On December 31, 2024, STATE STREET CORP (Trades, Portfolio) executed a strategic transaction involving Hexcel Corp (HXL, Financial), a prominent player in the aerospace and defense industry. The firm added 4,440 shares of Hexcel Corp at a price of $62.7 per share. This acquisition reflects STATE STREET CORP (Trades, Portfolio)'s continued interest in expanding its holdings within the composite materials sector, which is crucial for aerospace and defense applications. The transaction highlights the firm's confidence in Hexcel Corp's potential for growth and value creation.

STATE STREET CORP (Trades, Portfolio): A Profile of the Investment Firm

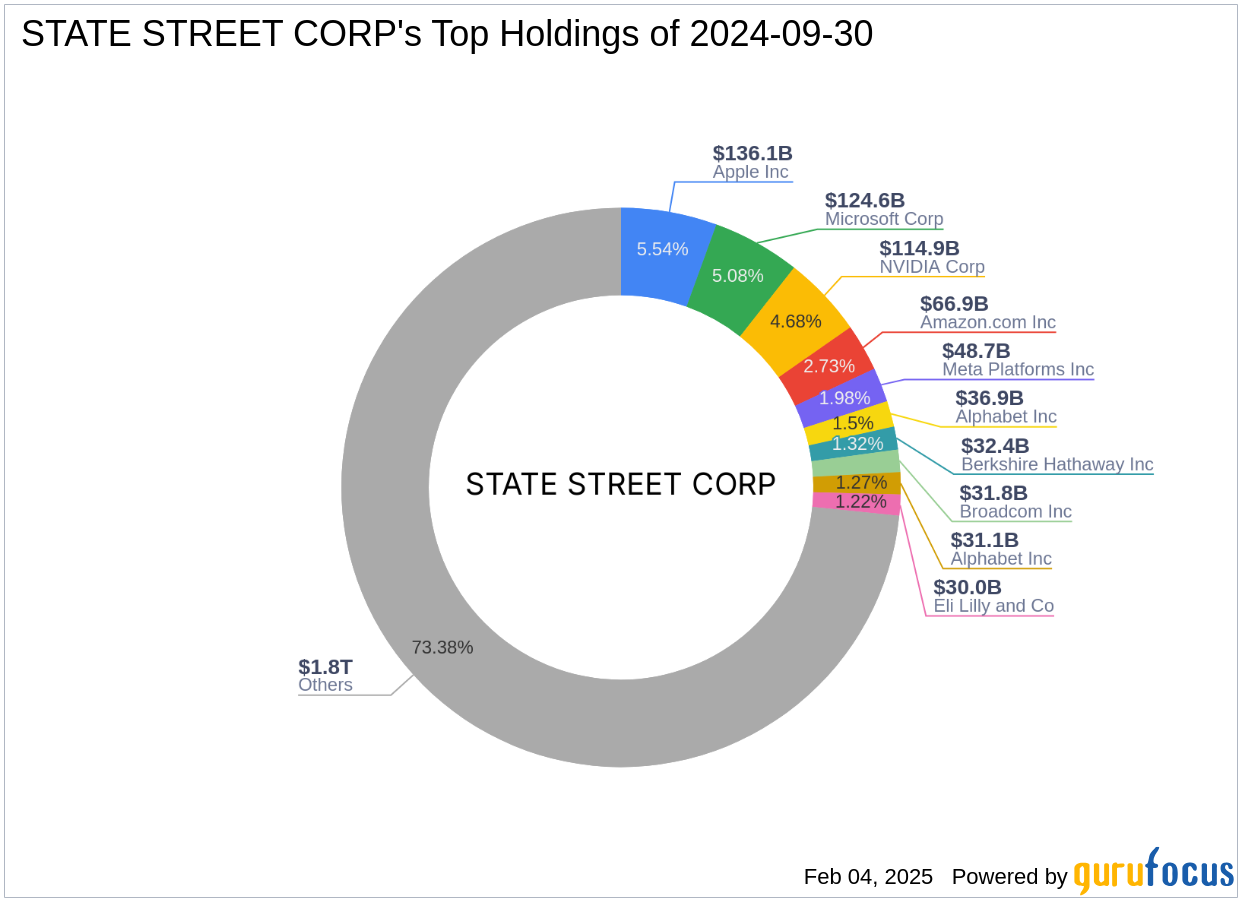

STATE STREET CORP (Trades, Portfolio), headquartered in Boston, MA, is a leading investment firm with a strong focus on the technology and financial services sectors. The firm boasts a diverse portfolio, with top holdings in major companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Meta Platforms Inc (META, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial). With an equity value of $2,454.55 trillion, STATE STREET CORP (Trades, Portfolio) is a significant player in the investment landscape, leveraging its expertise to manage a wide array of assets. The firm's strategic investments are guided by a philosophy that emphasizes long-term growth and value creation.

Hexcel Corp: A Leader in Composite Materials

Founded in 1948, Hexcel Corp is a leading manufacturer of composite materials, primarily serving the aerospace and defense industries. The company is renowned for its innovative lightweight materials, which are essential for aircraft frames, wings, engines, and other components. With a market capitalization of $5.24 billion, Hexcel Corp is a key supplier to major aerospace companies like Airbus and Boeing. The company's products are designed to perform under rigorous conditions, offering a competitive edge in the market.

Details of the Recent Transaction

The recent transaction increased STATE STREET CORP (Trades, Portfolio)'s total holdings in Hexcel Corp to 4,064,989 shares. This addition represents a 0.11% change in the firm's position in Hexcel Corp, which now constitutes 5% of the firm's holdings. The strategic move underscores STATE STREET CORP (Trades, Portfolio)'s commitment to enhancing its investment in companies with strong growth potential and robust market positions.

Financial Metrics and Valuation of Hexcel Corp

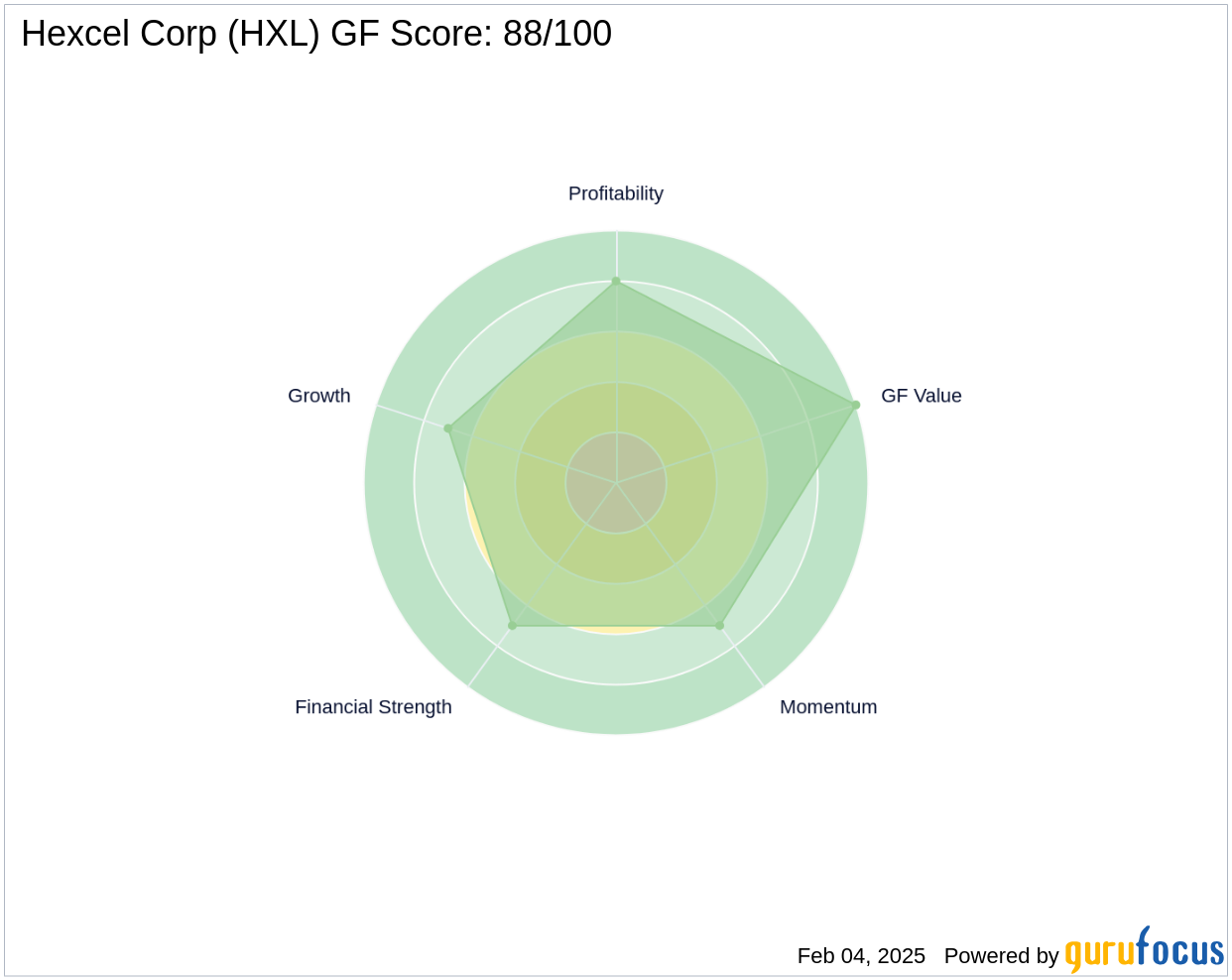

Hexcel Corp is currently trading at $64.7, with a price-to-earnings (PE) ratio of 40.69, indicating a modest undervaluation based on its GF Value of $78.79. The company has a GF Score of 88/100, suggesting good outperformance potential. These metrics reflect Hexcel Corp's strong financial health and its ability to deliver value to shareholders over the long term.

Performance and Growth Indicators

Hexcel Corp has demonstrated strong growth, with a 3-year revenue growth rate of 13.60% and an earnings growth rate of 95.90%. The company's profitability and growth ranks are 8/10 and 7/10, respectively, reflecting a solid financial foundation. These indicators highlight Hexcel Corp's ability to capitalize on market opportunities and drive sustainable growth.

Other Notable Investors in Hexcel Corp

In addition to STATE STREET CORP (Trades, Portfolio), other prominent investors in Hexcel Corp include Mario Gabelli (Trades, Portfolio), Tom Gayner (Trades, Portfolio), and Ken Fisher (Trades, Portfolio). Brandes Investment holds the largest share percentage in Hexcel Corp among the gurus, showcasing the widespread interest and confidence in the company's future prospects.

Transaction Analysis and Impact

The acquisition of additional shares in Hexcel Corp by STATE STREET CORP (Trades, Portfolio) is a strategic move that aligns with the firm's investment philosophy of targeting companies with strong growth potential. This transaction not only increases the firm's exposure to the aerospace and defense sector but also enhances its portfolio's overall value. As Hexcel Corp continues to innovate and expand its market presence, STATE STREET CORP (Trades, Portfolio)'s investment is poised to yield significant returns, reinforcing the firm's position as a leading investment entity.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.