Overview of the Recent Transaction

On September 30, 2024, Fuller & Thaler Asset Management, Inc. executed a significant transaction involving the shares of Kemper Corp (KMPR, Financial), a diversified insurance company. The firm reduced its holdings by 776,005 shares, which resulted in a decrease of 17.32% in their position, leaving them with a total of 3,704,511 shares. This move impacted the firm's portfolio by -0.2%, with the shares being traded at a price of $61.25 each.Insight into Fuller & Thaler Asset Management

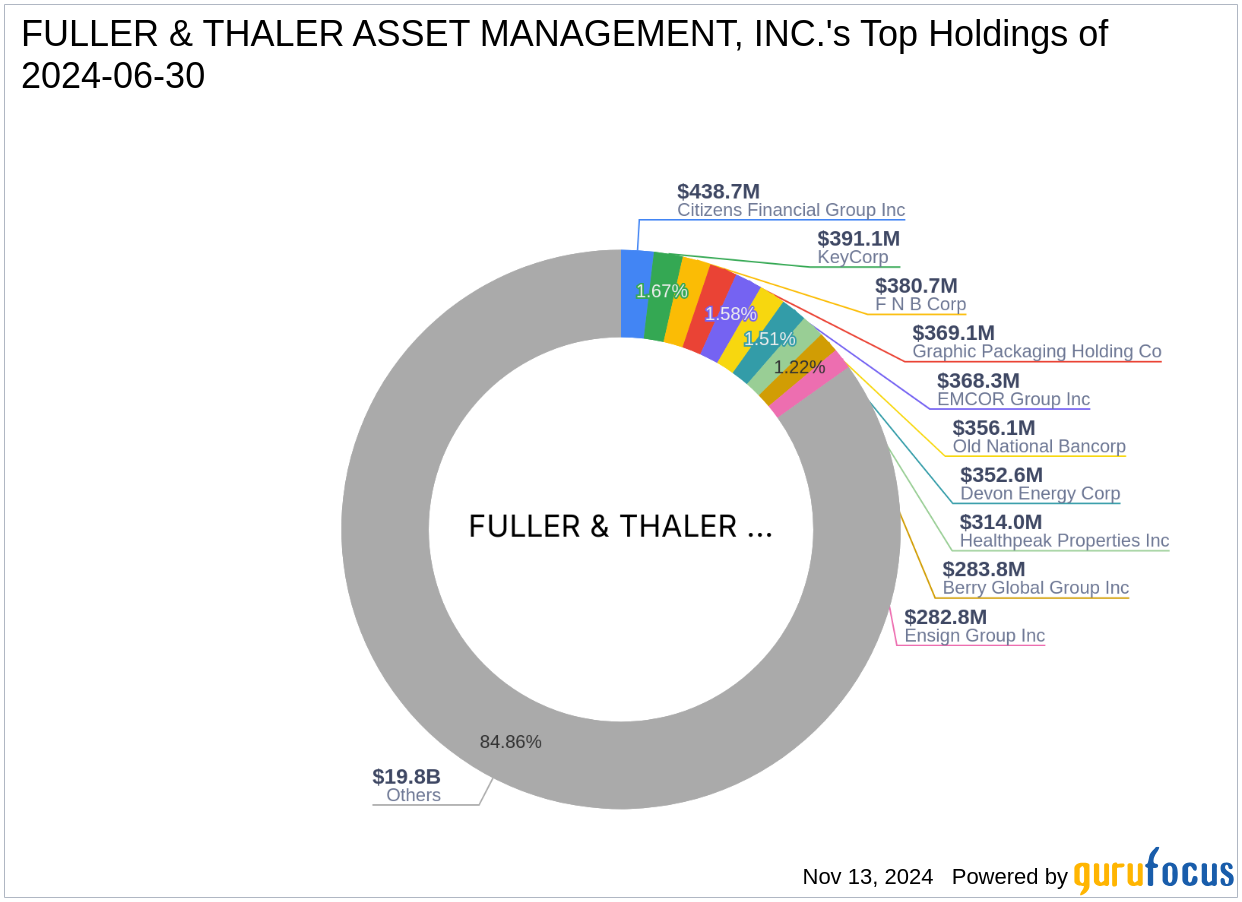

Fuller & Thaler Asset Management, Inc., based in San Mateo, California, is an employee-owned investment management firm established in 1993. With a focus on a bottom-up investment approach and fundamental analysis, the firm specializes in micro to small-cap growth and value stocks across global public equity markets. As of the latest data, Fuller & Thaler manages over $2.8 billion in assets, heavily investing in the financial services and industrials sectors. The firm's client base primarily consists of high net worth individuals, alongside pensions, charities, and corporate entities.

Kemper Corp at a Glance

Kemper Corp, headquartered in the USA, operates in the insurance industry with a focus on property and casualty, along with life and health insurance segments. As of the latest market data, Kemper has a market capitalization of approximately $4.45 billion and a stock price of $69.46, which is considered significantly overvalued based on the GF Value of $42.64. The company's stock has shown a robust year-to-date increase of 39.62%.Detailed Transaction Analysis

The reduction in Fuller & Thaler's holdings in Kemper Corp represents a strategic adjustment in their portfolio, with the remaining shares constituting 0.97% of their total investments and 5.75% of Kemper's available stock. This transaction, conducted at a trade price significantly lower than the current market price, suggests a timely decision by Fuller & Thaler, considering the stock's subsequent 13.4% price increase.Market and Stock Performance Insights

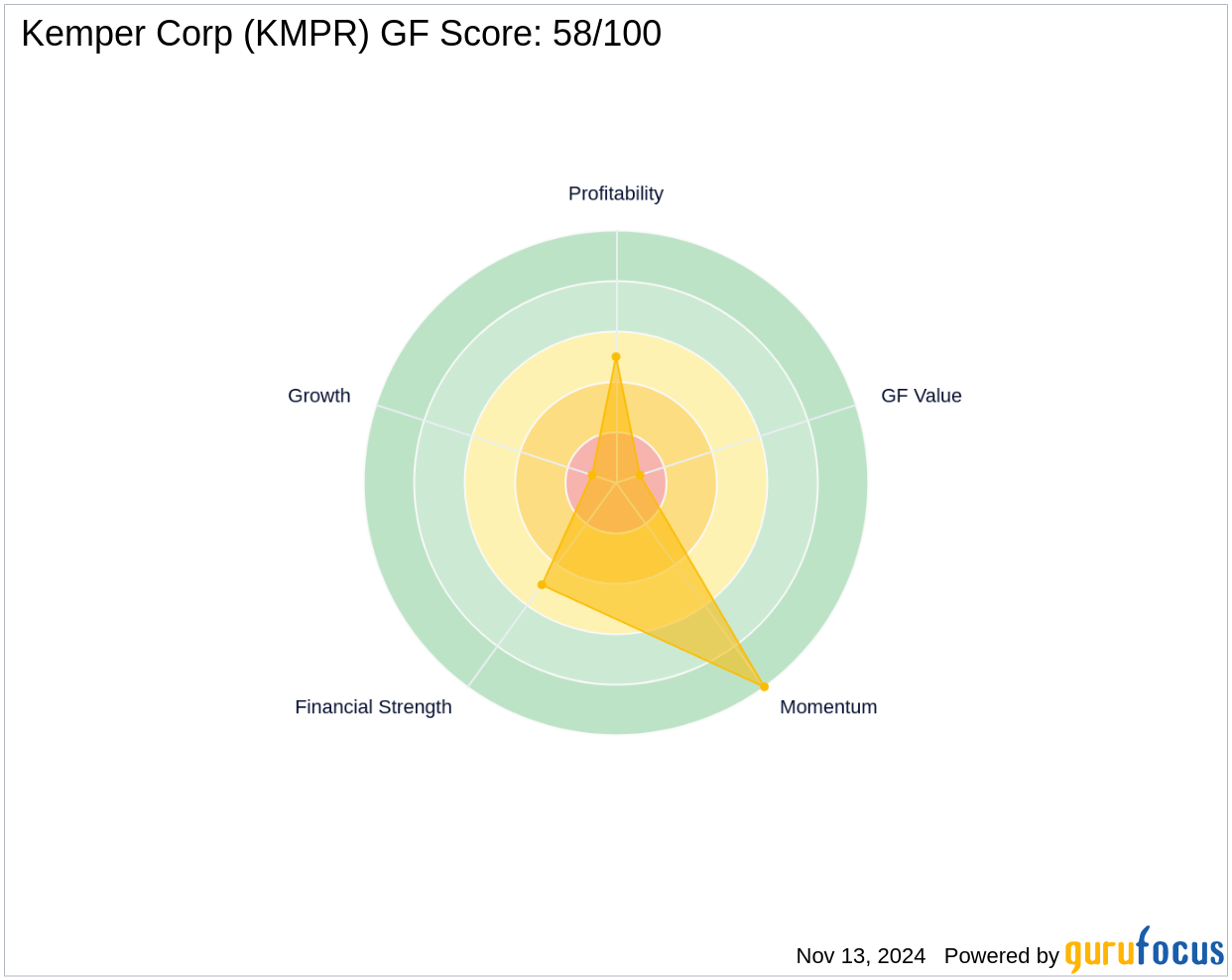

Kemper Corp's stock performance has been impressive, with a significant gain of 370.28% since its IPO and a notable increase post-transaction. The stock's GF Score of 58 indicates a moderate future performance potential. Despite a strong market momentum, the company's financial growth metrics remain low, with a Growth Rank of 1/10 and a GF Value Rank also at 1/10.

Broader Sector and Market Context

This transaction by Fuller & Thaler occurs within a broader context where the financial services sector, their top investment area, is experiencing significant activity. Comparatively, Kemper's performance and Fuller & Thaler's strategic positioning suggest a cautious approach to an overvalued stock amidst a volatile market.Implications and Future Outlook

Fuller & Thaler's decision to reduce their stake in Kemper may reflect a strategic realignment based on the stock's valuation and market performance. This move could influence Kemper's stock behavior in the short term, especially considering the firm's significant remaining stake. Investors and market watchers will likely keep a close eye on Fuller & Thaler's next moves, as they could signal broader market trends or shifts within the financial services sector.Other Significant Stakeholders

Besides Fuller & Thaler, Kemper Corp is also significantly held by First Eagle Investment (Trades, Portfolio) Management, LLC, and Hotchkis & Wiley, indicating a strong interest from major institutional investors. The dynamics among these key stakeholders could further shape the market's reception and the strategic decisions surrounding Kemper Corp moving forward.This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: