Scott Black (Trades, Portfolio), president and chief investment officer at Delphi Management, disclosed last week that his firm’s top five trades during the second quarter included new positions in Micron Technology Inc. (MU, Financial), Western Digital Corp. (WDC, Financial) and Foot Locker Inc. (FL, Financial), as well as the closure of the firm’s holdings in PVH Corp. (PVH, Financial) and EMCOR Group Inc. (EME, Financial).

The Boston-based firm pursues a conservative investing strategy in which managers only select stocks that meet the firm’s fundamental and quantitative criteria. As disciples of the Graham-Dodd school of value investing, Black and his partners believe that an investment should exhibit absolute value.

As of June 30, Delphi’s $105 million equity portfolio contains 105 stocks, with 26 new positions and a turnover ratio of 18%. The top four sectors in terms of weight are technology, financial services, consumer cyclical and health care, representing 22.70%, 19.38%, 14.73% and 10.69% of the equity portfolio.

Micron Technology

Delphi purchased 17,916 shares of Micron Technology (MU, Financial), giving the position 1.45% equity portfolio weight. Shares averaged $84.58 during the second quarter; the stock is modestly overvalued based on Monday’s price-to-GF Value ratio of 1.22.

GuruFocus ranks the Boise, Idaho-based DRAM chip producer’s profitability 8 out of 10 on several positive investing signs, which include a 3.5-star business predictability rank, a high Piotroski F-score of 8 and an operating margin that has increased over 20% per year on average over the past five years and is outperforming more than 78% of global competitors.

Gurus with large holdings in Micron Technology include PRIMECAP Management (Trades, Portfolio), Li Lu (Trades, Portfolio), Ruane Cunniff (Trades, Portfolio) and Seth Klarman (Trades, Portfolio). Micron is also David Tepper (Trades, Portfolio)’s top holding according to top 10 holdings statistics, a Premium feature of GuruFocus.

Western Digital

The firm purchased 19,918 shares of Western Digital (WDC, Financial), giving the position 1.35% equity portfolio space. Shares averaged $71.53 during the second quarter; the stock is modestly overvalued based on Tuesday’s price-to-GF Value ratio of 1.23.

GuruFocus ranks the San Jose-based data storage solutions company’s profitability 7 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7 and a Greenblatt return on capital that outperforms more than 70% of global competitors.

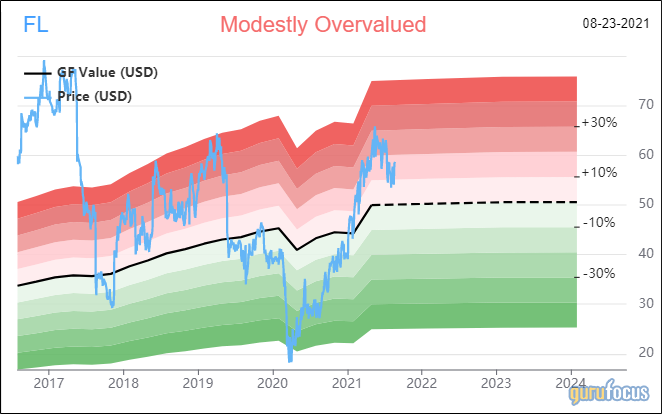

Foot Locker

The firm purchased 19,770 shares of Foot Locker (FL, Financial), giving the position 1.16% equity portfolio weight. Shares averaged $60.36 during the second quarter; the stock is modestly overvalued based on Tuesday’s price-to-GF Value ratio of 1.18.

GuruFocus ranks the New York-based apparel company’s profitability 8 out of 10 on several positive investing signs, which include a high Piotroski F-score of 8 and profit margins and returns that outperform more than 71% of global competitors.

PVH Corp.

The firm sold 11,557 shares of PVH Corp. (PVH, Financial), shipping out 1.30% of its equity portfolio. Shares averaged $109.70 during the second quarter; the stock is modestly overvalued based on Tuesday’s price-to-GF Value ratio of 1.20.

GuruFocus ranks the New York-based apparel company’s financial strength 4 out of 10 on several warning signs, which include a low Altman Z-score of 1.79 and interest coverage and debt ratios that underperform more than 70% of global competitors.

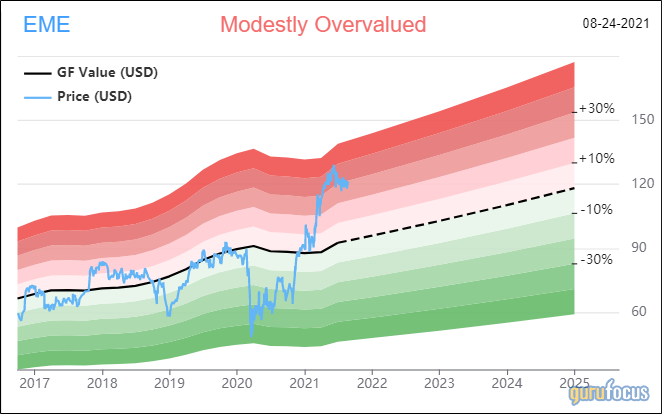

EMCOR

The firm sold 10,065 shares of EMCOR (EME, Financial), slicing 1.20% of its equity portfolio. Shares averaged $121.79 during the second quarter; the stock is modestly overvalued based on Tuesday’s price-to-GF Value ratio of 1.30.

GuruFocus ranks the Norwalk, Connecticut-based electrical construction company’s profitability 7 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7 and an operating margin that is near a 10-year high of 5.7% yet underperforms approximately half of global competitors.

Also check out: