On December 31, 2024, Vanguard Group Inc executed a significant transaction involving BayCom Corp, a bank holding company. The firm reduced its holdings in BayCom Corp by 186,553 shares, marking a change of -27.92%. This transaction was executed at a price of $26.84 per share. Following this adjustment, Vanguard now holds 481,691 shares of BayCom Corp, which represents 4.33% of the firm's holdings. This strategic move by Vanguard may indicate a shift in its investment strategy or a response to market conditions.

Vanguard Group Inc: A Profile

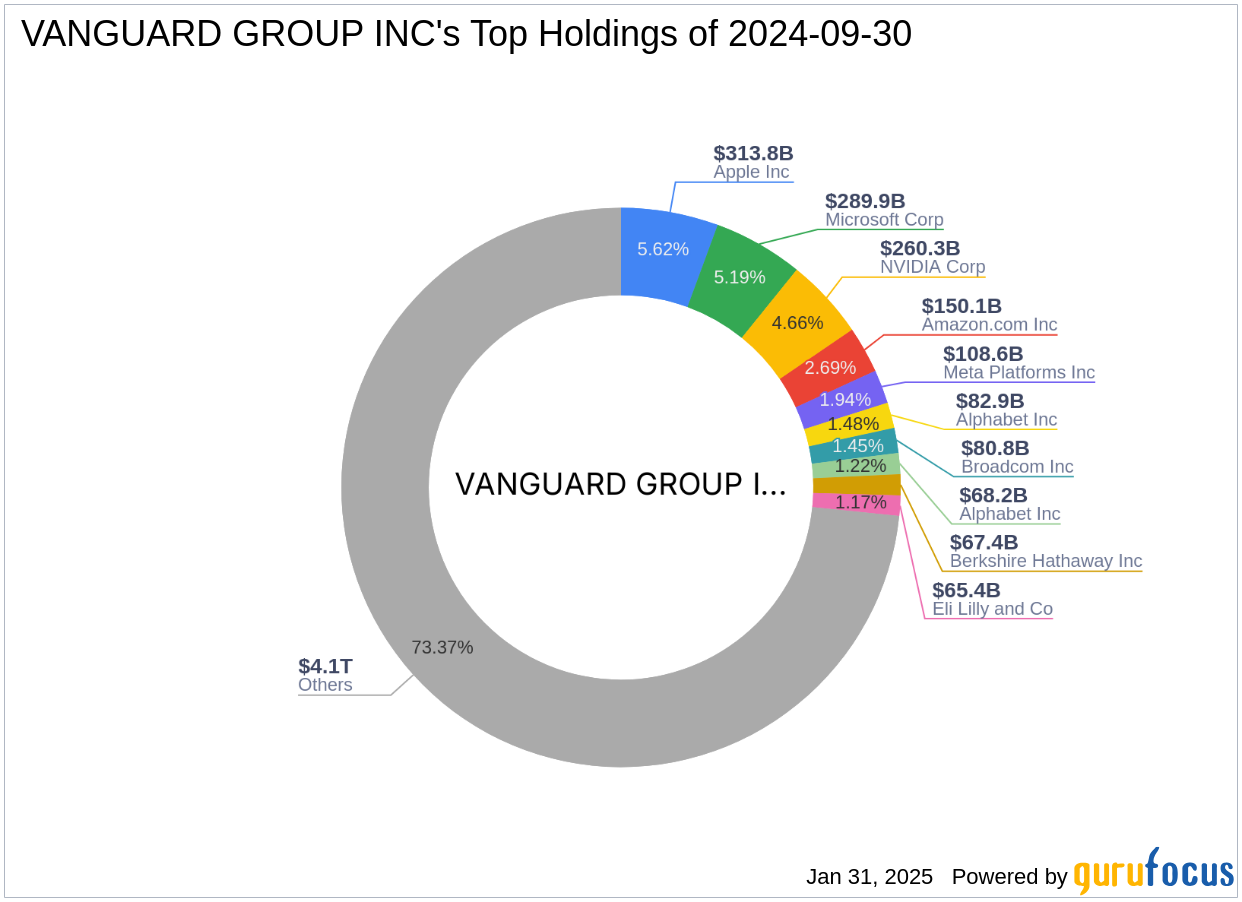

Founded in 1975 by John C. Bogle, Vanguard Group Inc is renowned for its focus on mutual funds and cost efficiency. The firm operates under a client-owned structure, which allows it to offer low-cost mutual funds and maintain a strong presence in the technology and financial services sectors. Vanguard's competitive edge is further enhanced by its introduction of index mutual funds, which have contributed to its reputation for cost efficiency. Over the years, Vanguard has expanded globally, offering a variety of investment products and services to over 20 million clients worldwide.

BayCom Corp: Company Overview

BayCom Corp, established in 2004, is a bank holding company for United Business Bank. It provides a wide range of financial services to businesses and individuals, with a focus on small to medium-sized businesses. The company's offerings include deposit products, personal accounts, loans, online banking, and cash management services. BayCom Corp's strategic focus on serving professional firms, real estate professionals, and nonprofit entities positions it as a key player in the financial services industry.

Current Valuation and Performance of BayCom Corp

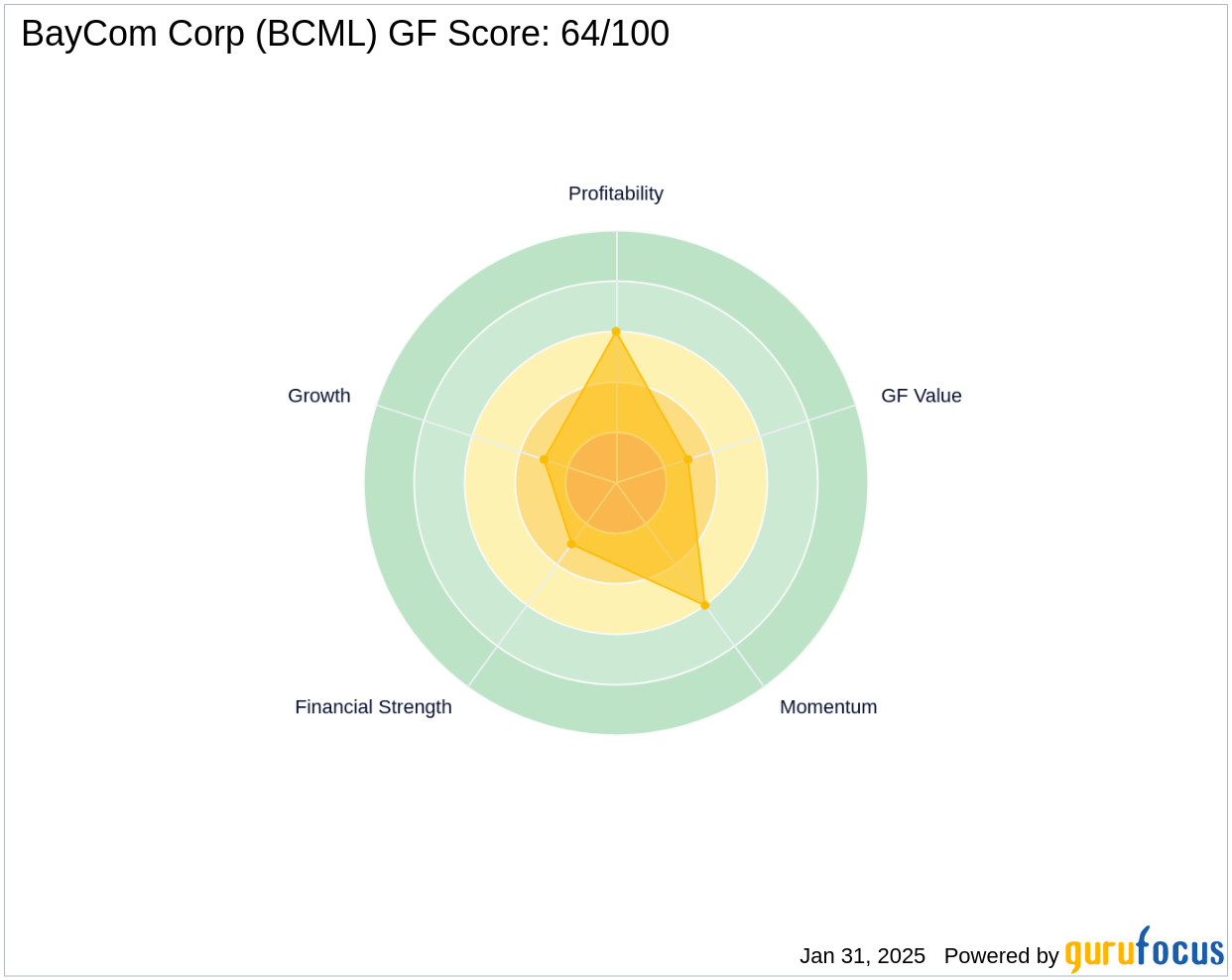

As of January 31, 2025, BayCom Corp's stock is priced at $28.52, with a market capitalization of $317.184 million. The stock is considered significantly overvalued, with a GF Value of $21.00 and a Price to GF Value ratio of 1.36. Despite this, the company has demonstrated a 3-year revenue growth of 6.10% and an impressive earnings growth of 25.40%. However, the company's GF Score of 64/100 suggests poor future performance potential.

Financial Metrics and Growth Indicators

BayCom Corp operates within the banks industry and has a balance sheet rank of 3/10 and a profitability rank of 6/10. The company's cash to debt ratio stands at 0.27, indicating its financial leverage and liquidity position. Despite these challenges, BayCom Corp has shown resilience with a 3-year earnings growth of 25.40%, reflecting its ability to generate profits in a competitive market.

Industry Context and Competitive Position

BayCom Corp's position within the banks industry is characterized by its focus on serving niche markets such as small to medium-sized businesses and nonprofit entities. The company's growth rank of 3/10 and GF Value rank of 3/10 highlight the challenges it faces in achieving sustainable growth. However, its momentum rank of 6/10 suggests potential for future performance improvements.

Conclusion

Vanguard Group Inc's decision to reduce its stake in BayCom Corp may reflect strategic portfolio adjustments in response to the company's current valuation metrics and growth prospects. Investors should carefully consider BayCom Corp's financial metrics and industry position when evaluating its potential as an investment. The firm's focus on niche markets and its ability to generate earnings growth are key factors to watch in the broader context of the financial services industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.