David Tepper (Trades, Portfolio), manager of Appaloosa Management, disclosed in a regulatory portfolio filing that his firm’s top four sells during the third quarter included reductions to its holdings of Micron Technology Inc. (MU, Financial) and Amazon.com Inc. (AMZN, Financial) and the closure of its positions in Emerson Electric Co. (EMR, Financial) and ViacomCBS Inc. (VIAC, Financial).

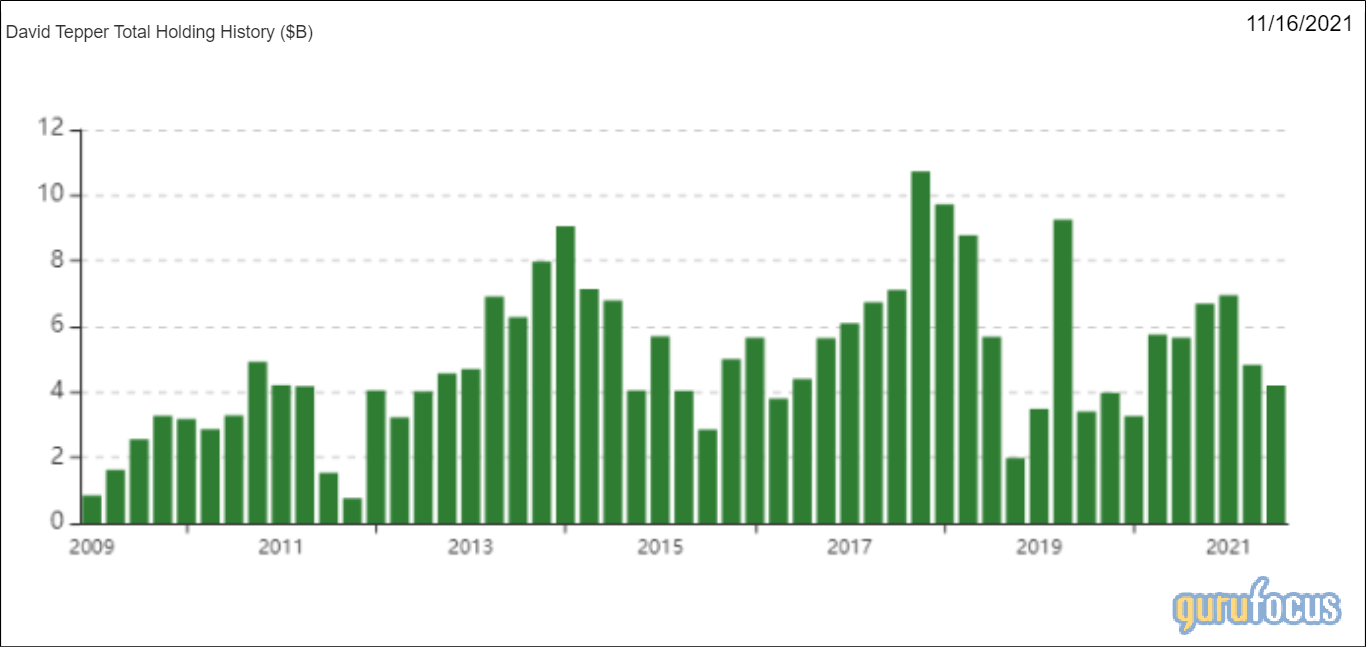

A distressed-debt specialist, Tepper became interested in investing when his father traded stocks in his hometown in Pittsburgh. The investor is known for achieving some of the highest returns among Wall Street investors. The guru announced over the past few years that he plans to convert his hedge fund into a family office.

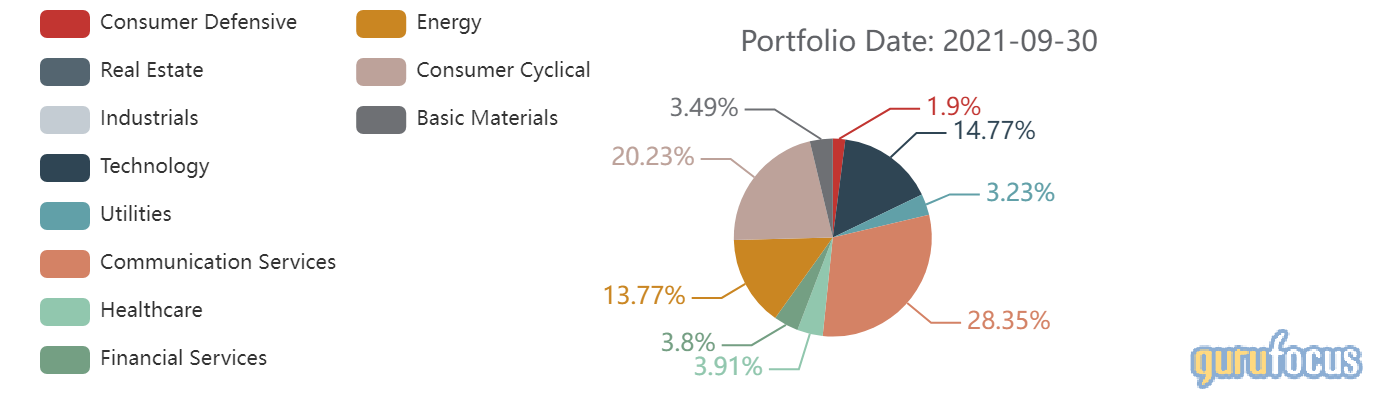

As of Sept. 30, Appaloosa’s $4.20 billion equity portfolio contains 52 stocks, with three new positions and a turnover ratio of 8%. The top four sectors in terms of weight are communication services, consumer cyclical, technology and energy, representing 28.35%, 20.23%, 14.77% and 13.77% of the equity portfolio.

Micron

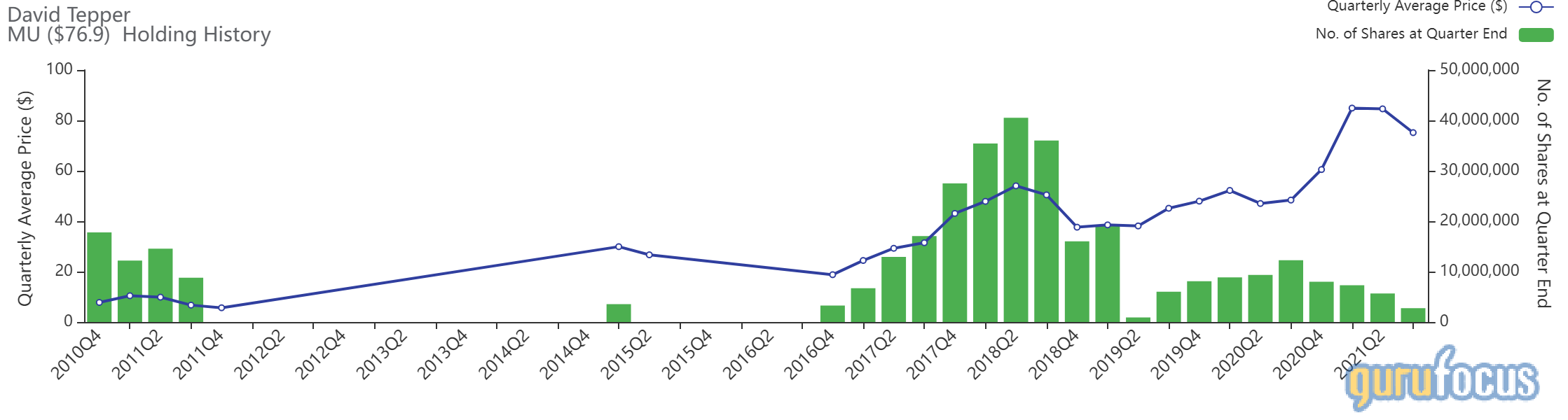

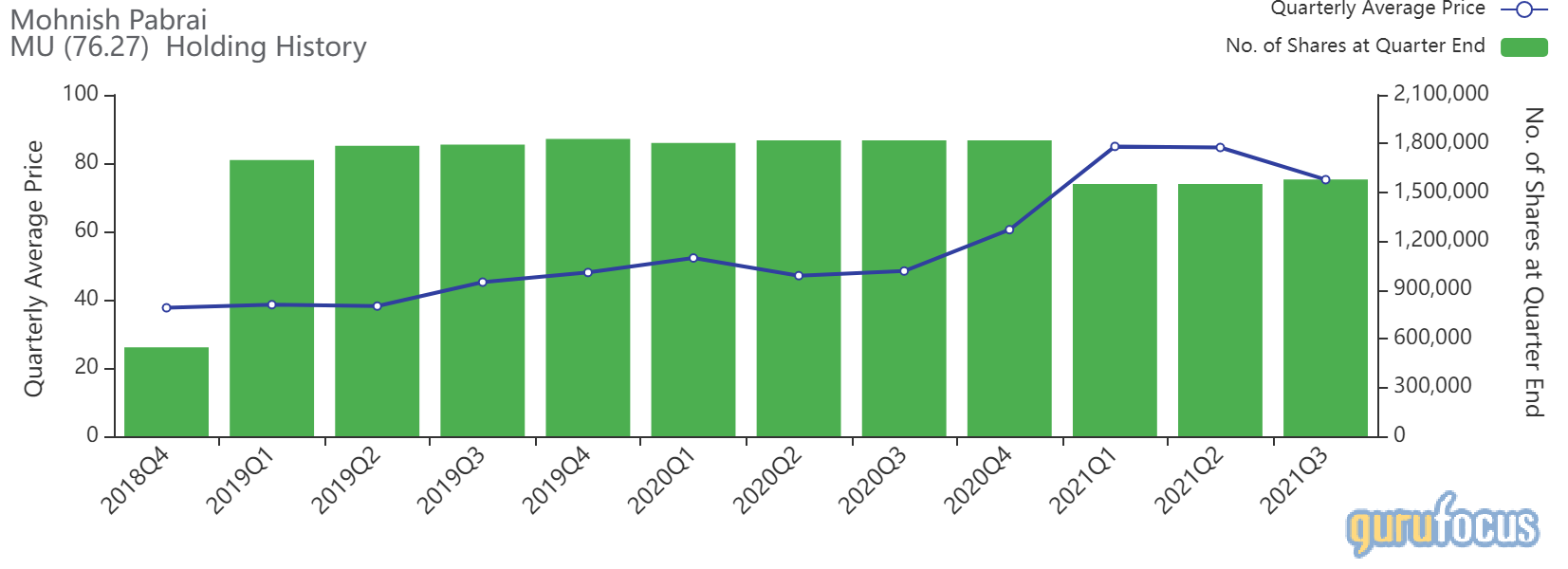

Tepper sold 2,902,691 shares of Micron (MU, Financial), slashing 51.35% of the position and 5.10% of his equity portfolio.

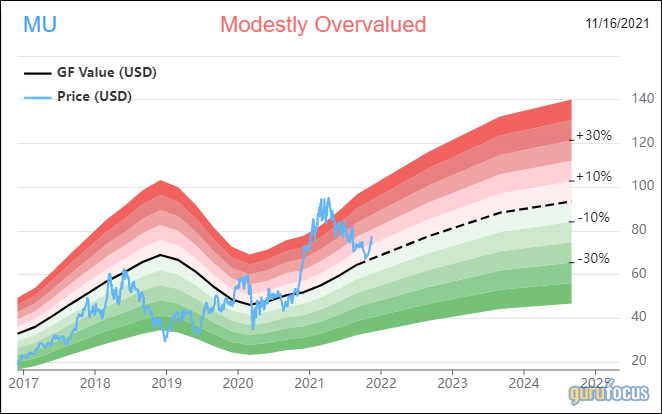

Shares of Micron averaged $75.15 during the third quarter; the stock is modestly overvalued based on Tuesday’s price-to-GF Value ratio of 1.14.

GuruFocus ranks the Boise, Idaho-based semiconductor company’s profitability 9 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank, a high Piotroski F-score of 8 and an operating margin that has increased more than 30% per year on average over the past five years and outperforms over 85% of global competitors.

Gurus with holdings in Micron include Mohnish Pabrai (Trades, Portfolio) and Li Lu (Trades, Portfolio)’s Himalaya Capital Management.

Amazon.com

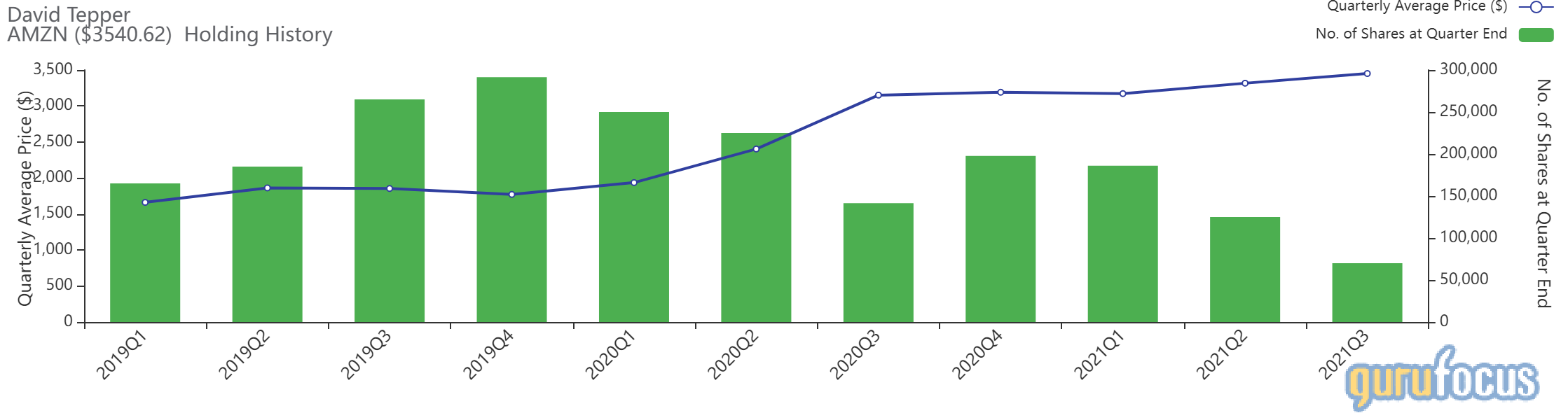

Tepper sold 55,000 shares of Amazon.com (AMZN, Financial), chopping 44% of the position and 3.92% of his equity portfolio.

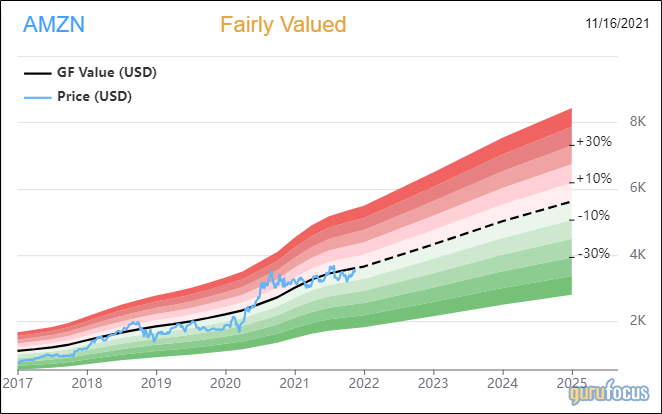

Shares of Amazon.com averaged $3,451.22 during the third quarter; the stock is fairly valued based on Tuesday’s price-to-GF Value ratio of 0.98.

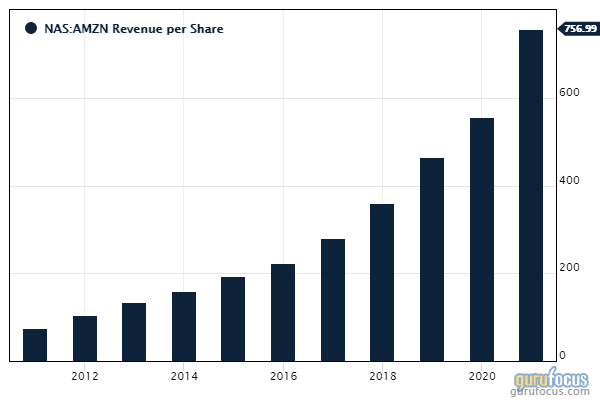

GuruFocus ranks the Seattle-based retail giant’s profitability 8 out of 10 on several positive investing signs, which include a five-star business predictability rank, a high Piotroski F-score of 7 and three-year revenue and earnings growth rates that outperform more than 88% of global competitors.

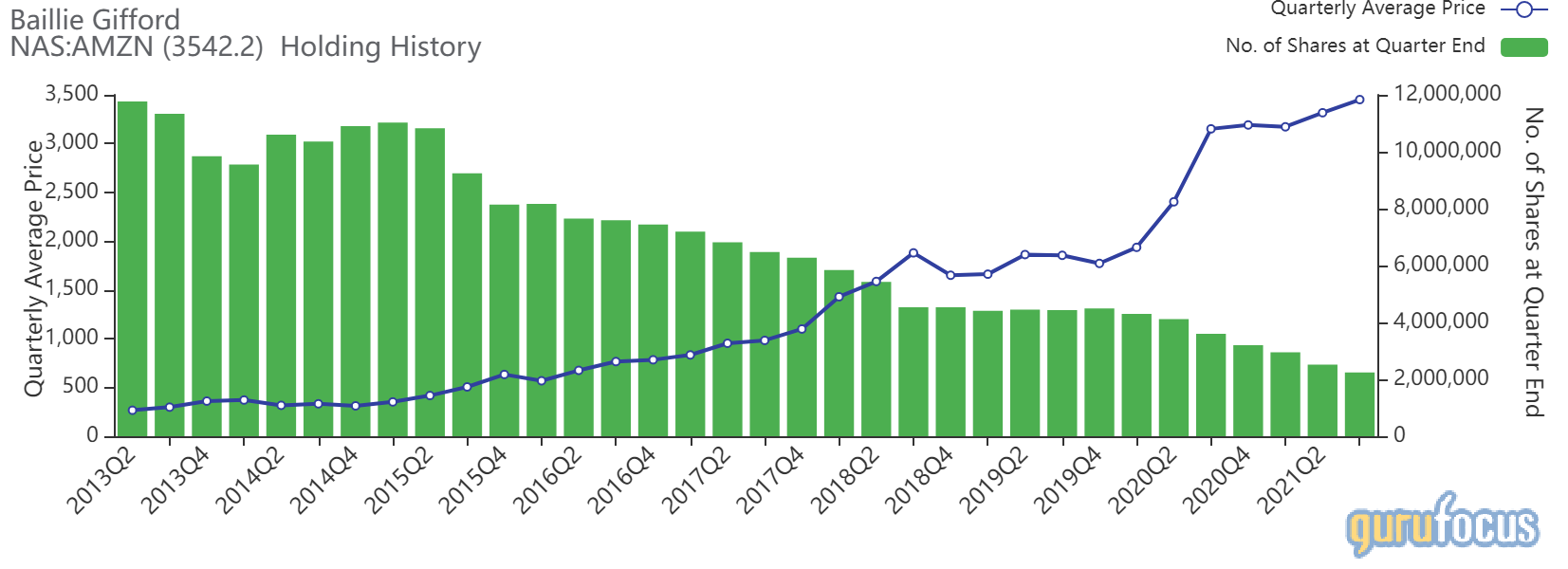

Gurus with holdings in Amazon.com include Baillie Gifford (Trades, Portfolio) and Ken Fisher (Trades, Portfolio)’s Fisher Investments.

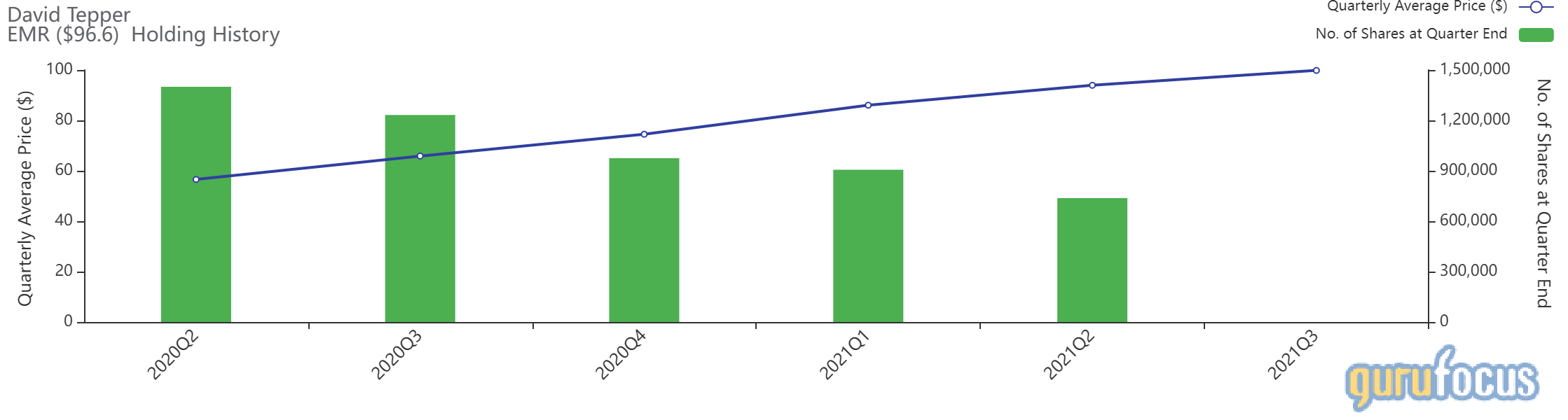

Emerson Electric

Tepper sold 737,500 shares of Emerson Electric (EMR, Financial), freeing up 1.47% of his equity portfolio.

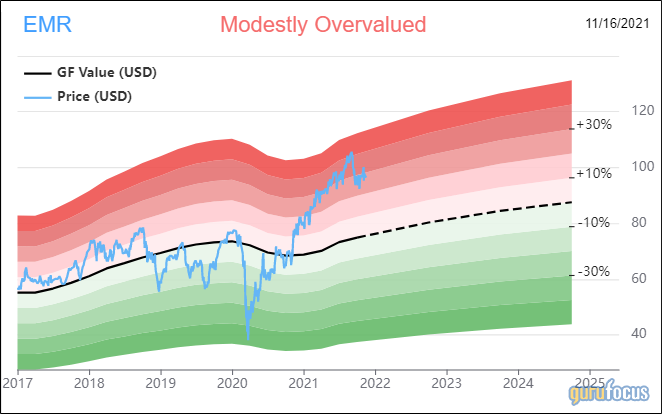

Shares of Emerson Electric averaged $99.83 during the third quarter; the stock is modestly overvalued based on Tuesday’s price-to-GF Value ratio of 1.27.

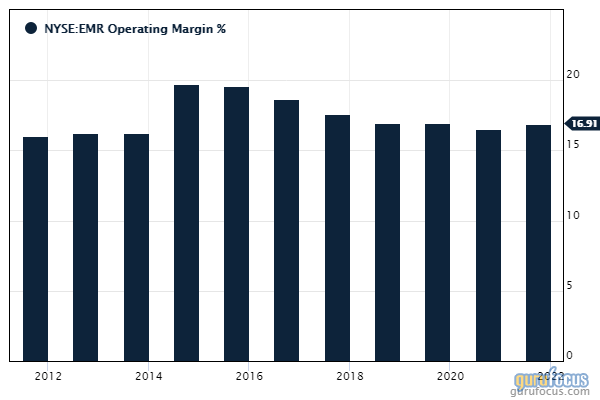

GuruFocus ranks the St. Louis-based industrial company’s profitability 8 out of 10 on several positive investing signs, which include profit margins and returns that are outperforming more than 82% of global competitors.

ViacomCBS

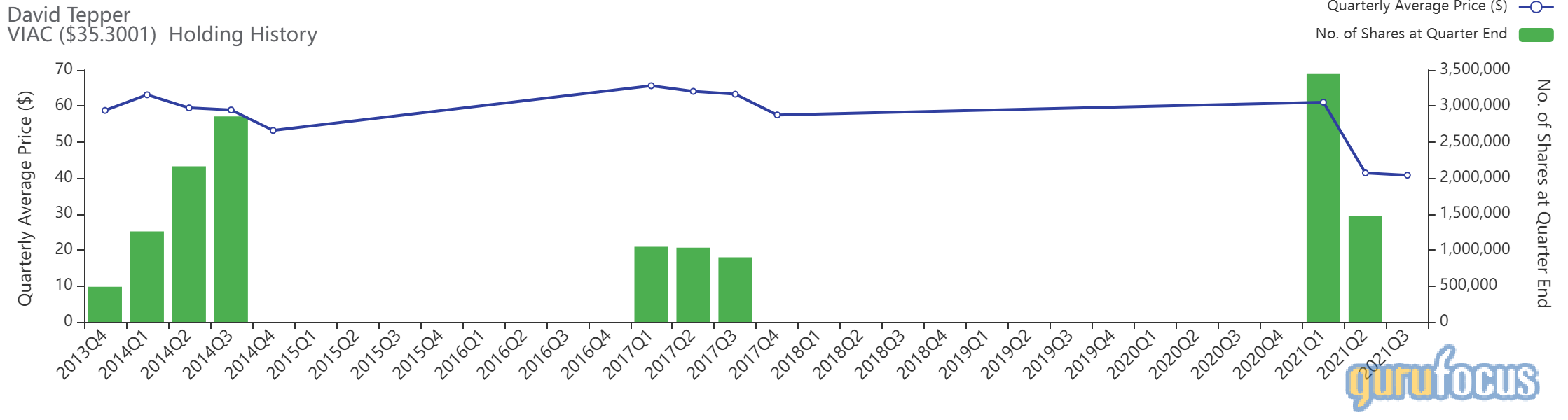

Tepper sold 1.475 million shares of ViacomCBS (VIAC, Financial), clipping 1.38% of his equity portfolio.

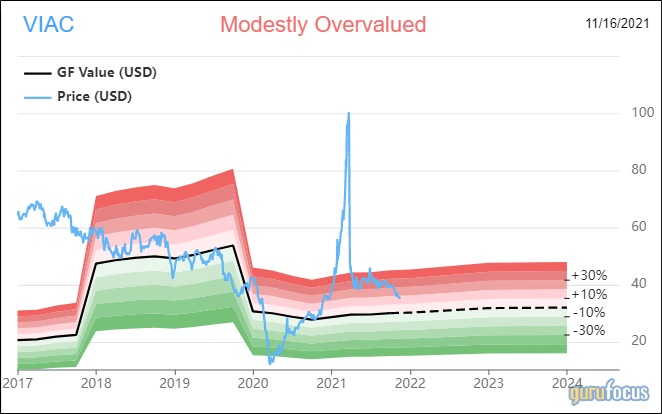

Shares of ViacomCBS averaged $40.80 during the third quarter; the stock is modestly overvalued based on Tuesday’s price-to-GF Value ratio of 1.17.

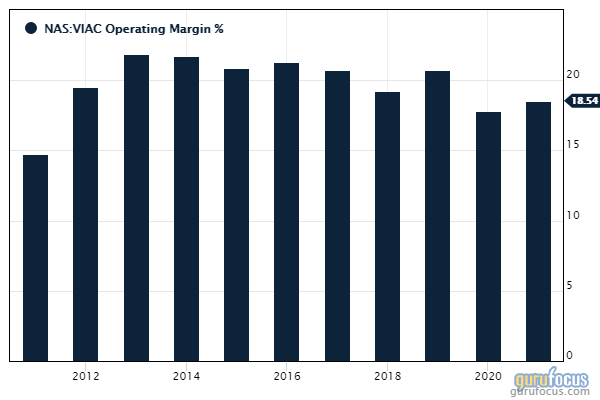

GuruFocus ranks the New York-based media company’s profitability 8 out of 10 on several positive investing signs, which include a 3.5-star predictability rank and an operating margin that outperforms more than 83% of global competitors.

Also check out: