The CI Select Canadian Equity Fund (Trades, Portfolio), part of CI Investments Inc., disclosed in a regulatory filing that its top-five buys during the six-month period from March to September were CI Global Financial Sector ETF (TSX:FSF.TO, Financial), TELUS Corp. (TSX:T, Financial), Royal Bank of Canada (TSX:RY, Financial), U.S. Foods Holding Corp. (USFD, Financial) and Alphabet Inc. (GOOGL, Financial).

The fund seeks long-term capital appreciation by investing in Canadian and global equities based on analyses of companies’ full capital structure and qualitative measures such as management quality, financial disclosures and governance structures.

The fund releases its portfolio updates semiannually. As of September, the fund’s $2.62 billion equity portfolio contains 108 stocks, with 31 new positions and a semiannual turnover of 40%. The top four sectors in terms of weight are financial services, energy, industrials and health care, with weights of 27.57%, 13.73%, 9.6% and 7.88%.

Investors should be aware that portfolio updates for mutual funds do not necessarily provide a complete picture of a guru’s holdings. The data is sourced from the quarterly updates on the website of the fund(s) in question. This usually consists of long equity positions in U.S. and foreign stocks. All numbers are as of the quarter’s end only; it is possible the guru may have already made changes to the positions after the quarter ended. However, even this limited data can provide valuable information.

CI Global Financial Sector ETF

The fund invested in 5,625,387 shares of the CI Global Financial Sector ETF (TSX:FSF.TO, Financial), giving the position a 4.20% equity portfolio weight. Shares averaged $21.11 during the third quarter.

The ETF seeks to track the performance of a basket of stocks in the global financial services sector. During the past five years, the ETF returned an annualized 3.61% per year.

TELUS

The fund purchased 1,904,909 shares of TELUS (TSX:T, Financial), giving the position 2% equity portfolio weight.

Shares of TELUS averaged 30.35 Canadian dollars ($22.34) during the third quarter; the stock is fairly valued based on its price-to-GF-Value ratio of 0.99 as of Thursday.

The Vancouver-based telecom giant has a GF Score of 89 out of 100 based on a rank of 9 out of 10 for profitability and growth, a momentum rank of 8 out of 10, a GF Value rank of 5 out of 10 and a financial strength rank of 4 out of 10.

TELUS’ profitability ranks 9 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank and an operating margin that outperforms approximately 70% of global competitors.

Gurus with holdings in TELUS’ U.S.-based shares (TU, Financial) include Jim Simons (Trades, Portfolio)’ Renaissance Technologies and Chuck Royce (Trades, Portfolio)’s Royce Investment Partners.

Royal Bank of Canada

The fund purchased 346,731 shares of Royal Bank of Canada (TSX:RY, Financial), giving the position 1.65% equity portfolio weight.

Shares of Royal Bank of Canada averaged C$127.92 ($94.18) during the third quarter; the stock is fairly valued based on its price-to-GF-Value ratio of 1.04 as of Thursday.

The Montreal, Quebec-based bank has as GF Score of 79 out of 100: Even though the company’s financial strength and GF Value rank just 3 out of 10, Royal Bank of Canada has a momentum rank of 10 out of 10, a growth rank of 8 out of 10 and a profitability rank of 7 out of 10.

The bank’s profitability ranks 7 out of 10 on the heels of a five-star business predictability rank and 10 years of positive net income over the past 10 years despite returns on assets underperforming more than 55% of global competitors.

U.S. Foods Holdings

The fund purchased 883,500 shares of U.S. Foods Holdings (USFD, Financial), giving the position 1.23% equity portfolio weight.

Shares of U.S. Foods Holdings averaged $32.45 during the third quarter; the stock is fairly valued based on its price-to-GF-Value ratio of 0.91 as of Thursday.

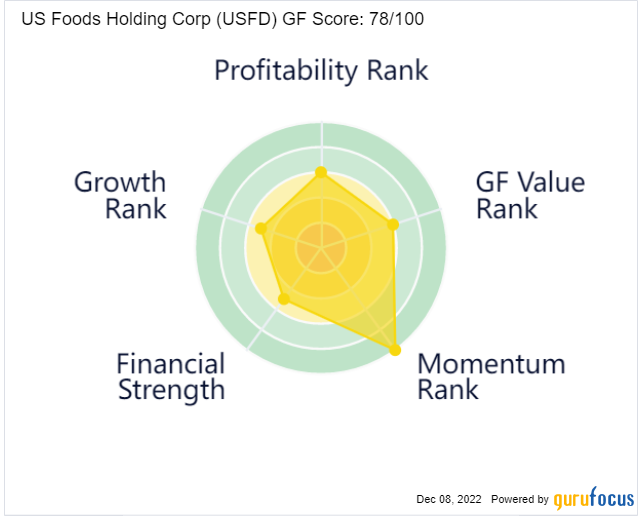

The Rosemont, Illinois-based food service company has a GF Score of 78 out of 100: Although the company has a momentum rank of 10 out of 10, U.S. Foods’ profitability and GF Value rank just 6 out of 10 while the company’s financial strength and growth rank just 5 out of 10.

U.S. Foods’ profitability ranks 6 out of 10 on the back of profit margins and returns underperforming over 60% of global competitors.

Alphabet

The fund purchased 235,780 Class A shares of Alphabet (GOOGL, Financial), giving the position 1.19% equity portfolio weight.

Class A shares of Alphabet averaged $93.71, showing that the stock is significantly undervalued based on its price-to-GF-Value ratio of 0.67 as of Thursday.

The Moutain View, California-based online media giant has a GF Score of 95 out of 100 driven on a rank of 10 out of 10 for growth and GF Value and a rank of 9 out of 10 for profitability and financial strength despite momentum ranking just 5 out of 10.

Alphabet’s profitability ranks 9 out of 10 on several positive investing signs, which include 10 years of positive operating income over the past 10 years and returns that outperform more than 80% of global competitors.

Also check out: