Overview of the Recent Transaction

On September 30, 2024, LSV Asset Management executed a significant transaction involving the shares of Xerox Holdings Corp (XRX, Financial). The firm decided to reduce its holdings by 635,255 shares, which resulted in a new total of 5,428,924 shares. This move marked a -10.48% change in their previous holding, reflecting a subtle yet notable adjustment in LSV Asset Management’s investment strategy towards Xerox. The shares were traded at a price of $10.38 each, impacting the firm's portfolio by a mere -0.01%.

Profile of LSV Asset Management

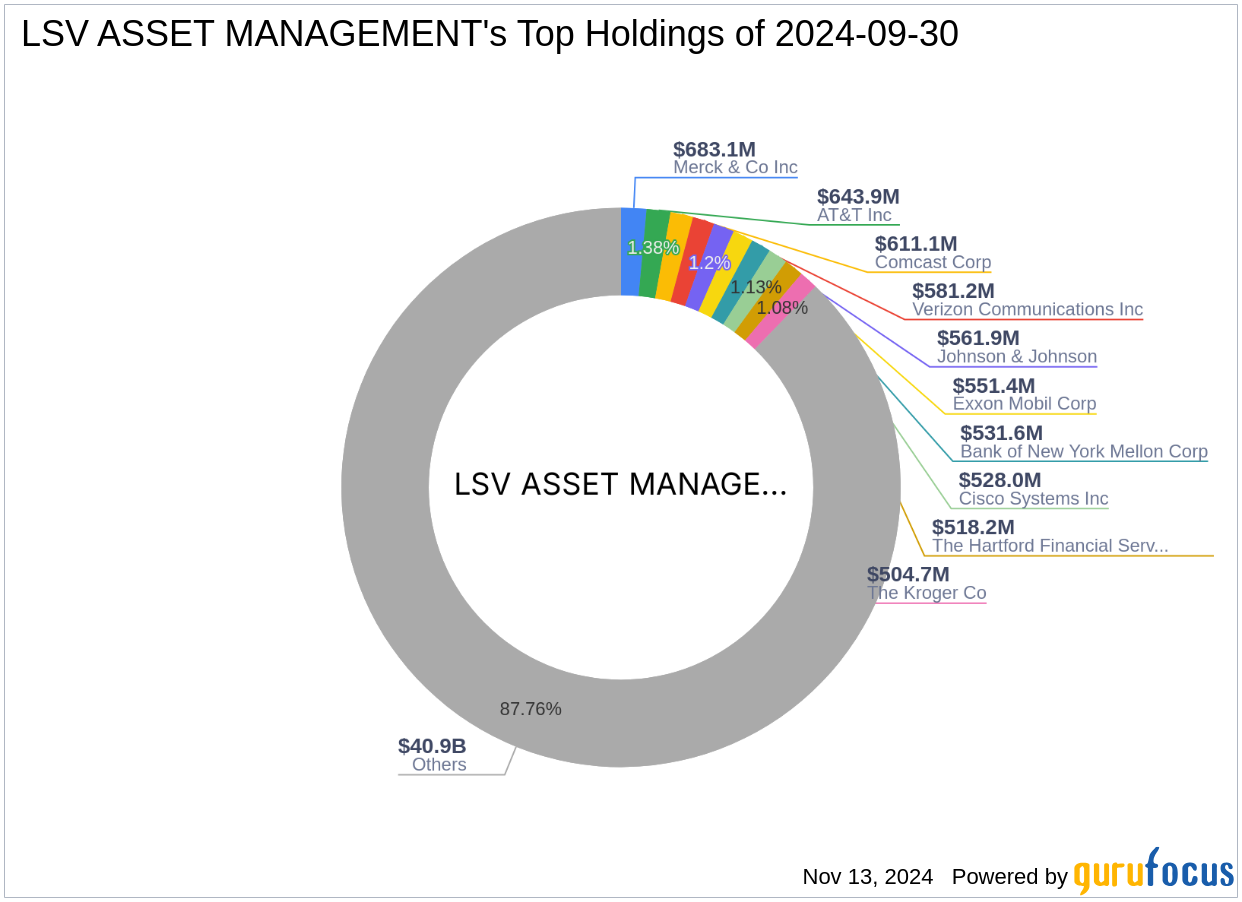

Founded in 1994, LSV Asset Management is renowned for its quantitative value management approach, serving institutional investors through proprietary investment models. The firm was initiated by three distinguished finance scholars and has grown into a partnership of 24 equity partners. With approximately $90 billion in managed assets, LSV Asset Management emphasizes a disciplined investment strategy focused on undervalued stocks that show potential for near-term appreciation. The firm’s top holdings include significant positions in major corporations such as Comcast Corp (CMCSA, Financial), Johnson & Johnson (JNJ, Financial), and Merck & Co Inc (MRK, Financial).

Insight into Xerox Holdings Corp

Xerox Holdings Corp, an iconic name in printing and digital transformation solutions, operates primarily through its segments in printing technology and related services. Despite its pioneering status, the company has faced challenges reflected in its current market capitalization of $1.03 billion and a significant decline in stock price, now standing at $8.27. Xerox's financial health shows potential vulnerabilities with a GF Score of 64/100, indicating poor future performance potential.

Analysis of the Trade Impact

The reduction in Xerox shares by LSV Asset Management suggests a strategic shift or a response to the ongoing performance dips in Xerox’s financials. Holding 4.37% of their portfolio in Xerox, the adjustment reflects a cautious approach, possibly due to the stock’s current valuation metrics and its performance relative to the market. The trade was executed at a price significantly lower than the GF Value of $17.76, indicating that the firm seized a moment where the stock was potentially undervalued.

Market Context and Strategic Implications

At the time of the trade, market conditions were tepid, with Xerox’s stock showing a year-to-date decline of -54.13%. The decision by LSV Asset Management to reduce their stake could be interpreted as a move to mitigate risk or reallocate resources to more promising areas. This strategic reduction aligns with broader market trends where investors are becoming increasingly cautious about tech and manufacturing sectors amidst economic uncertainties.

Comparative Insight and Broader Market Implications

Comparatively, other major stakeholders like Leucadia National have maintained different investment postures towards Xerox. This divergence highlights varying investor confidence and strategies in dealing with Xerox’s market position and financial health. Sector trends indicate a cautious approach towards companies like Xerox that are struggling with profitability and market adaptation.

Conclusion

In conclusion, LSV Asset Management’s recent reduction in Xerox Holdings Corp shares is a tactical move that reflects broader market sentiments and the firm's rigorous investment philosophy. As market conditions evolve, the firm’s future transactions will be closely watched for further insights into its strategic direction and market expectations.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.