Bernard Horn (Trades, Portfolio), manager of Polaris Global Value Fund, disclosed this week its fourth-quarter 2021 13F portfolio update, revealing new positions in FedEx Corp. (FDX, Financial) and Allison Transmission Holdings Inc. (ALSN, Financial), the closure of its holdings in Coca-Cola Europacific Partners (CCEP, Financial) and ALLETE Inc. (ALE, Financial) and a reduction to its holding of Jazz Pharmaceuticals (JAZZ, Financial).

The Boston-based fund seeks long-term capital appreciation by investing in companies with high free cash flow growth potential or low valuations. Polaris invests based on the belief that country and industry factors are important determinants of share prices and that global market fluctuations produce mispriced stocks.

As of December 2021, the fund’s $486 million equity portfolio contains 98 stocks, with three new positions and a quarterly turnover ratio of 4%. The top four sectors in terms of weight are financial services, consumer cyclical, basic materials and industrials, representing 21.79%, 17.09%, 11.85% and 11.46% of the equity portfolio.

FedEx

Polaris invested in 23,000 shares of FedEx (FDX, Financial), giving the position 1.22% of equity portfolio space. Shares averaged $240.55 during the fourth quarter; the stock is fairly valued based on Thursday’s price-to-GF Value ratio of 0.91.

GuruFocus ranks the Memphis, Tennessee-based logistics company’s profitability 9 out of 10 on several positive investing signs, which include a four-star business predictability rank, a high Piotroski F-score of 8 and a return on equity that outperforms more than 80% of global competitors.

Other gurus with holdings in FedEx include Dodge & Cox and PRIMECAP Management (Trades, Portfolio).

Allison Transmission Holdings

The fund purchased 150,200 shares of Allison Transmission Holdings (ALSN, Financial), dedicating 1.12% of its equity portfolio to the stake. Shares averaged $35.34 during the fourth quarter; the stock is modestly undervalued based on Thursday’s price-to-GF Value ratio of 0.83.

GuruFocus ranks the Indianapolis-based auto parts company’s profitability 9 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7 and profit margins and returns that outperform more than 89% of global competitors.

Coca-Cola Europacific Partners

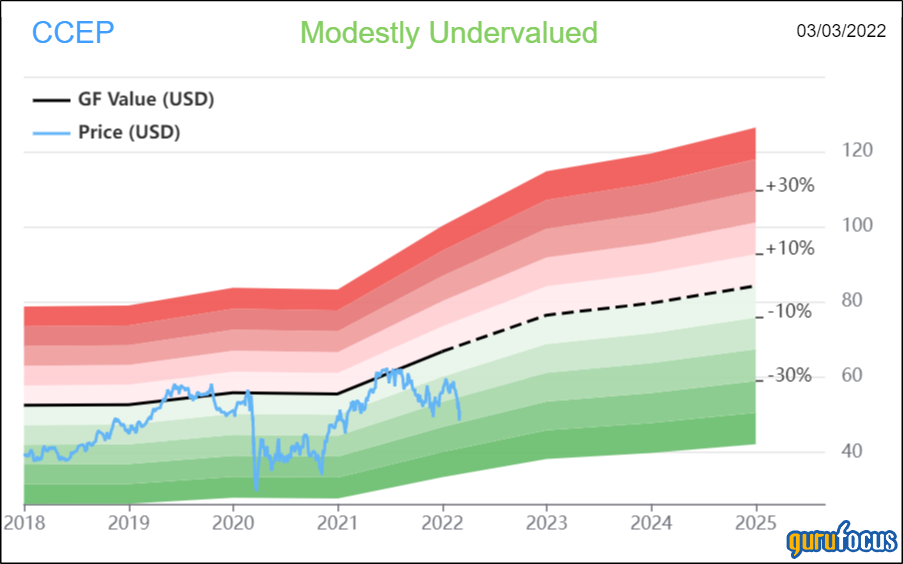

The fund sold all 107,600 shares of Coca-Cola Europacific Partners (CCEP, Financial), trimming 1.19% of its equity portfolio.

Shares of Coca-Cola Europacific Partners averaged $53.88 during the fourth quarter; the stock is modestly undervalued based on Thursday’s price-to-GF Value ratio of 0.74.

GuruFocus ranks the U.K.-based bottling company’s profitability 7 out of 10 on several positive investing signs, which include a three-star business predictability rank and a three-year revenue growth rate that outperforms more than 76% of global competitors.

ALLETE

Polaris sold all 82,400 shares of ALLETE (ALE, Financial), trimming 0.98% of its equity portfolio.

Shares of ALLETE averaged $62.74 during the fourth quarter; the stock is modestly undervalued based on Thursday’s price-to-GF Value ratio of 0.84.

GuruFocus ranks the Duluth, Minnesota-based utility company’s profitability 7 out of 10 on the back of net profit margins outperforming more than 64% of global competitors despite three-year revenue and earnings decline rates underperforming over 66% of global regulated utility companies.

Jazz Pharmaceuticals

The fund sold 35,600 shares of Jazz Pharmaceuticals (JAZZ, Financial), slicing 49.24% of the position and 0.93% of its equity portfolio.

Shares of Jazz Pharmaceuticals averaged $131.36 during the fourth quarter; the stock is modestly undervalued based on Thursday’s price-to-GF Value ratio of 0.75.

GuruFocus ranks the Dublin, Ireland-based biotech company’s profitability 9 out of 10 on several positive investing signs, which include profit margins and returns outperforming more than 77% of global competitors.