Mohnish Pabrai (Trades, Portfolio), managing partner of Pabrai Investment Funds, disclosed in a regulatory portfolio filing that his firm axed more than 77% of its holding in Alibaba Group Holding Ltd. (BABA, Financial). With the proceeds, the firm increased its position in Micron Technology Inc. (MU, Financial).

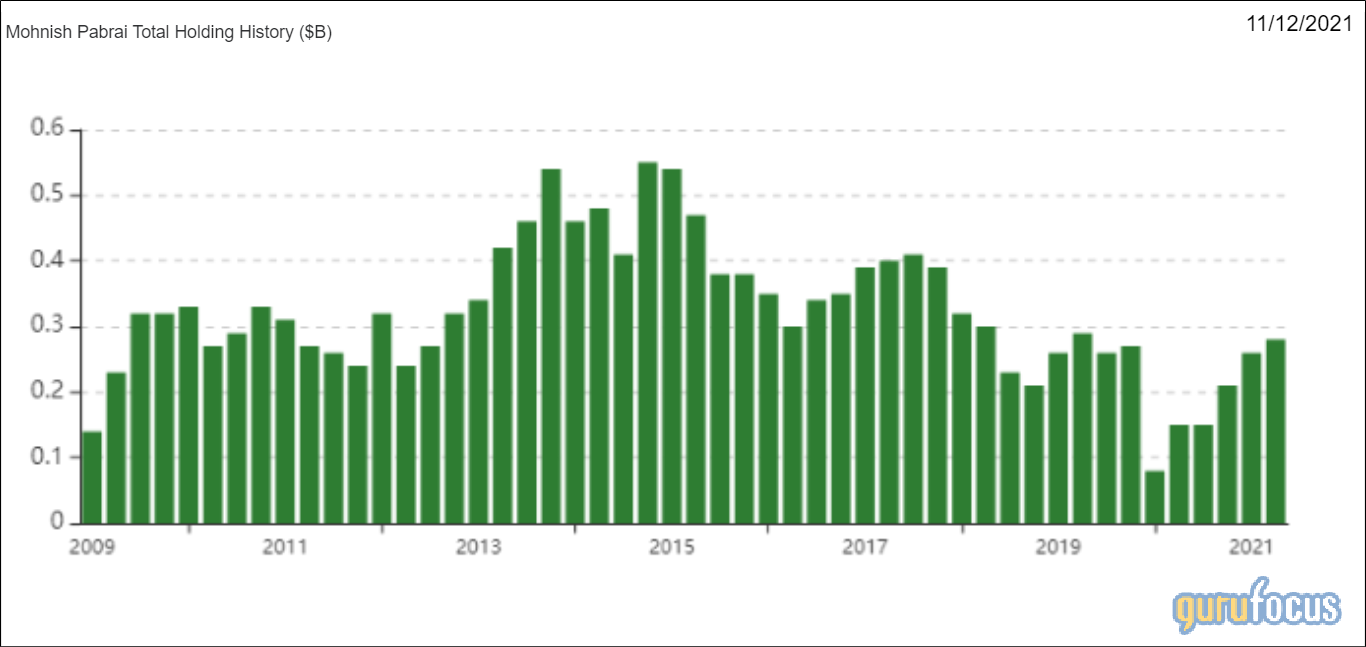

Pabrai said in a 2019 interview with GuruFocus that he had moved the majority of his funds into India, Turkey and South Korea, where he was finding much better investing opportunties. His U.S.-based portfolio makes up a small portion of his total assets under management.

As of Sept. 30, Pabrai’s U.S.-based equity portfolio contains three stocks, which are Alibaba, Micron and Seritage Growth Properties (SRG, Financial).

Alibaba

Pabrai sold 201,734 shares of Alibaba (BABA, Financial), chopping 77.83% of the holding and 16.45% of his firm’s equity portfolio.

Shares of Alibaba averaged $182.30 during the third quarter; the stock is significantly undervalued based on Friday’s price-to-GF Value ratio of 0.43.

GuruFocus ranks the Chinese e-commerce giant’s profitability 8 out of 10 on several positive investing signs, which include a three-star business predictability rank and an operating margin that outperforms more than 78% of global competitors despite declining approximately 17% per year on average over the past five years.

Gurus with holdings in Alibaba include Charlie Munger (Trades, Portfolio)’s Daily Journal Corp. (DJCO, Financial), PRIMECAP Management (Trades, Portfolio), Baillie Gifford (Trades, Portfolio) and Dodge & Cox.

Micron Technology

Pabrai purchased 27,150 shares of Micron Technology (MU, Financial), increasing the position 1.75% and his firm’s equity portfolio 1.01%.

Shares of Micron averaged $75.15 during the third quarter; the stock is modestly overvalued based on Friday’s price-to-GF Value ratio of 1.15.

GuruFocus ranks the Boise, Idaho-based semiconductor company’s profitability 9 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank, a high Piotroski F-score of 8 and an operating margin that has increased more than 30% per year on average over the past five years and outperforms over 85% of global competitors.

Gurus with holdings in Micron Technology include PRIMECAP and Li Lu (Trades, Portfolio)’s Himalaya Capital Management.

Seritage Growth Properties

Pabrai owns 4,733,118 shares of Seritage Growth Properties (SRG, Financial), unchanged from the second-quarter filing.

Shares of Seritage Growth Properties traded around $15.15, showing the stock is modestly undervalued based on Friday’s price-to-GF Value ratio of 0.87.

GuruFocus ranks the New York-based retail real estate investment trust’s financial strength 2 out of 10 on several warning signs, which include a low Piotroski F-score of 2 and a debt-to-equity ratio that underperforms more than 90% of global competitors.

Other gurus with holdings in Seritage include Hotchkis & Wiley and Edward Lampert (Trades, Portfolio)’s RBS Partners.

Also check out: