Renowned economist and investor Jeremy Grantham (Trades, Portfolio), one of the co-founders of GMO, has built a reputation over the course of his long career by correctly identifying speculative market bubbles as they were happening and steering his clients’ assets clear of impending crashes.

In an interview with CNBC’s “Closing Bell” on Tuesday, he doubled down on his most current call, saying the U.S. has a “magnificent” equity bubble that is even crazier than before the crashes of 1929 and 2000.

Founded in 1977, the guru’s Boston-based firm oversees multi-asset class, fixed income and alternative investments. To produce superior risk-adjusted returns, GMO’s specialized investment teams seek to identify and exploit long-term and even contrarian opportunities by focusing on environmental, social and governance factors as well as sector-specific trends and expertise.

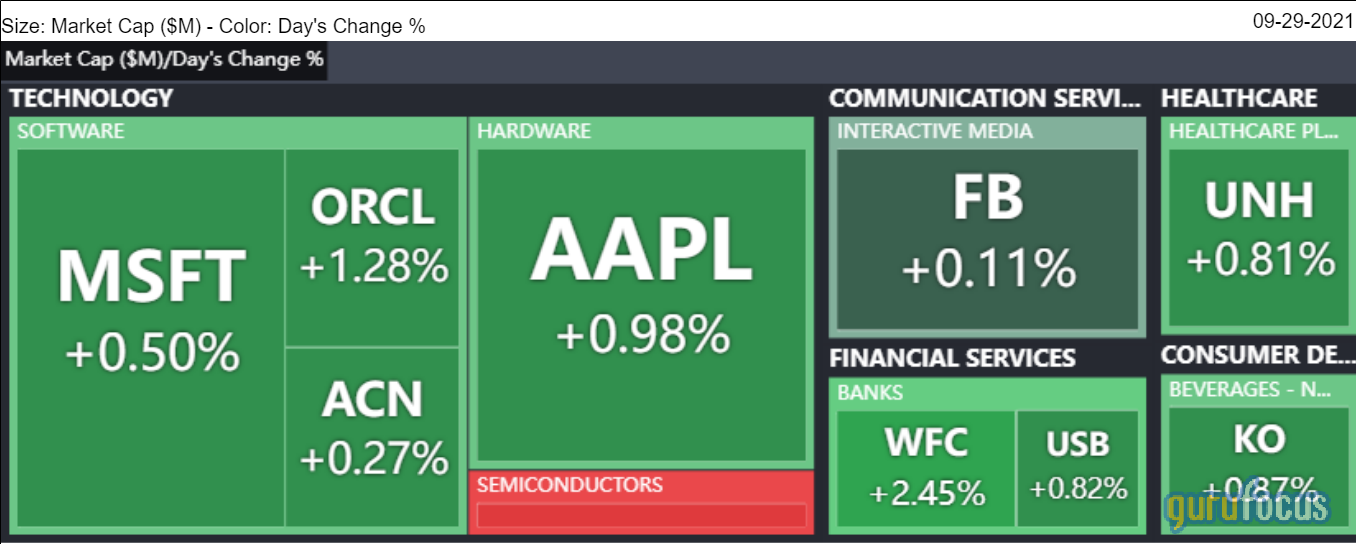

Despite his recent advice to “avoid the U.S. like the plague,” as of the end of the second quarter, GuruFocus portfolio data shows the guru’s five largest holdings were Microsoft Corp. (MSFT, Financial), UnitedHealth Group Inc. (UNH, Financial), Apple Inc. (AAPL, Financial), U.S. Bancorp (USB, Financial) and Oracle Corp. (ORCL, Financial).

Microsoft

In the second quarter, Grantham increased his stake in Microsoft (MSFT, Financial) by 6.28% to 3.2 million shares. As his largest holding, the position accounts for 4.33% of the equity portfolio. GuruFocus estimates the guru has gained 106.33% on the investment over its lifetime.

The Redmond, Washington-based software company has a $2.14 trillion market cap; its shares were trading around $285.07 on Wednesday with a price-earnings ratio of 35.42, a price-book ratio of 15.09 and a price-sales ratio of 12.9.

The GF Value Line suggests the stock is significantly overvalued currently based on historical ratios, past performance and future earnings projections.

GuruFocus rated Microsoft’s financial strength 6 out of 10, driven by a comfortable level of interest coverage as well as a high Altman Z-Score of 8.48, indicating the company is in good standing even though assets are building up at a faster rate than revenue is growing. The return on invested capital also overshadows the weighted average cost of capital, suggesting good value creation is occurring as the company grows.

The company’s profitability fared even better, scoring a 9 out of 10 rating on the back of an expanding operating margin, strong returns on equity, assets and capital that outperform a majority of competitors and a high Piotroski F-Score of 8 out of 9, indicating business conditions are healthy. As a result of consistent earnings and revenue growth, Microsoft also has a predictability rank of 2.5 out of five stars. According to GuruFocus, companies with this rank return an average of 7.3% annually over a 10-year period.

Of the many gurus invested in Microsoft, Ken Fisher (Trades, Portfolio) has the largest stake with 0.33% of outstanding shares. Other top guru shareholders include Pioneer Investments, PRIMECAP Management (Trades, Portfolio), Chase Coleman (Trades, Portfolio), Dodge & Cox, Spiros Segalas (Trades, Portfolio), Baillie Gifford (Trades, Portfolio), Steve Mandel (Trades, Portfolio) and Andreas Halvorsen (Trades, Portfolio).

UnitedHealth Group

The guru upped his UnitedHealth (UNH, Financial) position by 0.23% to 1.47 million shares, which represent 2.95% of the equity portfolio and is the second-largest holding. According to GuruFocus, Grantham has gained an estimated 103.64% on the investment so far.

The managed care company headquartered in Minnetonka, Minnesota has a market cap of $376.95 billion; its shares were trading around $400.03 on Wednesday with a price-earnings ratio of 26.41, a price-book ratio of 5.47 and a price-sales ratio of 1.42.

According to the GF Value Line, the stock is modestly overvalued currently.

UnitedHealth’s financial strength was rated 5 out of 10 by GuruFocus. Despite issuing approximately $12.9 billion in new long-term debt over the past three years, it is at a manageable level due to adequate interest coverage. The Altman Z-Score of 3.63 also indicates it is in good standing even though assets are building up at a faster rate than revenue is growing. Additionally, value is being created since the ROIC eclipses the WACC.

The company’s profitability scored an 8 out of 10 rating on the back of an expanding operating margin, strong returns that outperform a majority of industry peers and a moderate Piotroski F-Score of 4, indicating business conditions are typical for a stable company. Despite recording consistent earnings and revenue growth, UnitedHealth’s perfect five-star predictability rank is on watch. GuruFocus says companies with this rank return an average of 12.1% annually.

With a 0.76% stake, the Vanguard Health Care Fund (Trades, Portfolio) is UnitedHealth’s largest guru shareholder. Dodge & Cox, Mandel, Fisher, Ruane Cunniff (Trades, Portfolio), Halvorsen, Pioneer Investments and Barrow, Hanley, Mewhinney & Strauss also have significant positions in the stock.

Apple

The investor trimmed his holding of Apple (AAPL, Financial) during the quarter by 0.92% to 4.3 million shares. As the third-largest holding, the investment occupies 2.91% of the equity portfolio. GuruFocus data shows Grantham has gained an estimated 171.21% on the stock so far.

The Cupertino, California-based tech giant, which is known for the iPhone and Mac computer, has a $2.38 trillion market cap; its shares were trading around $143.25 on Wednesday with a price-earnings ratio of 28.12, a price-book ratio of 37.02 and a price-sales ratio of 7.03.

Based on the GF Value Line, the stock appears to be significantly overvalued currently.

GuruFocus rated Apple’s financial strength 5 out of 10. The robust Altman Z-Score of 7.45 indicates the company is in good standing, while the ROIC surpasses the WACC by a wide margin, indicating good value creation is occurring.

The company’s profitability fared better with an 8 out of 10 rating. Even though the operating margin is in decline, Apple is supported by strong returns that outperform a majority of competitors, a high Piotroski F-Score of 7 and steady earnings and revenue growth. It also has a 2.5-star predictability rank.

Warren Buffett (Trades, Portfolio) is the company’s largest guru shareholder with a 5.37% stake. Fisher, Pioneer Investments, Segalas, Jim Simons (Trades, Portfolio)’ Renaissance Technologies, PRIMECAP Management (Trades, Portfolio), Elfun Trusts (Trades, Portfolio) and Tom Gayner (Trades, Portfolio) also have large holdings in Apple.

U.S. Bancorp

Grantham curbed his U.S. Bancorp (USB, Financial) stake by 1.11% during the quarter to 9.6 million shares. Accounting for 2.74% of the equity portfolio, it is the firm’s fourth-largest holding. GuruFocus says he has gained an estimated 18.6% on the investment so far.

The bank holding company, which is headquartered in Minneapolis, has a market cap of $89.72 billion; its shares were trading around $60.50 on Wednesday with a price-earnings ratio of 12.95, a price-book ratio of 1.9 and a price-sales ratio of 3.96.

The GF Value Line suggests the stock is fairly valued currently.

Weighed down by debt-related ratios that are underperforming in comparison to over half of its industry, U.S. Bancorp’s financial strength was rated 3 out of 10 by GuruFocus.

The company’s profitability fared better, scoring a 6 out of 10 rating. U.S. Bancorp is supported by margins and returns that top over half of its industry peers as well as a high Piotroski F-Score of 8. Consistent earnings and revenue growth also contributed to a 4.5-star predictability rank. GuruFocus data shows companies with this rank return, on average, 10.6% annually.

Of the gurus invested in the bank, Buffett has the largest stake with 8.69% of its outstanding shares. Chris Davis (Trades, Portfolio), Barrow, Hanley, Mewhinney & Strauss, First Eagle Investment (Trades, Portfolio), Mairs and Power (Trades, Portfolio), PRIMECAP Management (Trades, Portfolio), Yacktman Asset Management (Trades, Portfolio), Pioneer Investments and Tweedy Browne (Trades, Portfolio), among others, also own the stock.

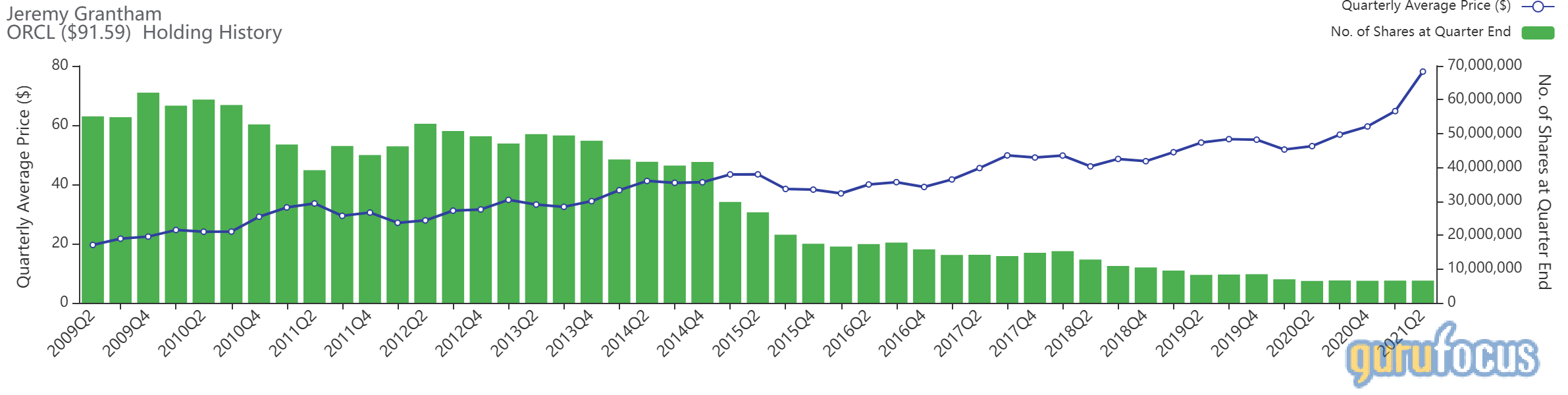

Oracle

In the second quarter, Grantham increased his position in Oracle (ORCL, Financial) by 0.09% to 6.5 million shares. It accounts for 2.55% of the equity portfolio and is his fifth-largest holding. GuruFocus estimates he has gained 79.09% on the investment over its lifetime.

The Redwood City, California-based software company has a $251.06 billion market cap; its shares were trading around $91.79 on Wednesday with a price-earnings ratio of 19.5 and a price-sales ratio of 6.67.

According to the GF Value Line, the stock is modestly overvalued currently.

GuruFocus rated Oracle’s financial strength 3 out of 10. While the company has adequate interest coverage, the Altman Z-Score of 1.89 indicates it is under some pressure. The ROIC outweighs the WACC, however, so value is being created.

The company’s profitability scored a 9 out of 10 rating, driven by operating margin expansion and returns that outperform a majority of competitors. Oracle also has a high Piotroski F-Score of 7, steady earnings and revenue growth and a 3.5-star predictability rank. GuruFocus has found that companies with this rank return, on average, 9.3% annually.

With a 0.96% stake, First Eagle is the company’s largest guru shareholder. Other guru investors with large holdings in Oracle include Fisher, PRIMECAP Management (Trades, Portfolio), Hotchkis & Wiley, Barrow, Hanley, Mewhinney & Strauss, Pioneer Investments, Richard Pzena (Trades, Portfolio) and the Yacktman funds.

Additional top holdings and portfolio composition

Other large positions in Grantham’s portfolio as of the end of the second quarter were Accenture PLC (ACN, Financial), Coca-Cola Co. (KO, Financial), Facebook Inc. (FB, Financial), Wells Fargo & Co. (WFC, Financial) and Lam Research Corp. (LRCX, Financial).

Nearly half of the guru’s $20.05 billion equity portfolio, which consisted of 704 stocks as of June 30, was invested in the technology and health care sectors, followed by smaller holdings in the financial services and communication services spaces.