The Estée Lauder Companies Inc. (EL, Financial) has one of the best sets of fundamentals among all American stocks.

Its latest financial update, released on May 3, was upbeat, noting, “Net sales grew in every product category, largely reflecting continued recovery in brick-and-mortar retail stores, driven by double-digit growth in The Americas and Europe, the Middle East & Africa (“EMEA”) regions, as well as growth in global online.”

Yet, its share price is in the dumps, as shown in this three-year chart:

About Estée Lauder

This $89.34 billion company was founded by Estée and Joseph Lauder in 1946. Based in New York, it is one of the world’s largest and best-known cosmetic companies.

According to its 10-K for fiscal 2021, it is "one of the world’s leading manufacturers, marketers and sellers of quality skin care, makeup, fragrance and hair care products."

The company continued:

"Our products are sold in approximately 150 countries and territories under a number of well-known brand names including: Estée Lauder, Clinique, Origins, M·A·C, Bobbi Brown, La Mer, Aveda, Jo Malone London, Too Faced, Dr. Jart+, and The Ordinary. We are also the global licensee for fragrances, cosmetics and/or related products sold under various designer brand names. Each brand is distinctly positioned within the market for cosmetics and other beauty products.”

Competition

It reports “significant” competition in each of its markets, with both global and local companies. Named competitors include L’Oreal S.A (XPAR:OR, Financial), Unilever (UL, Financial), Procter & Gamble (PG, Financial), Shiseido Company, Ltd. (TSE:4911, Financial), L Brands, Natura & Co. (NTCO, Financial), Beiersdorf (XTER:BEI, Financial), LVMH Moët Hennessey Louis Vuitton (XPAR:MC, Financial), Chanel S.A., Kao Corp. (TSE:4452, Financial) and LG Household & Health Care.

Also according to the annual filing, consumers choose among products and companies based on brand recognition, product quality and effectiveness, distribution channels, accessibility and price points.

Estée Lauder believes it has significant competitive advantages and considers itself an industry leader as a result of "the global recognition of our brand names, our excellence in product innovation, our strong position in key geographic markets and the consistently high quality of our products and 'High-Touch' services.”

That claim is confirmed by its industry-leading profit margins and returns.

Financial strength

Estée Lauder has grown its debt along with its cash flow for the past decade. At the end of March 2022, it had short-term debt of $269 million, long-term debt of $5.18 billion and long-term capital lease obligations of $1.95 billion. The balance sheet also shows cash and cash equivalents of $3.84 billion.

With return on invested capital that is nearly triple the weighted average cost of capital, the company clearly creates value for shareholders. The WACC is 8.09% versus a ROIC of 23.59%.

Profitability

As the table displays, all three margins are high, with the net being better than 91.41% of the 1,737 companies in the consumer packaged goods industry. Its return on equity outperforms 97.37% of peers and competitors.

Growth

Management is doing an excellent job of converting revenue into earnings. Although revenue has increased by an average of just 6.5% per year over the past three years, earnings without non-recurring items have grown an average of 38.2% per year.

Estée Lauder’s free cash flow has also grown significantly over both three-year and 10-year terms (but not in two of the past three quarters):

Dividends and repurchases

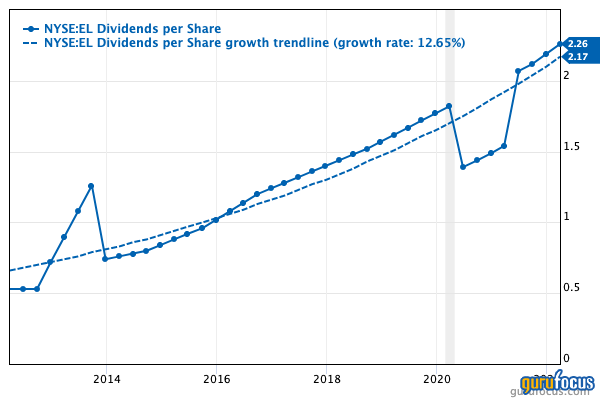

Despite the significant drop in the share price, the dividend yield is well below the S&P 500 average. Still, Estée Lauder has a history of raising the dividend per share payment:

At the same time, the company has been reducing the number of shares outstanding, slightly pushing up earnings per share. Over the last 10 years, the company has averaged a reduction of 0.91% annually.

Valuation

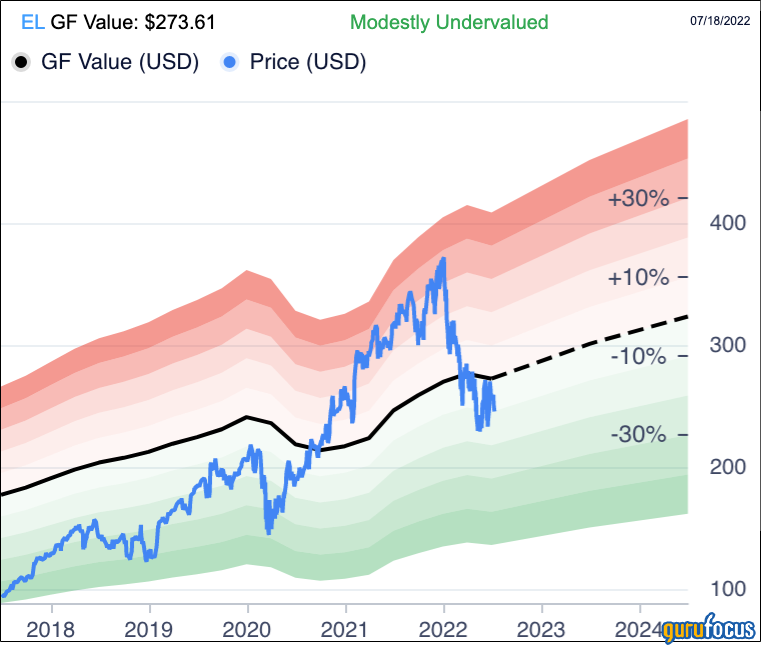

Estée Lauder gets a middling ranking for valuation, with mixed results from the metrics and other measures.

The price-earnings ratio is relatively high at 26.86, which is higher than 67.13% of companies in the consumer packaged goods industry.

The PEG ratio is relatively high as well at 2.71, though some investors would consider this a fair valuation. It would be much higher if not for the strength of Ebitda growth over the past five years. Average growth per year over the past half decade is 11.17%.

Modestly undervalued is the verdict of the GF Value chart:

With a predictability rating of 4.5 out of five stars, the discounted cash flow calculator seems an obvious choice for a valuation opinion. But the question is, which growth rate to choose?

Using the default 10-year average of earnings per share without nonrecurring items, which is 8.40%, Estée Lauder shares are significantly overvalued. The five-year average is slightly higher at 10.70% and, again, the shares are currently overpriced. But the three-year average is 38.2% and, at that growth rate, the share price is significantly undervalued. Finally, the one-year growth rate is 143.70%, which, if projected forward over 10 years, would offer a wildly significant undervaluation.

Two sets of assumptions demand our attention. First, as the 10-, five-, three- and one-year rates indicate, the company’s earnings per share growth has sped up. Second, how long will this acceleration last? Investors need to bring their own assumptions to this valuation tool.

Overall, I believe the shares are somewhere near fair valuation.

Fundamentals overview

Taken together, the key fundamental metrics show a dynamic and robust company. The GF Score totals an enviable 95 out of 100:

Gurus

A total of 12 gurus own shares of Estée Lauder. The three largest holdings are those of:

- Baillie Gifford (Trades, Portfolio), which held the largest stake at the end of the first quarter of 2022. After a reduction of 8.23%, it finished the quarter with 2,812,538 shares. They represent 0.78% of Estée Lauder’s stock and 0.54% of the fund’s holdings.

- Spiros Segalas (Trades, Portfolio) of the Harbor Capital Appreciation Fund reduced his position by 6.26% and wound up with 1,977,594 shares.

- Ray Dalio (Trades, Portfolio)'s Bridgewater Associates was more bullish. During the quarter, it increased its holding by 41.43% to 724,888 shares.

Conclusion

The Estée Lauder company is an excellent stock for long-term growth and capital appreciation. As we saw, it offers exceptional fundamentals and a modest but growing dividend.

Valuation may be an issue for many investors, considering the stock. Despite the slump in the share price, it appears to be only fairly valued.

That valuation, plus the short- and long-term debt, makes this unsuitable for value investors. On the other hand, growth investors might want to consider the possibility the share price might rebound once the market catches up to the fundamentals. Finally, there is a dividend, but income investors will probably want a higher starting yield.