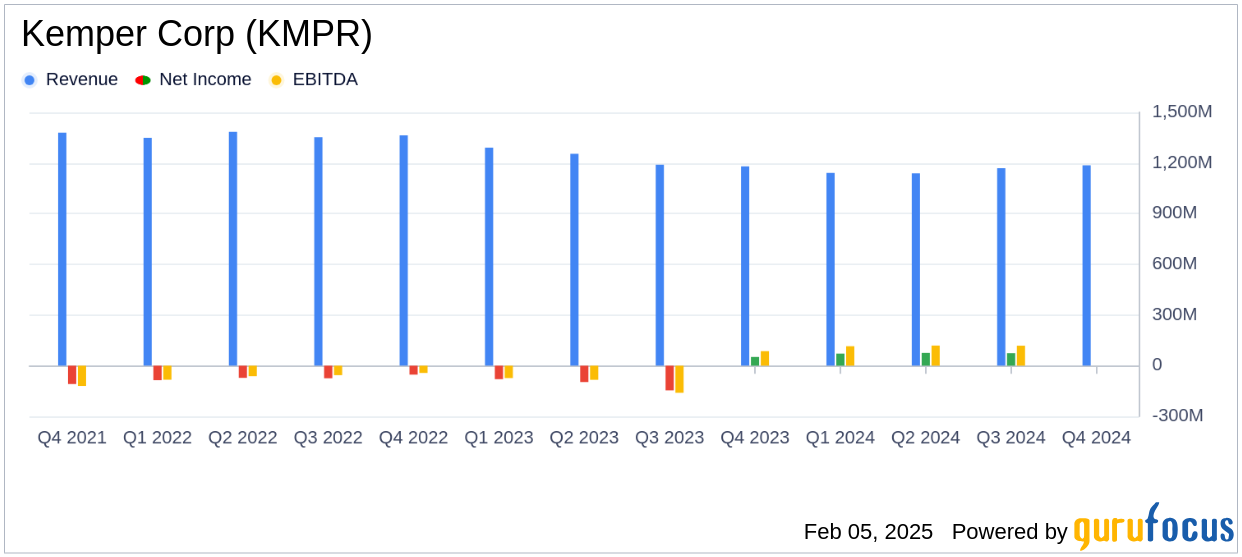

On February 5, 2025, Kemper Corp (KMPR, Financial) released its 8-K filing detailing its fourth-quarter 2024 earnings. The diversified insurance company, known for its property and casualty insurance as well as life and health insurance services, reported a net income of $97.4 million, or $1.51 per diluted share. This performance significantly exceeded the analyst estimate of $1.32 per share. The company's revenue for the quarter was $1,186.8 million, surpassing the estimated $1,082.84 million.

Performance Highlights and Challenges

Kemper Corp's fourth-quarter results reflect a strong operational performance, particularly in its Specialty Property & Casualty Insurance segment, which achieved a 5.1% year-over-year growth in policies in force. The segment reported an adjusted net operating income of $101.2 million, a substantial increase from $45.3 million in the same quarter of the previous year. This growth was driven by higher average earned premiums per exposure and lower underlying claim frequency.

Despite these achievements, the company faces challenges such as the impact of catastrophe losses and related loss adjustment expenses, which affected net income by $4.3 million in the fourth quarter. These challenges highlight the volatility inherent in the insurance industry, which can impact profitability.

Financial Achievements and Industry Relevance

Kemper Corp's financial achievements are noteworthy, with a reported return on equity (ROE) of 14.0% and an adjusted ROE of 21.4% for the quarter. These metrics are crucial for insurance companies as they indicate the efficiency with which the company is using its equity to generate profits. The company's strong liquidity position, with $1.3 billion in parent liquidity, further underscores its financial stability.

Key Financial Metrics and Statements

The company's total revenues for the fourth quarter were $1,186.8 million, slightly down from $1,187.2 million in the previous year. However, the Specialty Property & Casualty Insurance segment saw an increase in earned premiums to $954.8 million from $865.6 million. The Life Insurance segment also reported an increase in adjusted net operating income to $23.5 million, driven by favorable mortality experience.

On the balance sheet, Kemper Corp reported total assets of $12,630.4 million as of December 31, 2024, with shareholders' equity increasing by 11% to $2,788.4 million. The company's book value per share rose to $43.68, reflecting a 12% increase from the previous year.

Commentary and Analysis

“I’m pleased to report that we delivered very strong results for the year and even stronger results for the quarter,” said Joseph P. Lacher, Jr., President and CEO. “Our core businesses are performing very well, led by Specialty Auto’s operating results including solid policies in force growth and an underlying combined ratio outperforming long-term expectations.”

Kemper Corp's strong performance in the fourth quarter of 2024, particularly in its Specialty Property & Casualty segment, underscores its competitive advantages and ability to meet the needs of underserved markets. The company's focus on strengthening its balance sheet and maintaining financial flexibility positions it well for future growth and profitability.

For more detailed financial information, visit the 8-K filing on the SEC website.

Explore the complete 8-K earnings release (here) from Kemper Corp for further details.