- AppLovin Corporation announces a strategic addition to its Board with industry veteran Maynard Webb.

- Analyst forecasts suggest a potential 85.24% upside for AppLovin's stock price.

- Current AppLovin brokerage recommendations hint at an "Outperform" status.

AppLovin Corporation (APP) has strategically expanded its Board of Directors by appointing Maynard Webb, an industry expert with substantial experience from notable firms such as Visa and Salesforce. Webb joins as an independent director and will serve on significant board committees. Conversely, Ted Oberwager has announced he will not stand for re-election at the forthcoming stockholder meeting.

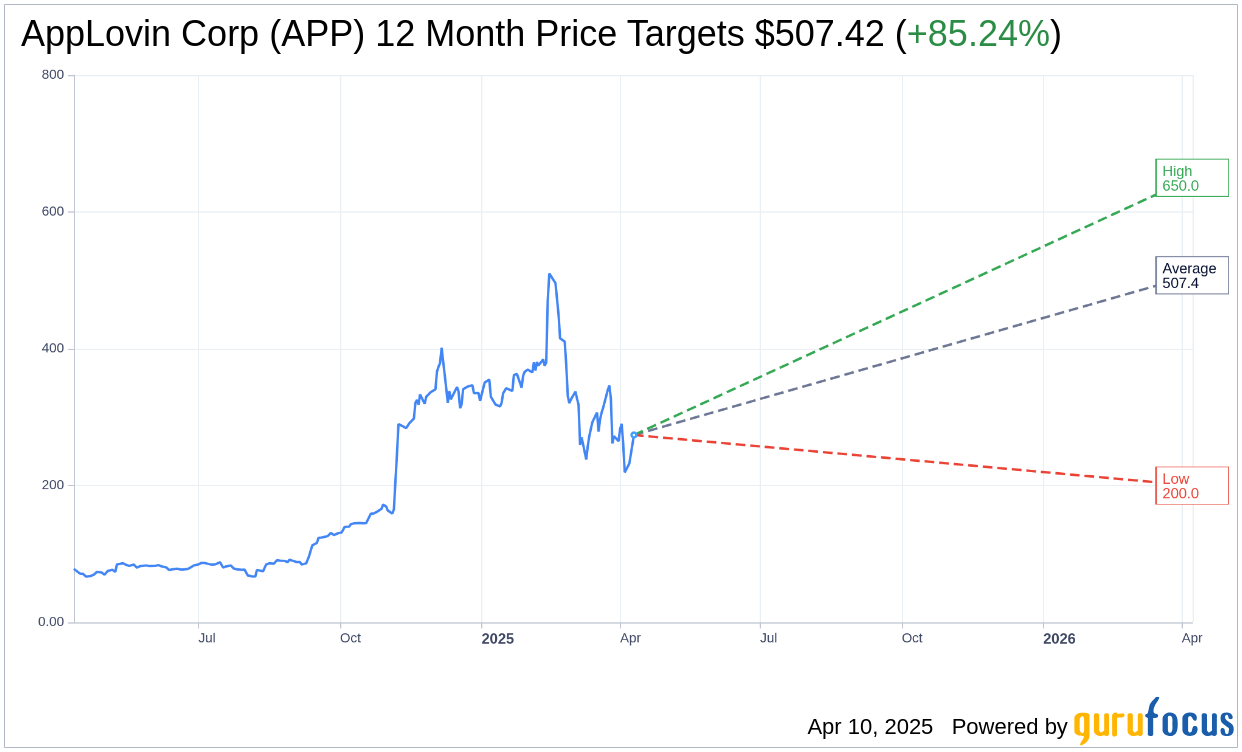

Wall Street Analysts Forecast

According to assessments from 21 analysts, the average one-year price target for AppLovin Corp (APP) stands at $507.42. The projections include a high estimate of $650.00 and a low estimate of $200.00. This average target suggests a significant upside potential of 85.24% from the current stock price of $273.93. Investors can view more detailed analyst estimates on the AppLovin Corp (APP, Financial) Forecast page.

Brokerage Recommendations

The consensus recommendation from 27 brokerage firms currently rates AppLovin Corp's stock with an average recommendation of 2.0, which suggests an "Outperform" status. This rating system ranges from 1 to 5, where 1 represents a Strong Buy, and 5 indicates a Sell.

GuruFocus Valuation

According to GuruFocus estimates, the projected GF Value for AppLovin Corp (APP, Financial) over the next year is $90.07. This valuation implies a potential downside of 67.12% from the current trading price of $273.93. The GF Value is GuruFocus's calculated estimate of the fair trading value of a stock, based on its historical trading multiples, past business performance, and future business growth projections. For more detailed information, visit the AppLovin Corp (APP) Summary page.