Daniel Loeb (Trades, Portfolio), manager of Third Point, disclosed in a 13-F portfolio update that his firm’s top five trades during the fourth quarter of 2021 included new positions in Accenture PLC (ACN, Financial) and Rivian Automotive Inc. (RIVN, Financial), the closure of its position in Intel Corp. (INTC, Financial) and the reduction of its holdings in Upstart Holdings inc. (UPST, Financial) and The Walt Disney Co. (DIS, Financial).

The guru’s New York-based firm follows an event-driven, value oriented investment style. Third Point identifies situations in which a catalyst event can unlock shareholder value.

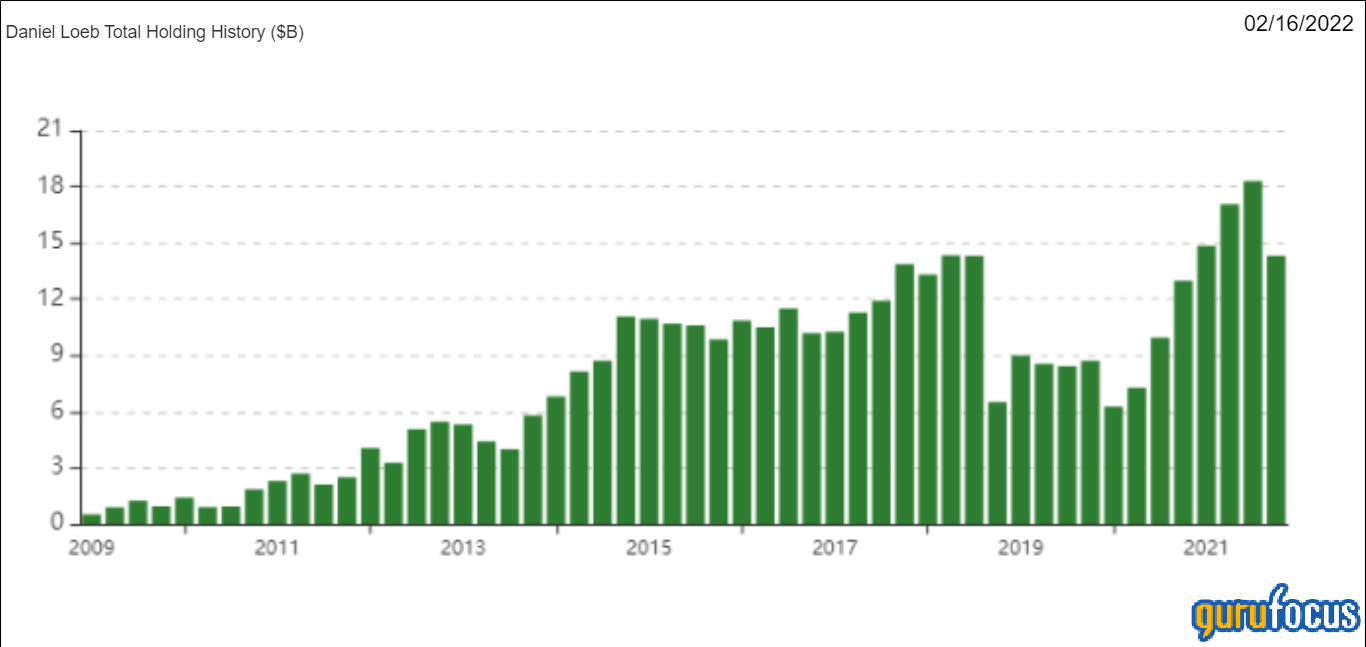

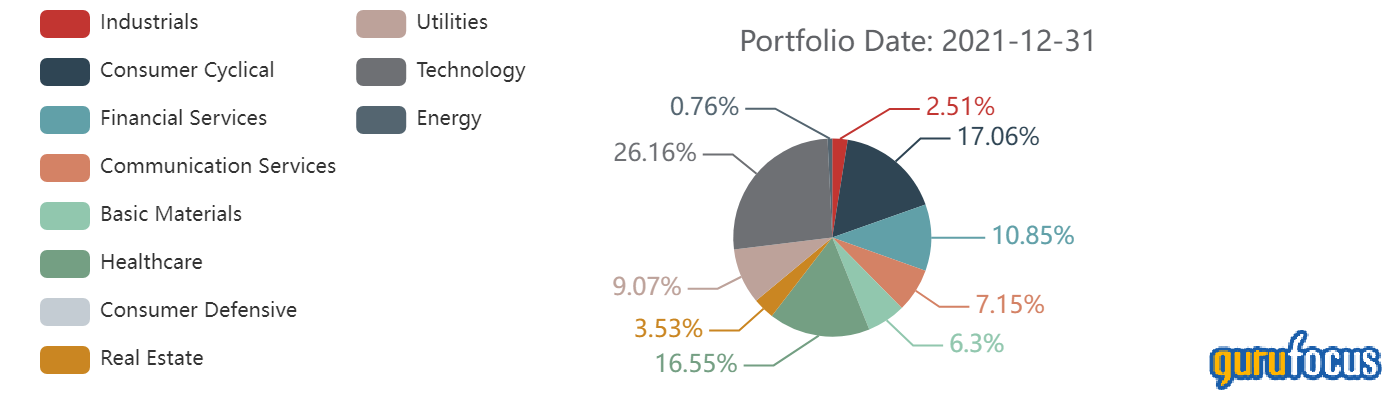

As of December 2021, Third Point’s $14.32 billion equity portfolio contains 91 stocks, with 28 new positions and a quarterly turnover ratio of 22%. The top four sectors in terms of weight are technology, consumer cyclical, health care and financial services, with weights of 26.16%, 17.06%, 16.55% and 10.85%, respectively.

Accenture

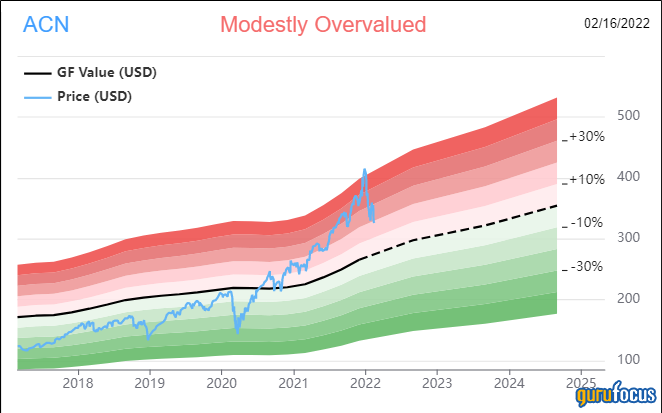

The firm purchased 1.25 million shares of Accenture (ACN, Financial), giving the position a 3.62% equity portfolio weight. Shares averaged $365.63 during the fourth quarter; the stock is modestly overvalued based on Wednesday’s price-to-GF-Value ratio of 1.20.

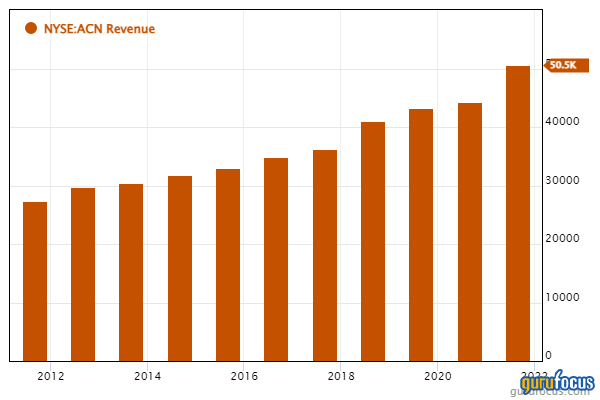

GuruFocus ranks the Dublin, Ireland-based consulting company’s profitability 9 out of 10 on several positive investing signs, which include a five-star business predictability rank, a high Piotroski F-score of 8 and profit margins and returns outperforming more than 80% of global competitors.

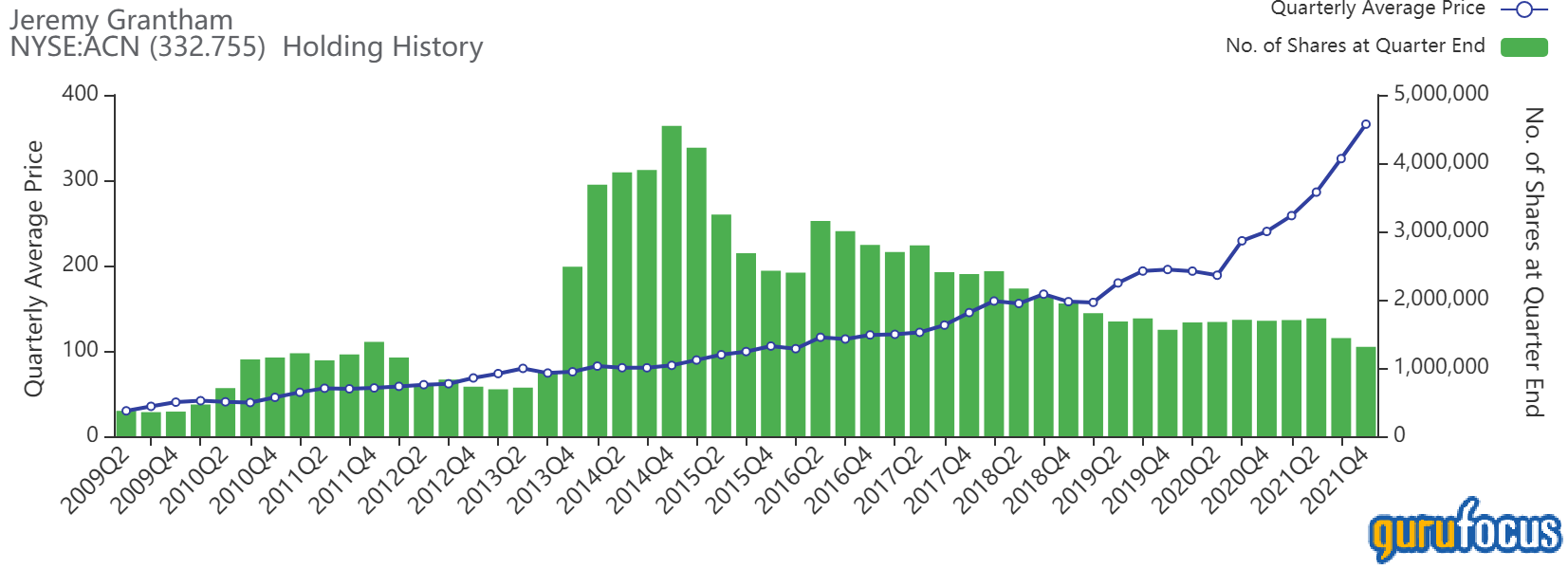

Other gurus with holdings in Accenture include Jeremy Grantham (Trades, Portfolio)’s GMO and MS Global Franchise Portfolio (Trades, Portfolio).

Rivian

Third Point invested in 4,046,572 shares of Rivian (RIVN, Financial), allocating 2.85% of its equity portfolio to the position. Shares averaged $114.72 during the fourth quarter.

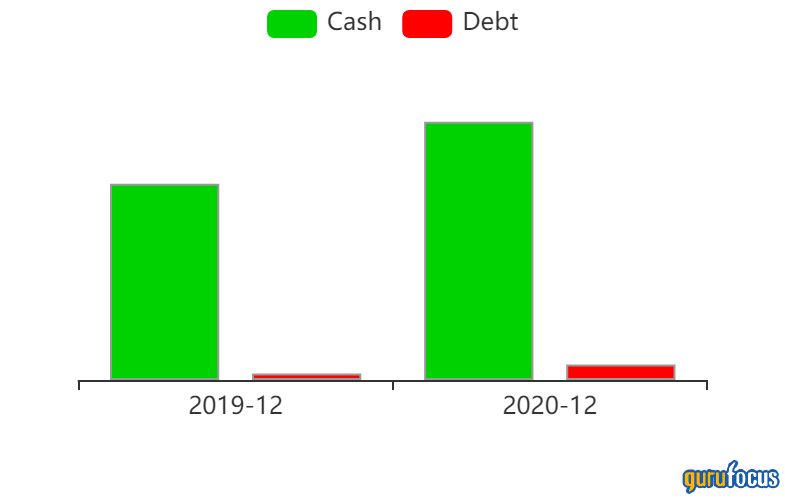

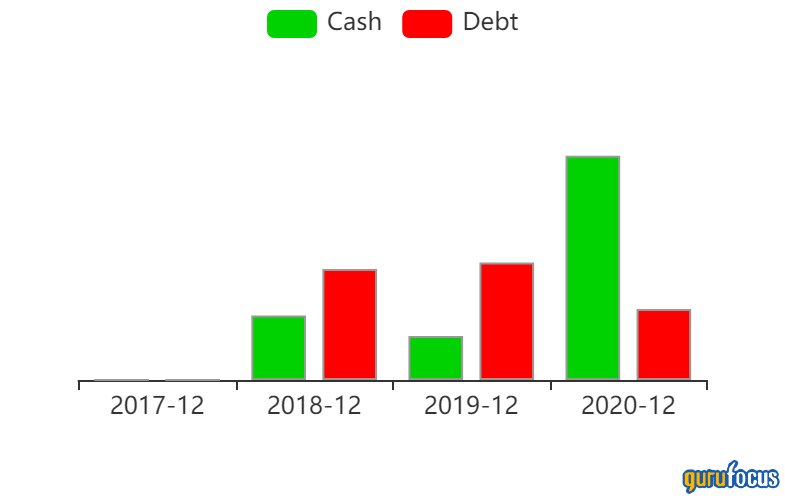

According to GuruFocus, the Irvine, California-based electric vehicle company’s cash-to-debt ratio of 1.62 outperforms approximately 69% of global competitors.

Other gurus with holdings in Rivian include Philippe Laffont (Trades, Portfolio)’s Coatue Asset Management and George Soros (Trades, Portfolio)’ Soros Fund Management.

Intel

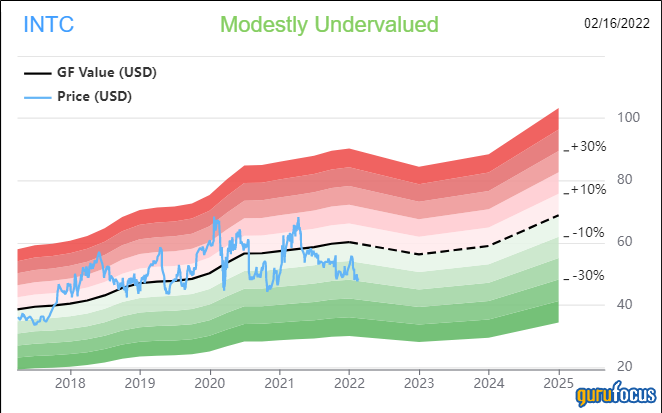

The firm sold all 9 million shares of its stake in Intel (INTC, Financial), trimming 2.62% of its equity portfolio.

Shares of Intel averaged $51.07 during the fourth quarter; the stock is modestly undervalued based on Wednesday’s price-to-GF-Value ratio of 0.81.

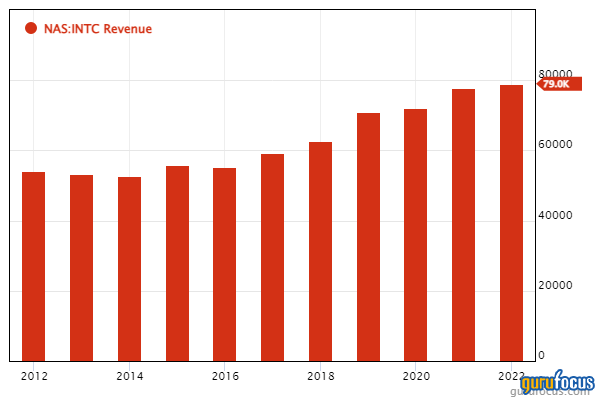

GuruFocus ranks the Santa Clara, California-based semiconductor giant’s profitability 8 out of 10 on the back of profit margins outperforming more than 88% of global competitors despite three-year revenue growth rates topping just over 65% of global semiconductor companies.

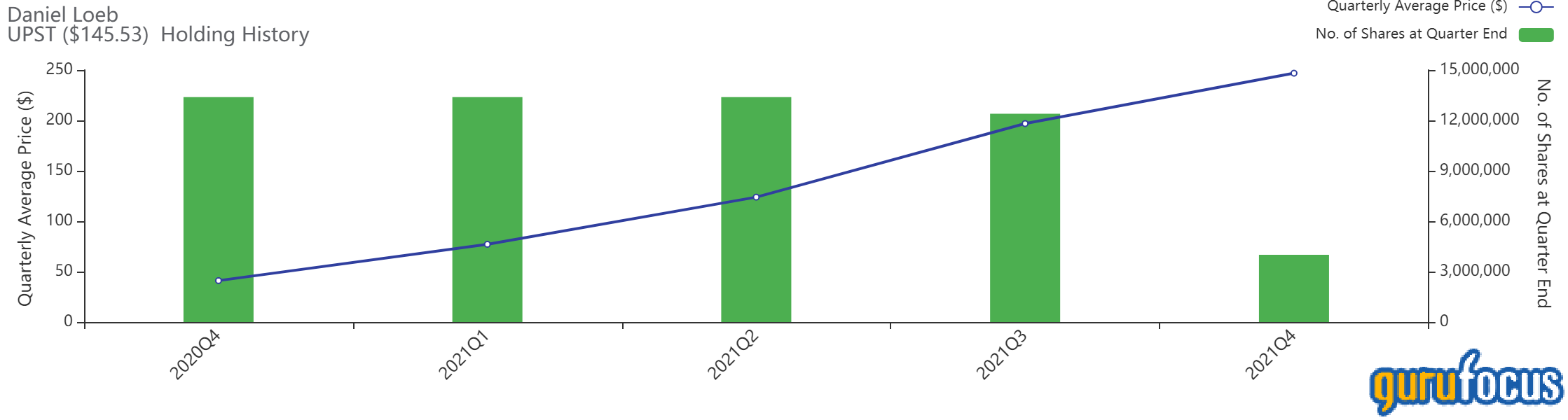

Upstart

The firm sold 8.4 million shares of Upstart (UPST, Financial), slicing 67.74% of the position and 14.52% of its equity portfolio. Shares averaged $246.83 during the fourth quarter.

According to GuruFocus, the San Mateo, California-based credit service company’s cash-to-debt ratio of 1.46 outperforms more than 70% of global competitors, while its debt-to-equity ratio of 1 outperforms approximately 51% of global credit service companies.

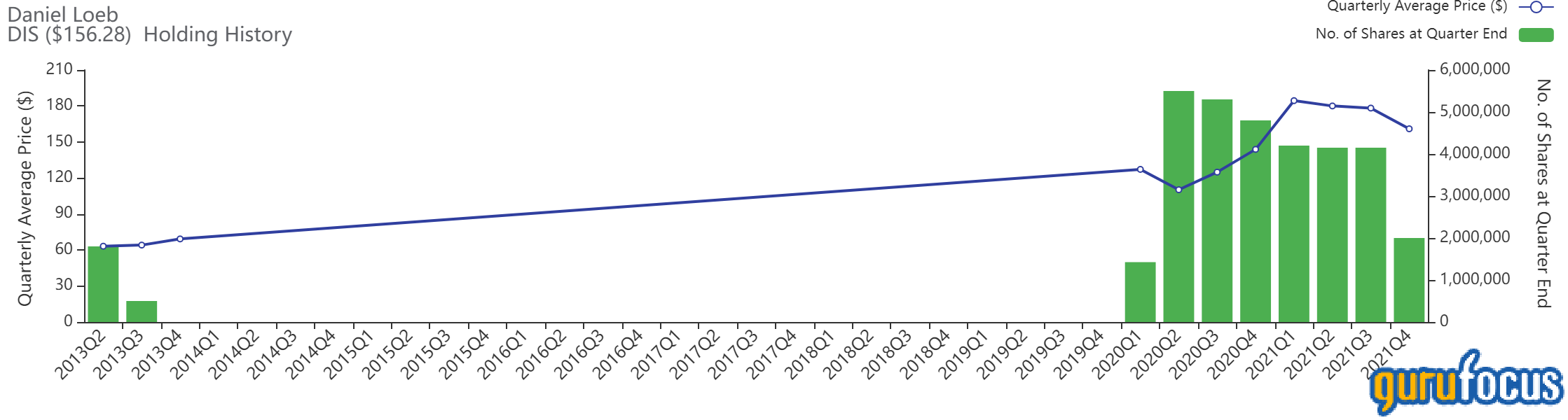

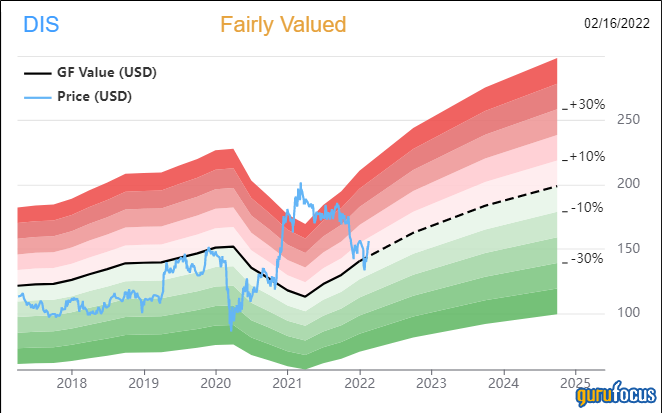

Walt Disney

The firm sold 2.15 million shares of Walt Disney (DIS, Financial), chopping 51.81% of the holding and 1.99% of its equity portfolio.

Shares of Walt Disney averaged $161 during the fourth quarter; the stock is fairly valued based on Wednesday’s price-to-GF-Value ratio of 1.08.

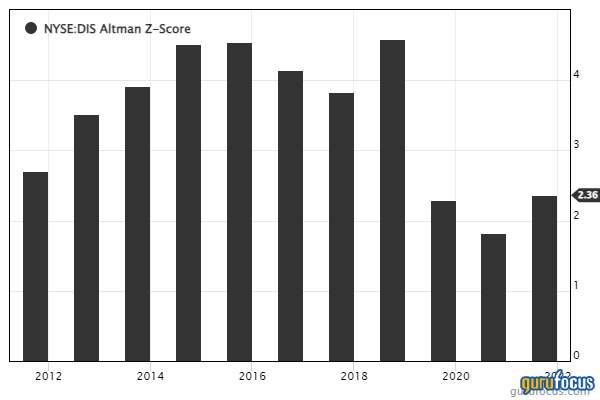

GuruFocus ranks the Burbank, California-based entertainment giant’s financial strength 5 out of 10 on the heels of a modest Altman Z-score of 2.31 and debt ratios underperforming more than 64% of global competitors despite the company having a high Piotroski F-score of 7.

Also check out: