On July 28, 2023, The Estee Lauder Companies Inc (EL, Financial) recorded a daily gain of 4.12% and reported an Earnings Per Share (EPS) of $3.01. But is the stock modestly undervalued? This article seeks to answer this question through a comprehensive valuation analysis. Let's delve into it.

Company Introduction

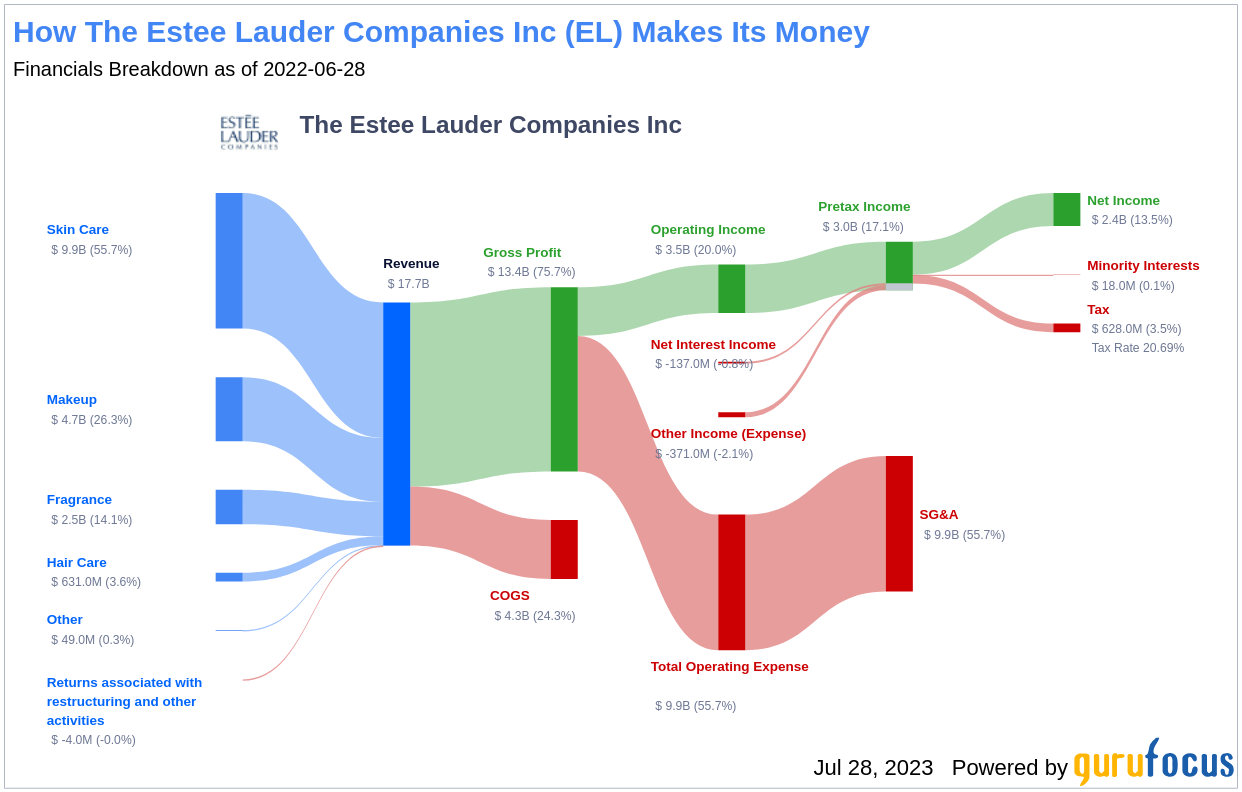

The Estee Lauder (EL, Financial), a leader in the global prestige beauty market, operates across skin care, makeup, fragrance, and hair care categories. With top-selling brands like Estee Lauder, Clinique, M.A.C, La Mer, Jo Malone London, Aveda, Bobbi Brown, and Origins, the company has a strong presence in over 150 countries. Its revenues are distributed across the Americas (26%), Europe, the Middle East, Africa (43%), and Asia Pacific (31%).

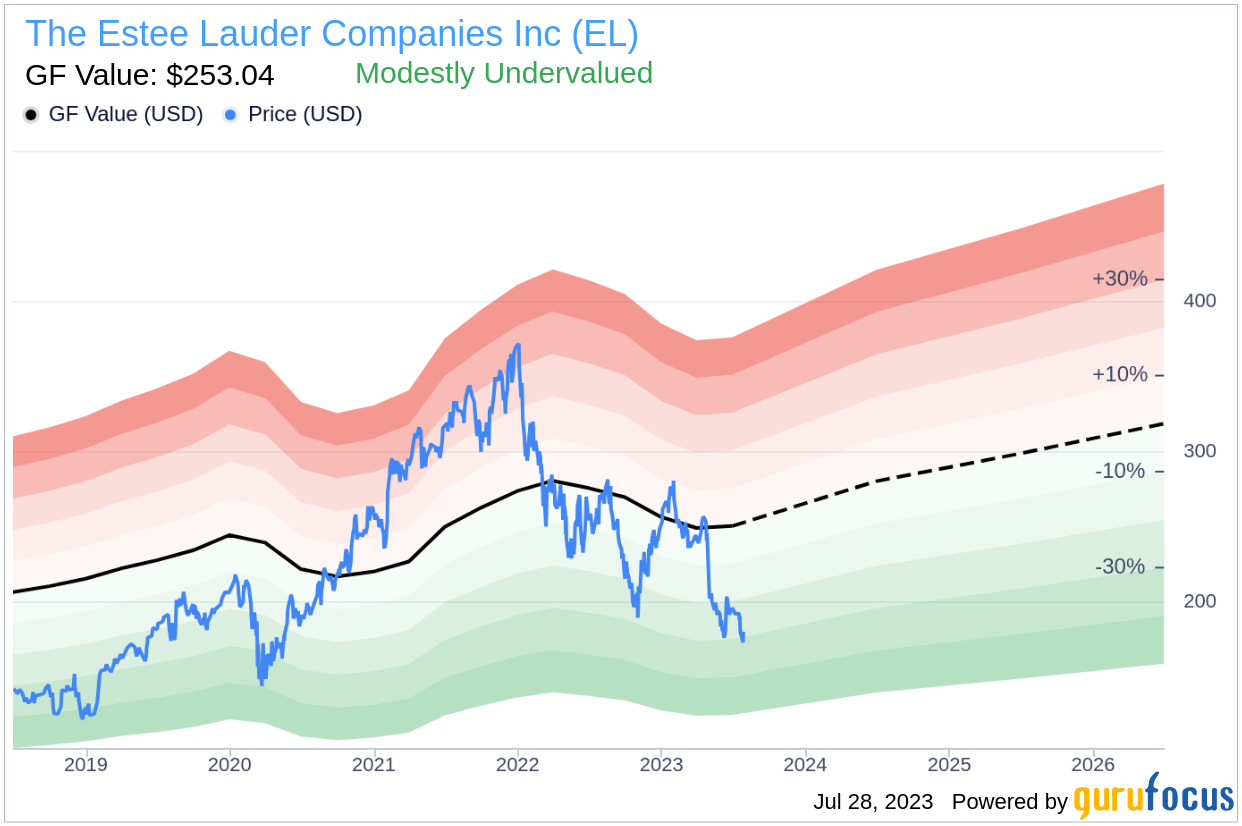

As of July 28, 2023, The Estee Lauder's stock price stands at $180.6 per share, with a market cap of $64.5 billion. The company's GF Value, an estimation of its fair value, is $253.04, suggesting that the stock might be modestly undervalued.

Understanding the GF Value

The GF Value is a proprietary measure of a stock's intrinsic value, computed considering historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line represents the stock's ideal fair trading value.

Based on the GuruFocus Value calculation, The Estee Lauder's stock appears to be modestly undervalued. This suggests that the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

Assessing a company's financial strength is crucial before investing in its stock. The Estee Lauder has a cash-to-debt ratio of 0.59, better than 54.12% of companies in the Consumer Packaged Goods industry. This indicates that The Estee Lauder's financial strength is fair.

Profitability and Growth

Investing in profitable companies carries less risk. The Estee Lauder has been profitable 10 years over the past 10 years, with revenues of $15.9 billion and Earnings Per Share (EPS) of $3.01 in the past 12 months. Its operating margin of 12.24% is better than 79.05% of companies in the Consumer Packaged Goods industry, indicating strong profitability.

Growth is a crucial factor in a company's valuation. The Estee Lauder's 3-year average revenue growth rate is better than 51.4% of companies in the Consumer Packaged Goods industry, and its 3-year average EBITDA growth rate is 10%, ranking better than 57.17% of companies in the industry.

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can provide insights into its profitability. The Estee Lauder's ROIC is 10.48, exceeding its WACC of 9.49, indicating that the company is likely creating value for its shareholders.

Conclusion

In conclusion, The Estee Lauder (EL, Financial) appears to be modestly undervalued. The company exhibits fair financial strength, strong profitability, and promising growth, ranking better than 57.17% of companies in the Consumer Packaged Goods industry. For more insights into The Estee Lauder's stock, check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, visit GuruFocus High Quality Low Capex Screener.