Ruane Cunniff (Trades, Portfolio), the firm founded by the late William Ruane, disclosed in a regulatory portfolio filing that its top five trades during the third quarter included additions to its holdings in Wayfair Inc. (W, Financial) and Taiwan Semiconductor Manufacturing Co. Ltd. (TSM, Financial), the closure of its positions in Fidelity National Information Services Inc. (FIS, Financial) and Arista Networks Inc. (ANET, Financial) and a reduction to its stake in Credit Acceptance Corp. (CACC, Financial).

The New York-based firm, which received recognition from Berkshire Hathaway Inc. (BRK.A, Financial)(BRK.B, Financial) CEO Warren Buffett (Trades, Portfolio), manages the Sequoia Fund and other separately managed accounts. The firm applies a long-term, value-oriented investing approach that emphasizes balance sheet metrics, earnings history and growth prospects over technical analysis studies.

As of Sept. 30, the firm’s $11.13 billion equity portfolio contains 33 stocks, with two new positions and a turnover ratio of 6%. The fund’s top three sectors in terms of weight are communication services, financial services and consumer cyclical, representing 37.39%, 20.14% and 13.75% of the equity portfolio.

Wayfair

The firm purchased 1,077,098 shares of Wayfair (W, Financial), increasing the position by 82.65% and its equity portfolio by 2.48%.

Shares of Wayfair averaged $282.20 during the third quarter; the stock is fairly valued based Wednesday’s price-to-GF Value ratio of 1.05.

GuruFocus ranks the Boston-based e-commerce company’s financial strength 5 out of 10 on the back of interest coverage ratios underperforming more than 80% of global competitors despite having a strong Altman Z-score of 5.82 and a high Piotroski F-score of 8.

Baillie Gifford (Trades, Portfolio) also has a holding in Wayfair.

Taiwan Semiconductor Manufacturing

The firm added 1,221,460 shares of Taiwan Semiconductor Manufacturing (TSM, Financial), boosting the position by 20.88% and its equity portfolio by 1.22%.

Shares averaged $117.53 during the third quarter; the stock is modestly overvalued based on Wednesday’s price-to-GF Value ratio of 1.27.

GuruFocus ranks the Taiwanese semiconductor giant’s profitability 9 out of 10 on several positive investing signs, which include a 3.5-star business predictability rank and profit margins and returns that outperform more than 89% of global competitors.

Other gurus with holdings in Taiwan Semiconductor include Ken Fisher (Trades, Portfolio)’s Fisher Investments and First Eagle Investment (Trades, Portfolio).

Fidelity National Information Systems

The firm sold its 1,898,755 shares of Fidelity National Information Systems (FIS, Financial), trimming 2.38% of its equity portfolio.

Shares averaged $134.16 during the third quarter; the stock is modestly undervalued based on Wednesday’s price-to-GF Value ratio of 0.85.

GuruFocus ranks the Jacksonville, Florida-based payment software company’s financial strength 4 out of 10 on the back of interest coverage and debt ratios that underperform more than 70% of global competitors despite having a high Piotroski F-score of 8.

Arista Networks

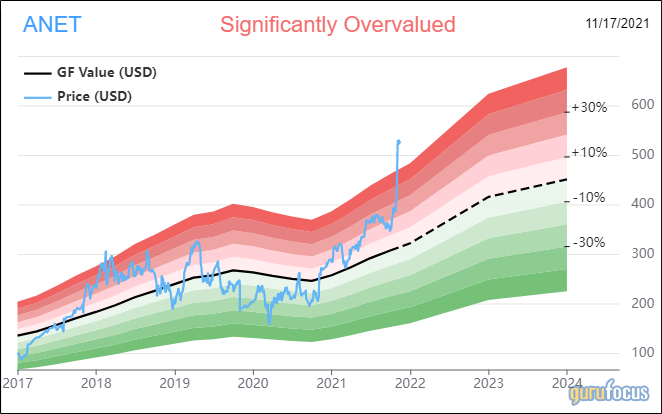

The firm sold its 619,855 shares of Arista Networks (ANET, Financial), discarding 1.99% of its equity portfolio.

Shares of Arista averaged $366.56 during the third quarter; the stock is significantly overvalued based on Wednesday’s price-to-GF Value ratio of 1.68.

GuruFocus ranks the Santa Clara, California-based hardware company’s profitability 8 out of 10 on the back of profit margins and returns that outperform more than 88% of global competitors.

Credit Acceptance

The fund sold 283,344 shares of Credit Acceptance (CACC, Financial), trimming 17.67% of the position and 1.14% of its equity portfolio.

Shares averaged $545.36 during the third quarter; the stock is fairly valued based on Wednesday’s price-to-GF Value ratio of 1.02.

GuruFocus ranks the Southfield, Michigan-based consumer finance company’s profitability 9 out of 10 on several positive investing signs, which include a high Piotroski F-score of 8, a 4.5-star business predictability rank and profit margins and returns that are outperforming more than 85% of global competitors.