through his Icahn Partners and Icahn Management hedge funds, the activist investor seeks positions in out-of-favor companies and pushes for management changes to unlock shareholder value. The guru explains that going with trends may lead to problems when momentum falls apart.

As of June 30, Icahn’s $24.29 billion equity portfolio contains 17 stocks, with no new positions and a turnover ratio of 4%. The top three sectors in terms of weight are industrials, energy and technology, representing 59.99%, 18.13% and 7.61% of the equity portfolio.

Herbalife

Icahn shuttered his firm’s stake in Herbalife (HLF, Financial), selling 8,018,886 shares. The transaction trimmed 1.49% of Icahn’s equity portfolio. Shares averaged $49.62 during the second quarter; the stock is modestly undervalued based on Thursday’s price-to-GF Value ratio of 0.72.

GuruFocus ranks the international nutrition company’s profitability 8 out of 10 on several positive investing signs, which include a 3.5-star business predictability rank and profit margins that outperform more than 72% of global competitors.

Icahn exited his position in Herbalife approximately three years after fellow activist investor Bill Ackman (Trades, Portfolio) shuttered his short position, ending a heated battle between the two. Based on GuruFocus estimates, Icahn gained approximately 69.89% on the stock since initially buying shares during the first quarter of 2013.

Gurus with holdings in Herbalife include Jim Simons (Trades, Portfolio)’ Renaissance Technologies, Steven Cohen (Trades, Portfolio)’s Point72 Asset Management and Ray Dalio (Trades, Portfolio)’s Bridgewater Associates.

Tenneco

Icahn closed his firm’s Tenneco (TEN, Financial) position, selling 9,589,751 shares. The transaction curbed the portfolio 0.43%; based on GuruFocus estimates, the guru took a loss of approximately 31.31% on the stock since initially buying shares during the fourth quarter of 2018. Shares averaged $14.85 during the second quarter; the stock is modestly overvalued based on Thursday’s price-to-GF Value ratio of 1.21.

GuruFocus ranks the Lake Forest, Illinois-based vehicle parts company’s financial strength 4 out of 10 on the back of a weak Altman Z-score of 1.61 and interest coverage ratios that underperform more than 79% of global competitors despite having a solid Piotroski F-score of 6.

Occidental Petroleum

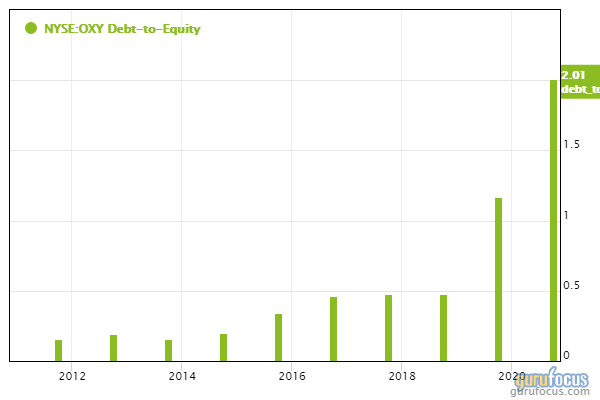

The firm sold 36,901,925 shares of Occidental Petroleum (OXY, Financial), spilling out 42.90% of the position and 4.12% of its equity portfolio. Shares averaged $26.82 during the second quarter; the stock is a possible value trap based on Thursday’s price-to-GF Value ratio of 0.62 and the company’s low financial strength. Based on GuruFocus estimates, the firm has an estimated loss of approximately 35.59% on the stock since initially buying shares in the second quarter of 2019.

GuruFocus ranks the Houston-based energy company’s financial strength 3 out of 10 on several warning signs, which include a weak Altman Z-score of 0.39 and debt ratios that underperform more than 84% of global competitors.

Other gurus with holdings in Occidental Petroleum include Dodge & Cox and David Tepper (Trades, Portfolio).

Delek US

The firm sold 3,078,225 shares of Delek US (DK, Financial), trimming 29.21% of the position and 0.28% of the equity portfolio. Shares averaged $22.57 during the second quarter; the stock is a possible value trap based on Thursday’s price-to-GF Value ratio of 0.65 and low financial strength.

GuruFocus ranks the Brentwood, Tennessee-based energy company’s financial strength 4 out of 10 on several warning signs, which include a low Altman Z-score of 1.21 and debt ratios that are underperforming more than 90% of global competitors.

Icahn Enterprises

The firm purchased 15,896,308 shares of Icahn Enterprises (IEP, Financial), boosting the position by 7.17% and its equity portfolio by 3.60%. Shares averaged $56.83 during the second quarter; the stock is modestly overvalued based on Thursday’s price-to-GF Value ratio of 1.10.

Icahn’s equity portfolio has a 53.80% weight in Icahn Enterprises.