According to GuruFocus Baskets statistics, the stocks broadly purchased by GuruFocus members as of October are Alibaba Group Holding Ltd. (BABA, Financial), Intel Corp. (INTC, Financial), Apple Inc. (AAPL, Financial), Facebook Inc. (FB, Financial) and Amazon.com Inc. (AMZN, Financial).

Berkshire Hathaway Inc. (BRK.A, Financial)(BRK.B, Financial) co-mangers Warren Buffett (Trades, Portfolio) and Charlie Munger (Trades, Portfolio) said that they have “three baskets for investing: yes, no, and too tough to understand.” The baskets allow investors to follow Buffett and Munger’s theory of achieving higher returns by investing only in one’s “circle of competence.”

GuruFocus’ Baskets feature allows its members to place a stock into one of four virtual baskets depending on the member’s degree of interest in the stock: buying, considering, researching or not interested.

Alibaba soars to most-bought stock among GuruFocus members

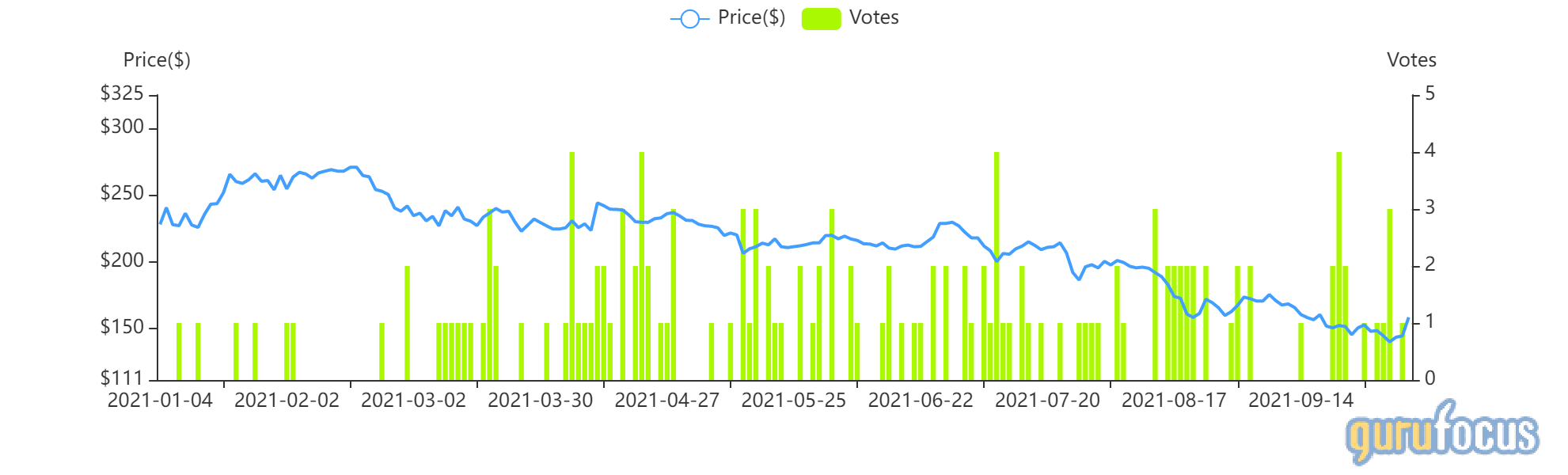

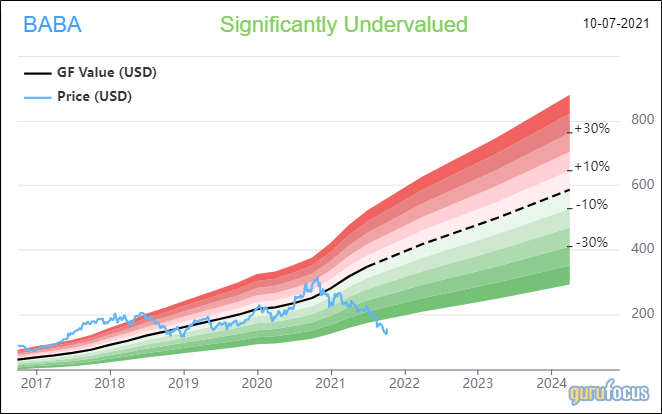

As of Thursday, 196 GuruFocus members said they have bought shares of Alibaba (BABA, Financial), the most-voted stock in the “buying” virtual basket. Shares traded around $156.78, showing the stock is significantly undervalued based on Thursday’s price-to-GF Value ratio of 0.42.

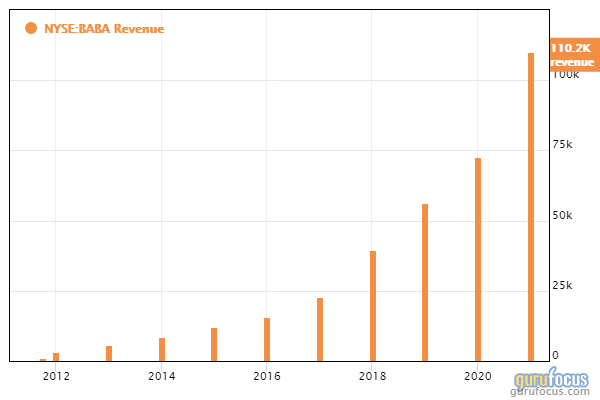

GuruFocus ranks the Chinese e-commerce giant’s profitability 8 out of 10 on several positive investing signs, which include a three-star business predictability rank and profit margins and returns that outperform more than 79% of global competitors.

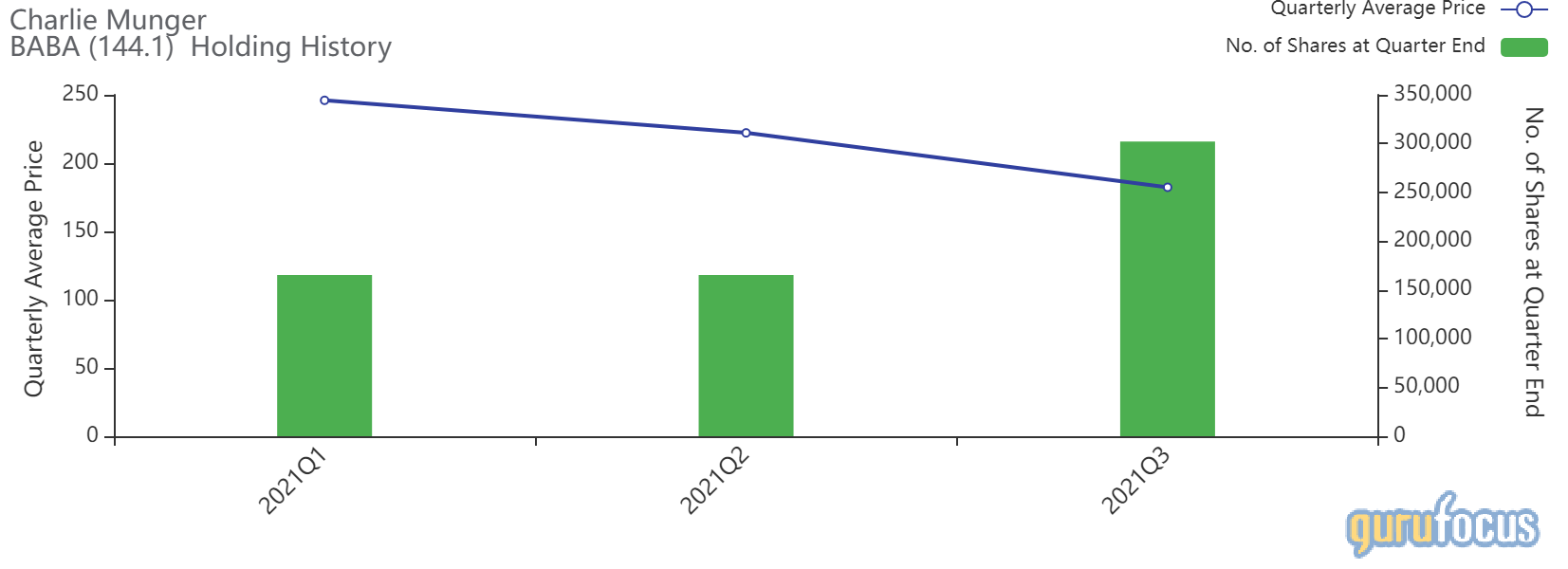

Gurus that have purchased shares of Alibaba over the past four months include Munger’s Daily Journal Corp. (DJCO, Financial), Mohnish Pabrai (Trades, Portfolio) and Tweedy Browne (Trades, Portfolio).

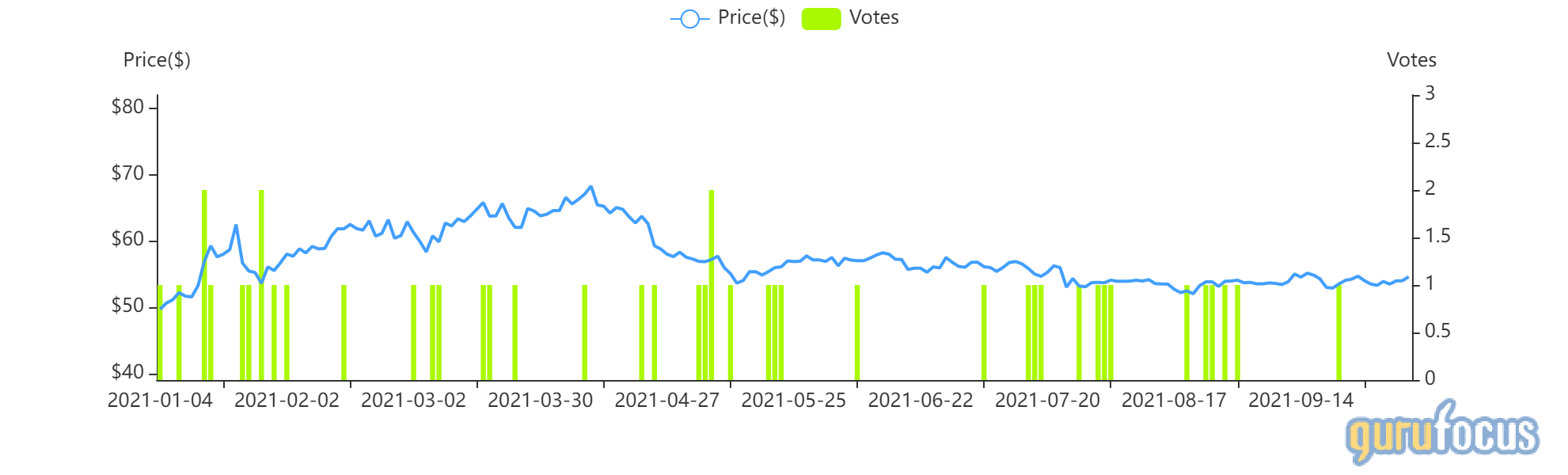

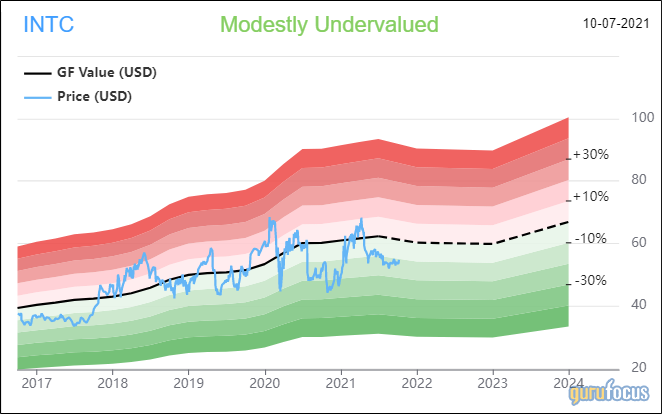

Intel

Intel (INTC, Financial) ranks second on the buying list with 120 member votes. Shares traded around $54.78, showing that the stock is modestly undervalued based on Thursday’s price-to-GF Value ratio of 0.89.

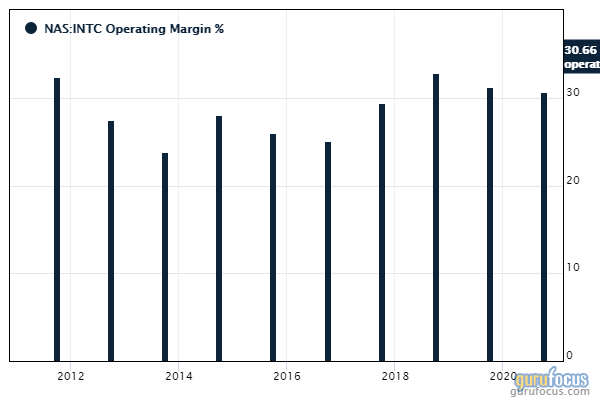

GuruFocus ranks the Santa Clara, California-based semiconductor company’s profitability 8 out of 10 on several positive investing signs, which include a 3.5-star business predictability rank and an operating margin that has increased approximately 4.7% per year on average over the past five years and outperforms more than 95% of global competitors.

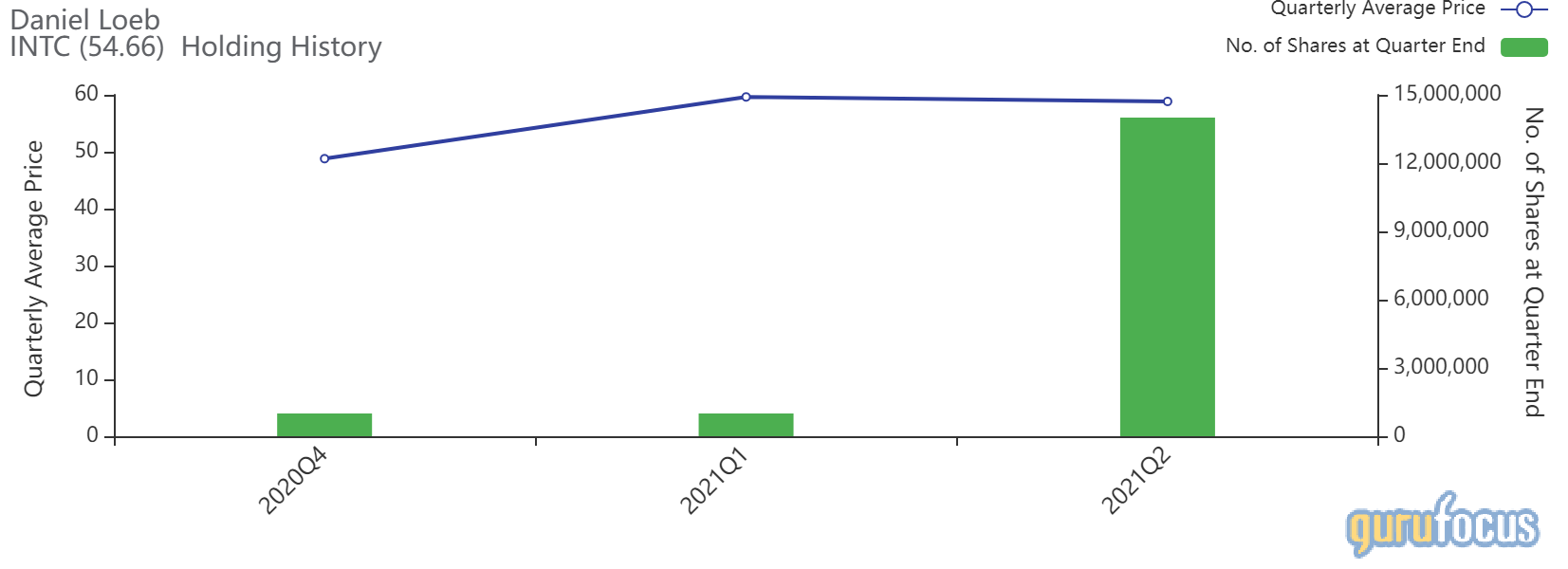

Gurus that bought shares of Intel during the past four months include Daniel Loeb (Trades, Portfolio)’s Third Point and Al Gore (Trades, Portfolio)’s Generation Investment Management.

Apple

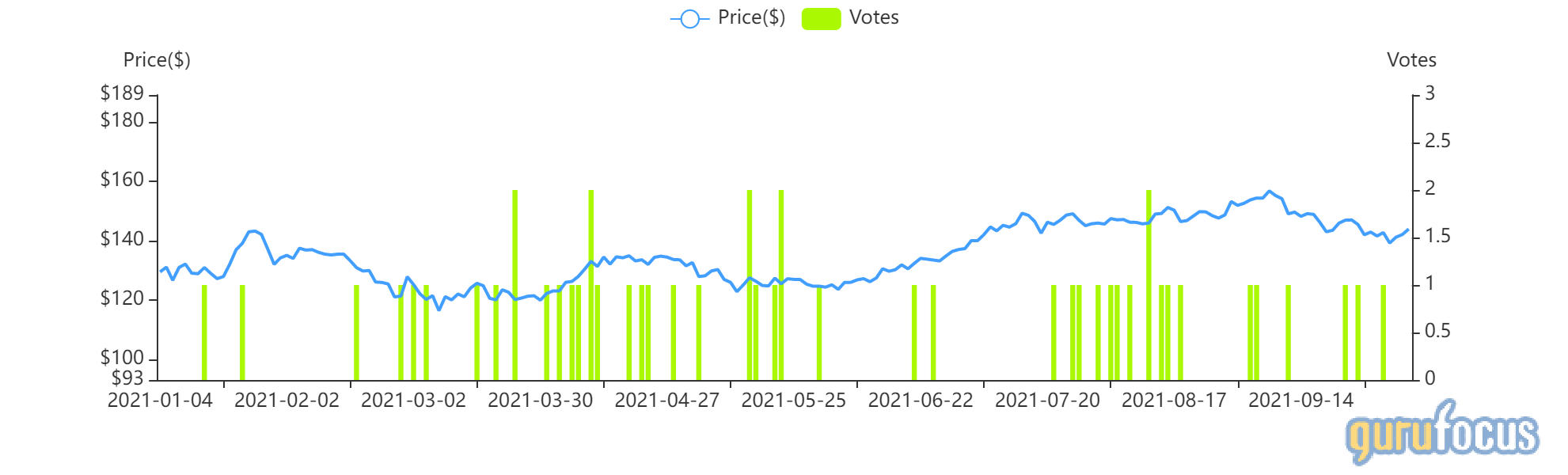

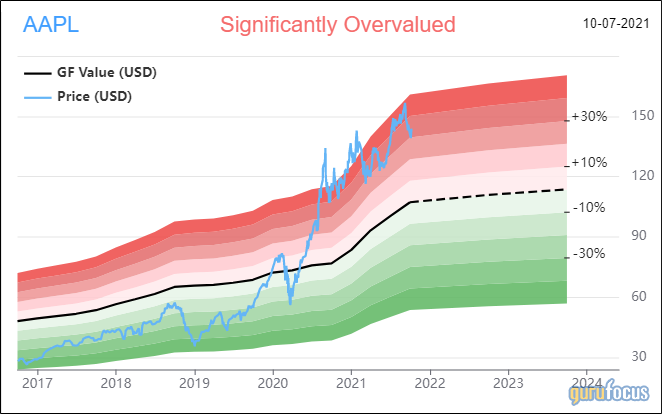

Apple (AAPL, Financial) ranks third on the buying list with 72 member votes. Shares traded around $143.86, showing the stock is significantly overvalued based on Thursday’s price-to-GF Value ratio of 1.34.

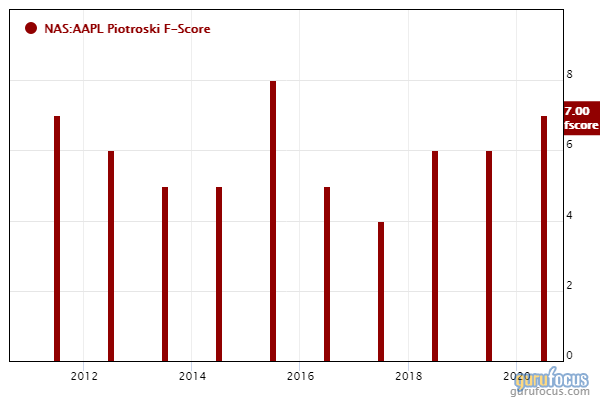

GuruFocus ranks the Cupertino, California-based consumer electronics giant’s profitability 8 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7 and profit margins and returns that are outperforming more than 96% of global competitors.

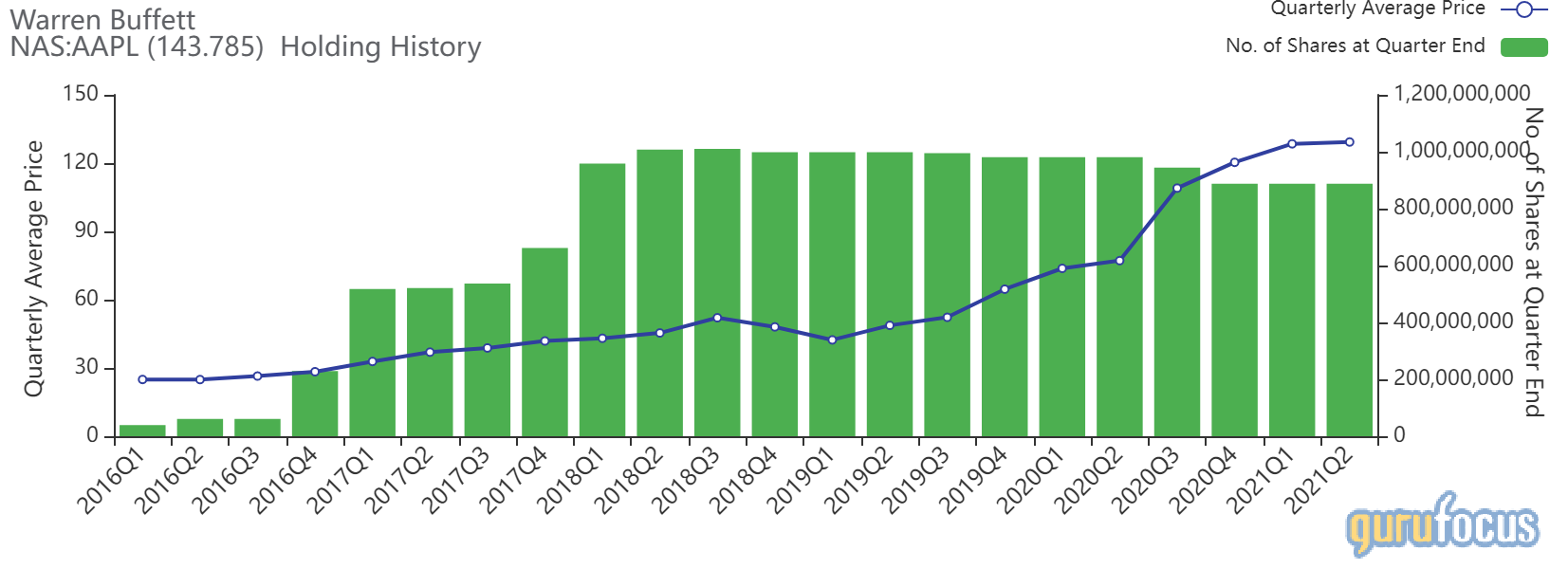

Gurus with large holdings in Apple include Buffett’s Berkshire and Ken Fisher (Trades, Portfolio)’s Fisher Investments.

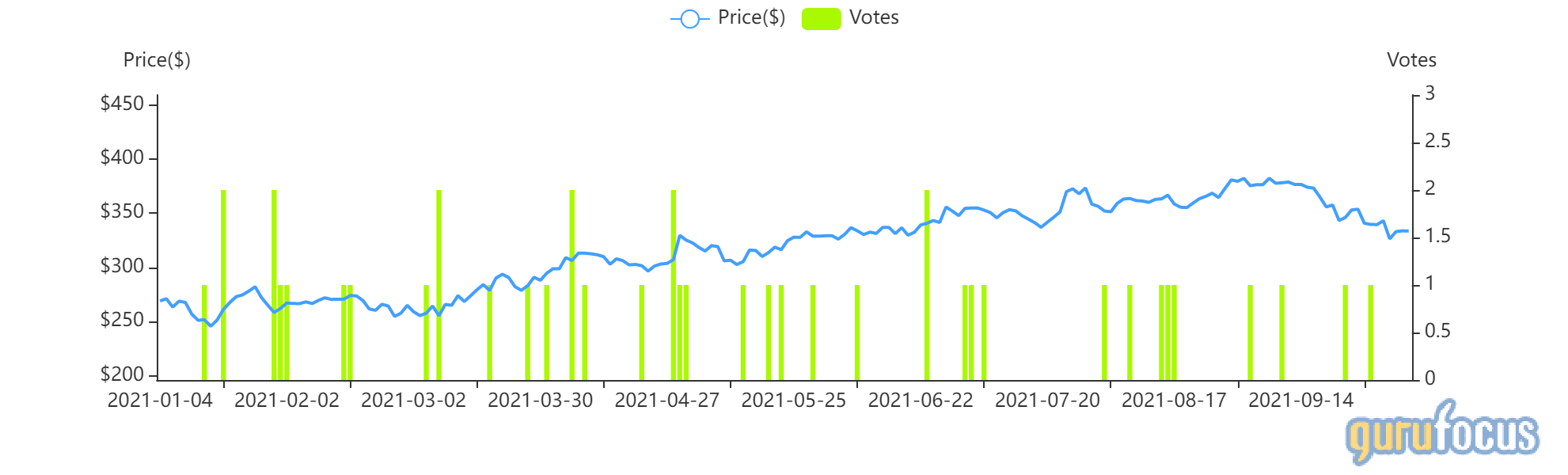

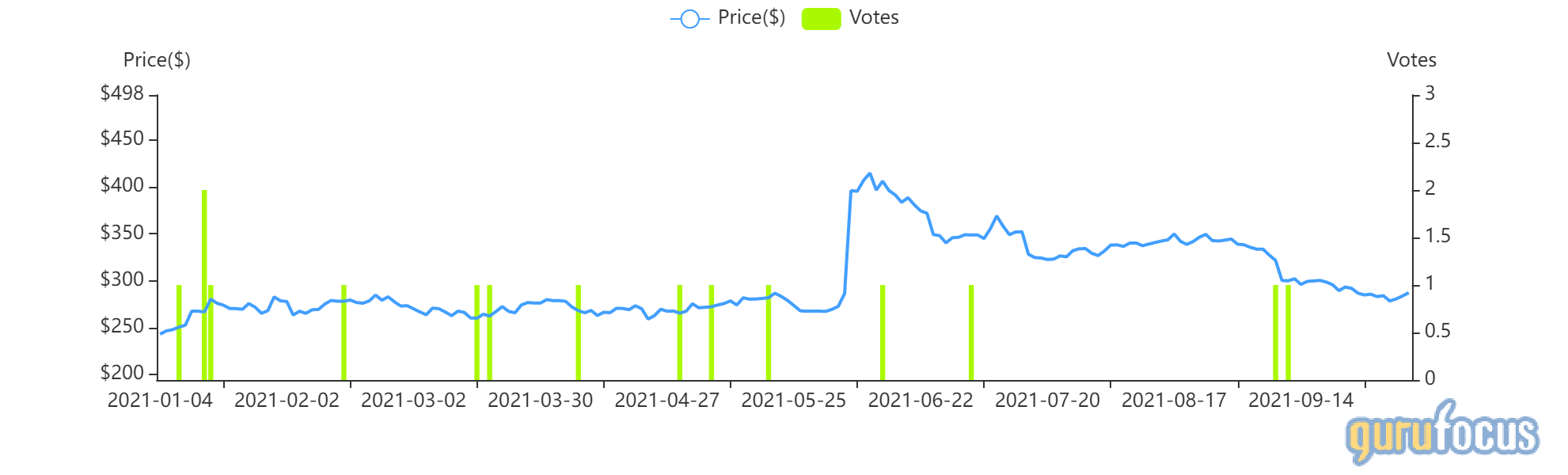

Facebook (FB, Financial) ranks fourth on the buying list with 66 member votes. Shares traded around $333.75, showing the stock is fairly valued based on Thursday’s price-to-GF Value ratio of 0.92.

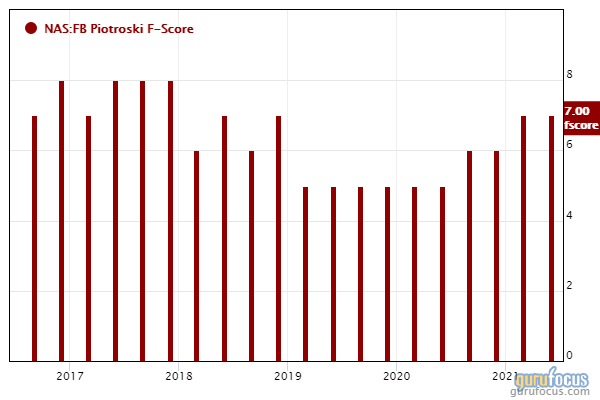

GuruFocus ranks the Menlo Park, California-based social media giant’s profitability 10 out of 10 on several positive investing signs, which include a five-star business predictability rank, a high Piotroski F-score of 7 and profit margins and returns that outperform more than 91% of global competitors.

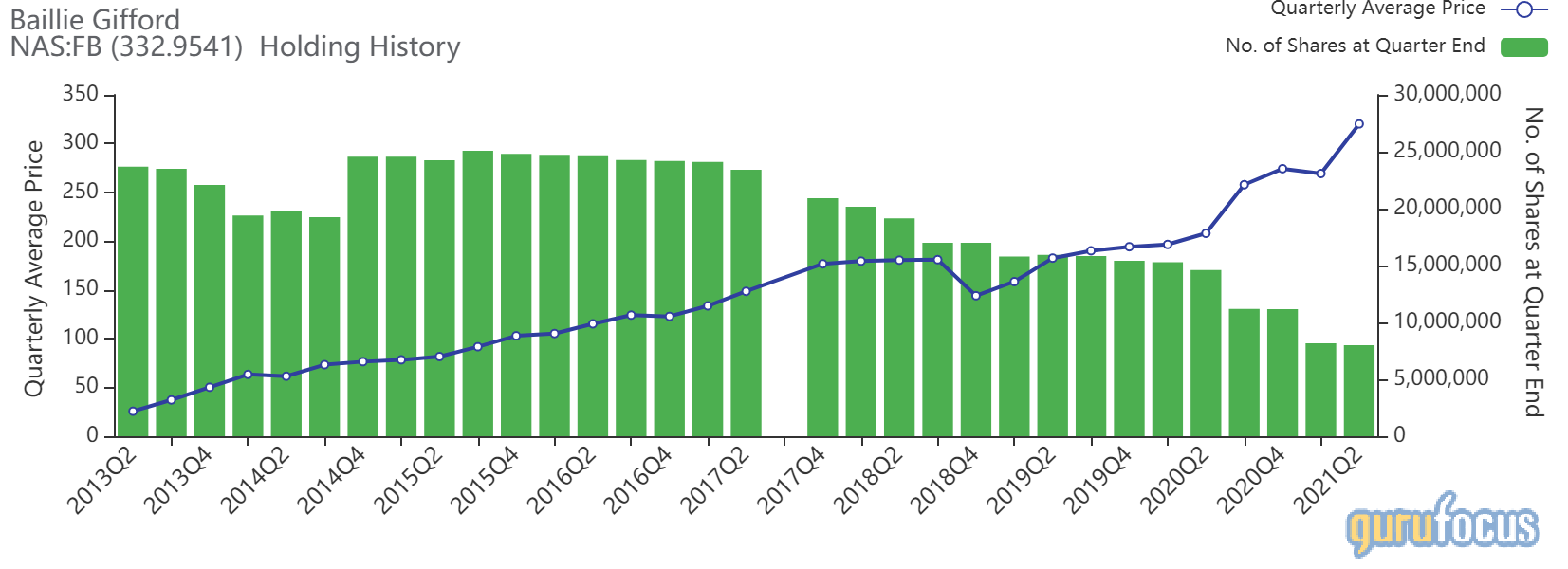

Gurus with holdings in Facebook include Baillie Gifford (Trades, Portfolio) and Chase Coleman (Trades, Portfolio)’s Tiger Global Management.

Amazon.com

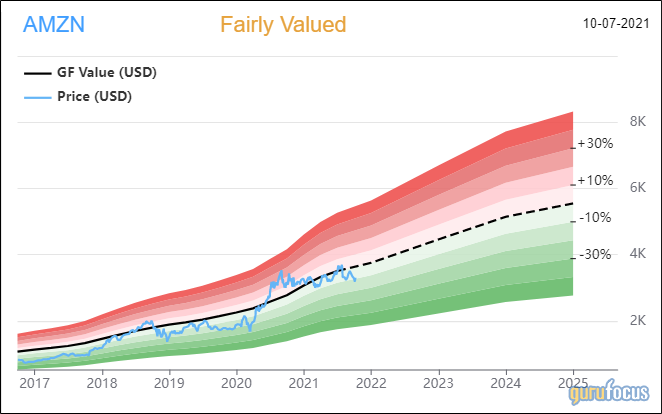

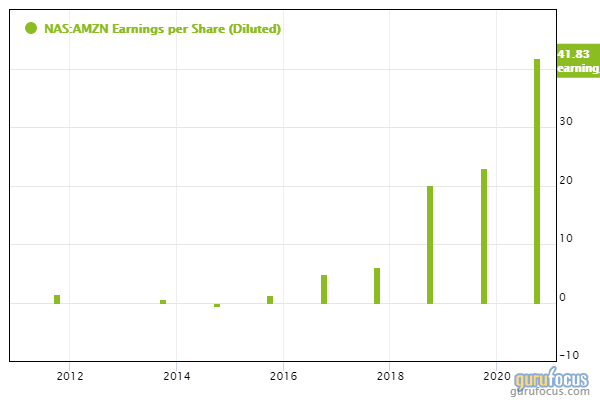

Amazon.com (AMZN, Financial) ranks fifth in the buying list with 58 member votes. Shares traded around $3,308.47, showing the stock is fairly valued based on Thursday’s price-to-GF Value ratio of 0.91.

GuruFocus ranks the Seattle-based e-commerce company’s profitability 8 out of 10 on several positive investing signs, which include a five-star business predictability rank, a high Piotroski F-score of 8 and three-year revenue and earnings growth rates that outperform more than 89% of global competitors.

See also

GuruFocus members can also share their discussions about their stocks using the “Notes” and “Discussions” features located in the tab on the right-hand side of the screen, which is marked with a pencil icon. The Discussion Board also allows members to invite other users to their discussion.

Other stocks with high member votes include Biogen Inc. (BIIB, Financial) and Microsoft Corp. (MSFT, Financial).