In light of consumer prices continuing their record surge in March, five consumer defensive stocks with high GF Scores are The Estee Lauder Companies Inc. (EL, Financial), Monster Beverage Corp. (MNST, Financial), Helen of Troy Ltd. (HELE, Financial), Usana Health Sciences Inc. (USNA, Financial) and Church & Dwight Co. Inc. (CHD, Financial) according to the All-in-One Screener, a Premium feature of GuruFocus.

Dow wavers as consumer prices accelerate near 40-year highs

On Tuesday, the U.S. Bureau of Labor Statistics reported the consumer price index increased 8.5% for the 12 months ending March, the largest 12-month increase since the period ending December 1981. Over the past month, the index increased 1.2% on the back of gasoline prices rising 18.3% while the food index gained 1%.

The Dow Jones Industrial Average closed at 34,220.36, down 87.72 points from the previous close of 34,308.08 despite trading at an intraday high of 34,669.97.

As investors continue monitoring the increase in consumer prices, GuruFocus’ All-in-One Screener listed five consumer defensive stocks that have a GF Score of 95 or better. Also known as consumer staples, the consumer defensive sector includes industries that are not as sensitive to business cycles as more cyclical industries.

GuruFocus' new GF Score grades a stock on a scale from 0 to 100 based on five rankings: financial strength, profitability, valuation, growth and momentum. Each of the ranks are graded from 1 to 10, with 10 as the highest score.

GuruFocus’ backtesting results found that stocks with a higher GF Score generally produce higher returns than stocks with a lower GF Score.

Estee Lauder

Estee Lauder (EL, Financial) produces fragrance, cosmetic and skincare products. The New York-based company has a GF Score of 97 on the back of a GuruFocus profitability rank of 10 and a growth rank of 10, despite the financial strength, valuation and momentum ranks ranging between 6 and 7.

Estee Lauder’s profitability ranks 10 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank and profit margins and returns outperforming more than 90% of global competitors.

Gurus with holdings in Estee Lauder include Baillie Gifford (Trades, Portfolio), Spiros Segalas (Trades, Portfolio)’ Harbor Capital Appreciation Fund and Ray Dalio (Trades, Portfolio)’s Bridgewater Associates.

Monster Beverage

Monster Beverage (MNST, Financial) produces energy drinks through its Monster Energy and Monster Ultra brands. The Corona, California-based company has a GF Score of 96, driven on a rank of 10 for the GuruFocus financial strength, profitability, growth and valuation ranks despite momentum ranking just 4 out of 10.

Monster’s high GF Score comes on the back of several positive investing signs, which include a strong Altman Z-score of 24, an interest coverage ratio that outperforms more than 89% of global competitors and an operating margin that outperforms more than 95% of global beverage companies.

Helen of Troy

Helen of Troy (HELE, Financial) produces consumer products for houseware and health. The company has a GF Score of 96, driven by a rank between 9 and 10 for profitability, financial strength and valuation.

Helen of Troy’s profitability ranks 9 out of 10 based on several positive investing signs, which include a four-star business predictability rank and profit margins and returns that are outperforming more than 76% of global competitors.

Usana Health Sciences

Usana Health Sciences (USNA, Financial) develops and produces science-based nutritional and personal care products. The Salt Lake City-based company has a GF Score of 95, driven by a rank of 10 for financial strength and valuation, a rank of 9 for profitability and growth and a rank of 7 for momentum.

Usana’s financial strength ranks 10 out of 10 on several positive investing signs, which include a strong Altman Z-score of 9.41 and an interest coverage ratio that outperforms more than 95% of global competitors.

Church & Dwight

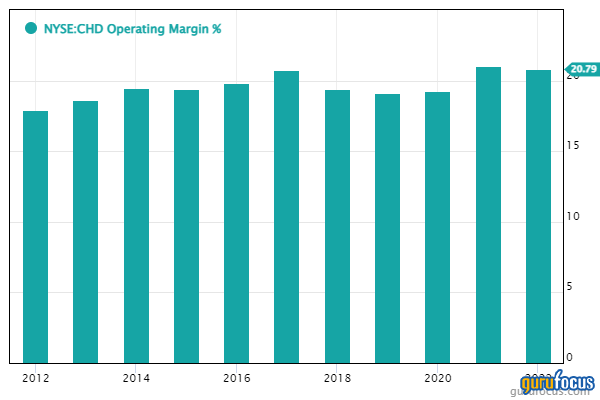

Church & Dwight (CHD, Financial) produces laundry, deodorant and oral care products. The Ewing, New Jersey-based company has a GF Score of 95, driven by a rank of 10 for profitability and growth despite a rank of 6 for financial strength, valuation and momentum.

Church & Dwight has a profitability rank of 10 based on several positive investing signs, which include a five-star business predictability rank and profit margins and returns outperforming more than 87% of global competitors.