Affirm Holdings Inc. (AFRM, Financial) is one of the leading companies in the "buy now pay later" (BNPL) industry. BNPL allows customers to purchase products for a lower up-front cost and then pay the full amount in installments over time.

This is the fastest growing payment method, according to the Worldpay Global Payments Report (2021), and is a whopping $10 trillion global market opportunity according to the IDC forecast for 2024.

Rapid growth

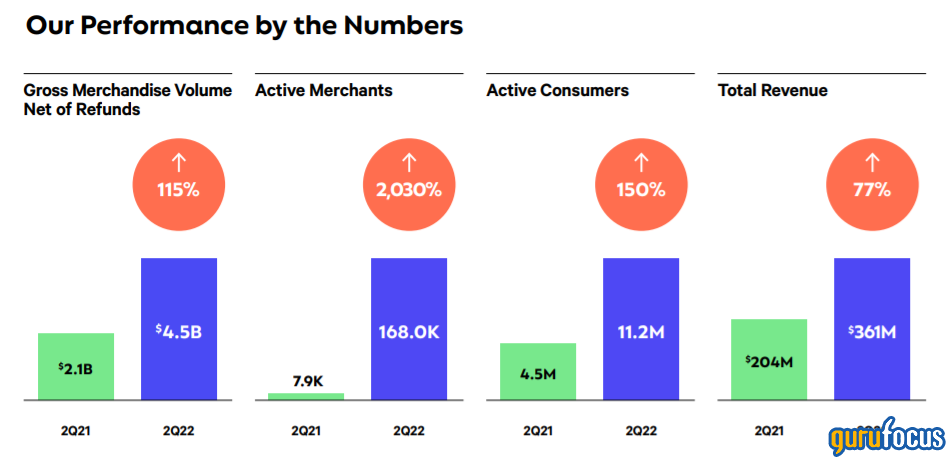

Affirm has been growing rapidly with the number of active merchants on their system up an incredible 2030% to over 168,000 year-over-year. This includes the number one e-commerce company in the world, Amazon (AMZN, Financial). Other Affirm merchant partners include Peloton (PTON, Financial), Adidas (FRA:ADS, Financial), Walmart (WMT, Financial) and Shopify (SHOP, Financial) (which is also a 7% shareholder).

Above is a chart from Affirm's quarterly earnings materials showing performance growth numbers. The active customers using the platform are up 150% to 11.2 million people, driving total revenue up 77% year-over-year.

Amazon partnership

Affirm has expanded its partnership with Amazon and will now allow BNPL purchases of over $50 to be split into monthly payments. This is huge news for Affirm as now they are part of the world’s largest e-commerce company.

A signal of a deep partnership was the multiple tranches of warrants which Amazon received that will allow them to purchase Affirm stock. This ties in with a BNPL exclusivity agreement till at least 2023. Affirm will also be embedded into Amazon Pay's digital wallet as a payment method.

Why is Affirm's stock down?

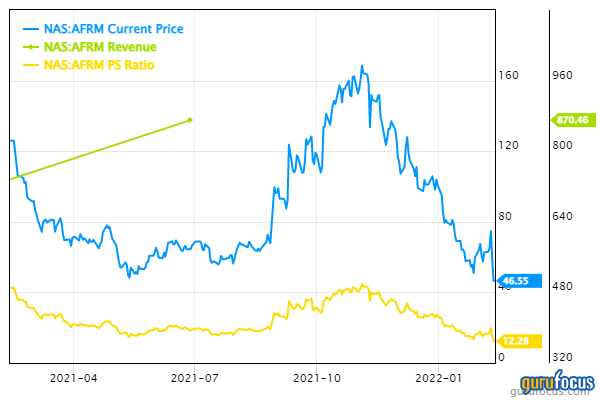

Despite the great news surrounding Affirm, the share price has slid down 76% from its highs in November 2021. This is for a few reasons. Firstly, the company's share price increased by an incredible 140% on the announcement of the Amazon partnership in August 2021. This sent Affirm’s stock to a stratospheric valuation and it now seems to be coming back down to earth, especially as investors finally noticed the warrants issued to Amazon.

Then there is the questionability of this business model in the long term. From my analysis, it seems that there are many competitors in this industry, such as Apple (AAPL, Financial) Pay Later, Afterpay (ASX:AFY, Financial), Klarna, Paypal (PYPL, Financial) Pay and many more!

Thus, Affirm doesn’t have a unique product and a moat around the business. Although the global market opportunity is super large at $10 trillion, I see this as a major issue. To gain market dominance, they will need to expand into multiple products or they will need to scale fast.

From a macro-economic perspective, the Federal Reserve has outlined plans to raise interest rates to curb inflation. This will increase the cost of borrowing for businesses and disproportionality lower the valuation of all growth stocks, as their value is usually based more upon future cash flows.

These are the indirect reasons I can see for why the stock is down, because the financials and quarterly earnings are producing fantastic results so far.

Founder-led (PayPal mafia)

One of Affirm’s possible competitive advantages is their incredible founder, Max Levchin, who was part of the original “PayPal mafia." Along with the founders of many great tech companies including Elon Musk of Tesla (TSLA) and Peter Thiel of Palantir (PLTR, Financial), I believe investing with great founders is a sound strategy.

Levchin has “skin in the game” and owns 6.36% of the company, which is great to see. Investing in companies which are founder-led is a strategy I and many successful hedge fund managers use. An example of this is Nick Sleep, whose Nomad Investment Partners generated 20.8% returns for 12 years with the majority of the fund in Amazon stock.

Affirm debit card+

Affirm told investors at a recent event they are planning a rollout of a new debit card, which will allow for installment payments. According to Levchin:

"It's a card that works with your existing checking account. You don't have to switch your banking relationship. You get the new card from us, swipe it and use it the way you normally would. You get a notification if the transaction is splitable."

Levchin said the waiting list for the product is close to 1 million. It will begin rolling out more broadly starting in 2022.

Is the stock undervalued?

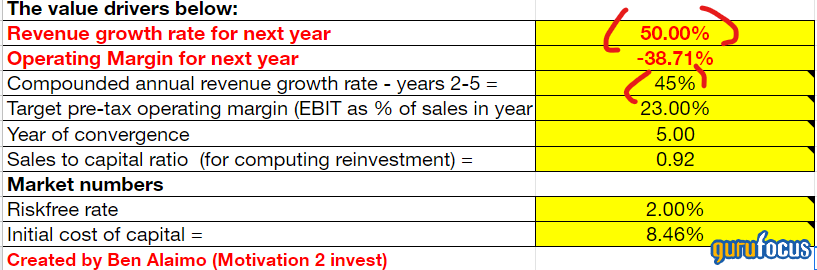

To value Affirm, I have plugged the most recent financials into my valuation model which uses the discounted cash flow method of analysis.

I have estimated 50% revenue growth for next year and 45% for the next two to five years. This is good but fairly conservative given the company's prior revenue growth of 70%+.

In addition, I expect Affirm’s margins to expand over the next five years to 23%, which is the average for a software systems company.

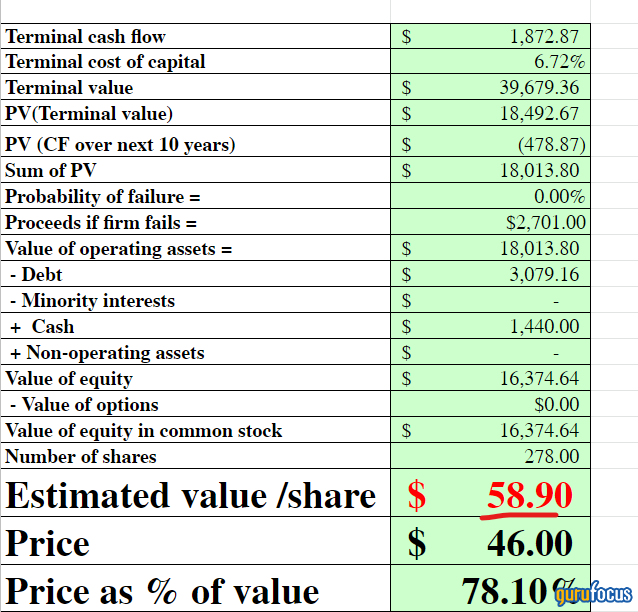

From these numbers, I get a fair value estimate for Affirm’s stock of $58 per share, which means the company is20% undervalued at its current $46 share price.

Final thoughts

Affirm is a market-leading company set to make its place in the large but competitive BNPL industry. Led by an experienced tech founder who was part of the PayPal Mafia, I believe the company is poised to continue its tremendous growth trajectory.

The risks I see with the company are the competitiveness of the BNPL industry and the macro situation which could keep growth stock valuations suppressed for a period of time (read more about my views on inflation here).

However, despite these factors, having Levchin at the helm should mean continued innovation and a potential to distrupt the traditional payments industry.