Southeastern Asset Management recently disclosed its 13F portfolio updates for the fourth quarter of 2021, which ended on Dec. 31.

Founded by Mason Hawkins (Trades, Portfolio) in 1975, the Memphis, Tennessee-based firm manages the Longleaf Partners Funds. The firm employs a fundamental, bottom-up appraisal process based on in-house research in order to select a concentrated portfolio of quality investments that have strong balance sheets, good management teams and attractive valuations.

Based on its latest filing, the firm was doing a lot of buying during the fourth quarter. The top new additions to the portfolio were Biogen Inc. (BIIB, Financial), Liberty Broadband Corp. (LBRDK, Financial), Fiserv Inc. (FISV, Financial), Oscar Health Inc. (OSCR, Financial) and Vimeo Inc. (VMEO, Financial).

Biogen

Southeastern took a new stake worth 858,523 shares in Biogen (BIIB, Financial) after selling out of its previous holding in the second quarter of 2021. The firm dedicated 3.46% of the portfolio to the stock. During the quarter, shares averaged $256.27 apiece.

Biogen is a biotech company based in Cambridge, Massachusetts that primarily researches and develops therapies for neurological and neurodegenerative diseases, including multiple sclerosis, leukemia and Alzheimer’s.

On Feb. 17, shares of Biogen traded around $210.60 for a market cap of $30.94 billion. According to the GF Value Line, the stock is modestly undervalued.

The company has a financial strength rating of 5 out of 10 and a profitability rating of 8 out of 10. Warning signs include declining earnings and Ebitda per share, while positive signs include a strong Altman Z-Score and a return on invested capital that typically surpasses the weighted average cost of capital.

Liberty Broadband

The firm purchased 861,320 shares of Liberty Broadband (LBRDK, Financial), dedicating 2.33% of the equity portfolio to the position. Shares traded for an average price of $164.24 in the three months through the end of December.

Liberty Broadband is a holding company for two subsidiaries, Charter Communications and TruePosition, which operate in the cable-broadband and mobile location technology businesses, respectively. The company is headquartered in Englewood, Colorado.

On Feb. 17, shares of Liberty Broadband traded around $148.81 for a market cap of $26.20 billion. The Peter Lynch chart shows the stock trading above its fair value but below its median historical valuation.

The company has a financial strength rating of 3 out of 10 and a profitability rating of 3 out of 10. Warning signs include poor financial strength and declining revenue per share, but on the positive side, both the top and bottom lines are beginning to increase again.

Fiserv

Hawkins’ firm added a 732,426-share stake in Fiserv Inc. (FISV, Financial), taking up 1.28% of the equity portfolio. During the quarter, shares traded for an average price of $103.27.

Based in Brookfield, Wisconsin, Fiserv is a multinational provider of financial services technology to corporate clients in the financial world, including banks, credit unions, thrifts, leasing and finance companies, insurance companies and securities processing organizations.

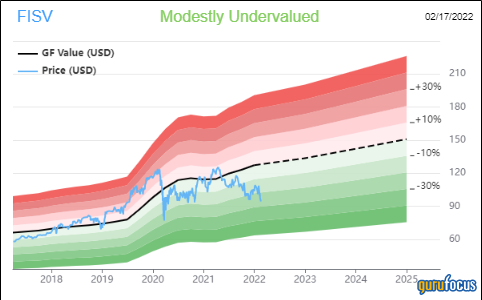

On Feb. 17, shares of Fiserv traded around $94.33 for a market cap of $62.28 billion. According to the GF Value Line, the stock is modestly undervalued.

The company has a financial strength rating of 3 out of 10 and a profitability rating of 8 out of 10. Warning signs include a distressed Altman Z-Score and a cash-debt ratio of 0.04, while positive signs include a three-year revenue per share growth rate of 19.7% and a three-year Ebitda per share growth rate of 14.3%.

Oscar Health

The firm added a new position of 9,109,822 shares in Oscar Health Inc. (OSCR, Financial), giving it a 1.20% weight in the equity portfolio. Shares traded around $12.37 apiece during the quarter.

Oscar Health is a New York-based health insurance company that is built around a full stack technology platform. By pursuing a technology-first approach, the company aims to reduce the costs of health insurance as well as the complexity of trying to find in-network health care providers.

On Feb. 17, shares of Oscar Health traded around $7.03 for a market cap of $1.48 billion. Since going public in March 2021, the stock is down 79%.

The company has a financial strength rating of 6 out of 10 and a profitability rating of 1 out of 10. It has no debt following a highly successful IPO, though negative return on equity and return on asset ratios show the company is not yet profitable.

Vimeo

Southeastern established a stake in Vimeo Inc. (VMEO, Financial) worth 3,206,147 shares, giving it an equity portfolio weight of 0.97%. During the quarter, shares were changing hands for an average price of $24.11.

Vimeo is a cloud-based video creating, streaming and hosting platform focused on delivering high-definition video to a range of devices. It operates on a software-as-a-service business model, allowing users to upload and promote their videos with a higher degree of customization.

On Feb. 17, shares of Vimeo traded around $12.70 for a market cap of $2.10 billion. Since spinning off from its parent company in May of 2021, the stock has lost 76%.

The company has a financial strength rating of 7 out of 10 and a profitability rating of 1 out of 10. Vimeo is debt-free following its spinoff and has ample cash on its balance sheet, though as the negative operating and net margins show, the company is still in its pre-earnings phase.

Portfolio overview

As of the end of the quarter, Southeastern’s equity portfolio consisted of 35 common stock holdings valued at a total of $5.96 billion. The turnover for the quarter was 16%.

The top holdings by portfolio weight were Lumen Technologies Inc. (LUMN, Financial) with 13.57% of the equity portfolio, Mattel Inc. (MAT, Financial) with 7.32% and CNX Resources Corp. (CNX, Financial) with 6.34%.

In terms of sector weighting, the firm was most invested in communication services stocks, followed by consumer cyclical and financial services.

Also check out: