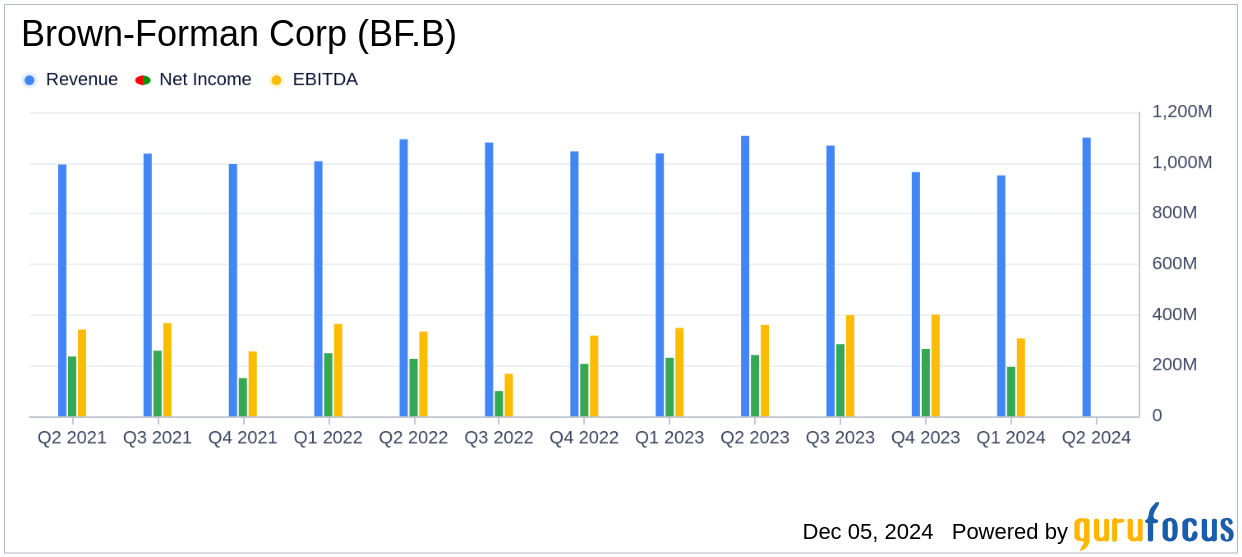

On December 5, 2024, Brown-Forman Corp (BF.B, Financial) released its 8-K filing detailing the financial results for the second quarter of fiscal 2025, which ended on October 31, 2024. The company reported a 1% decrease in net sales to $1.1 billion, slightly above the estimated revenue of $1,075.61 million. However, the diluted earnings per share (EPS) increased by 9% to $0.55, surpassing the analyst estimate of $0.51.

Company Background

Brown-Forman is a U.S.-based manufacturer of premium distilled spirits, with nearly 70% of its revenues generated from the whiskey category. The company is renowned for its Tennessee whiskey brand Jack Daniel's and bourbon brands Woodford Reserve and Old Forester. It also produces tequila, vodka, rum, gin, and premium wines. Brown-Forman generates 45% of its sales from the U.S., with significant international revenues from Europe, Australia, and Latin America. The Brown family holds over 50% of the economic interests and 67% voting power in the company.

Performance and Challenges

Brown-Forman's performance in the first half of fiscal 2025 was marked by a 5% decrease in net sales to $2.0 billion, attributed largely to the divestitures of Finlandia and Sonoma-Cutrer. Despite these challenges, the company managed to maintain flat organic net sales. The reported operating income decreased by 7% to $622 million, with a 3% decline in diluted EPS to $0.96 for the first half of the fiscal year.

Lawson Whiting, Brown-Forman’s President and CEO, stated, “Despite challenging economic conditions, our results for the first half of the fiscal year were in line with our expectations, and we anticipate a return to growth in fiscal 2025.”

Financial Achievements

In the second quarter, Brown-Forman achieved a 1% increase in operating income to $341 million, reflecting a 5% organic growth. The company's ability to increase its quarterly cash dividend for the 41st consecutive year underscores its commitment to financial stewardship and shareholder value. The dividend was raised by 4% to $0.2265 per share, payable on January 2, 2025.

Key Financial Metrics

Brown-Forman's gross profit for the second quarter declined by 4% to $646 million, with a gross margin contraction of 240 basis points to 59.1%. Operating expenses decreased by 10%, reflecting the company's efforts to manage costs amid divestitures and economic challenges. The effective tax rate improved to 17.6% from 22.0% in the prior year, contributing to the net income increase of 7% to $258 million.

| Metric | Q2 2024 | Q2 2023 | Change |

|---|---|---|---|

| Net Sales | $1,095 million | $1,107 million | -1% |

| Operating Income | $341 million | $339 million | 1% |

| Net Income | $258 million | $242 million | 7% |

| Diluted EPS | $0.55 | $0.50 | 9% |

Analysis and Outlook

Brown-Forman's performance highlights its resilience in navigating economic challenges and strategic divestitures. The company's focus on premium brands and geographic diversification positions it well for future growth. The reaffirmation of its full-year growth outlook, with expectations of 2% to 4% organic net sales and operating income growth, reflects confidence in its strategic initiatives and market positioning.

As Brown-Forman continues to adapt to market dynamics and consumer preferences, its commitment to maintaining strong financial health and shareholder returns remains evident. The company's strategic focus on premiumization and international expansion will be critical in driving long-term value for investors.

Explore the complete 8-K earnings release (here) from Brown-Forman Corp for further details.