KeyBanc has adjusted its price target for Simulations Plus (SLP, Financial), boosting it from $32 to $40, while maintaining an Overweight rating on the stock. This change comes ahead of the company's first-quarter earnings report, reflecting cautious optimism amidst broader industry concerns.

As the new quarter unfolds, KeyBanc anticipates that the healthcare information technology (HCIT) sector will be heavily influenced by legislative developments, healthcare system usage, and overarching economic conditions including a decelerating economy and potential inflationary pressures. Despite these challenges, valuations within the HCIT space are still seen as lower compared to the broader healthcare industry.

KeyBanc suggests that investors should prioritize companies capable of exceeding expectations over the next year. The firm identifies the least risk from revenue and earnings standpoints in companies with strong positions in the stable healthcare markets, especially those serving major pharmaceutical firms and healthcare payers.

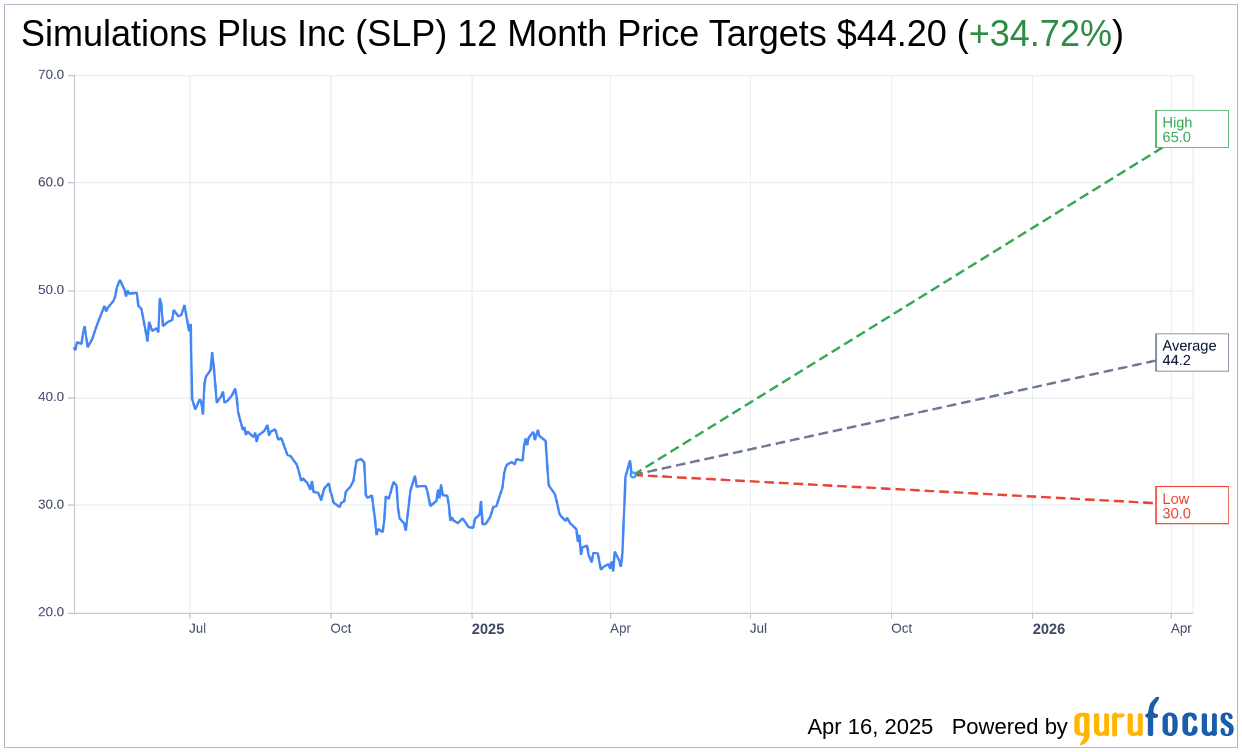

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Simulations Plus Inc (SLP, Financial) is $44.20 with a high estimate of $65.00 and a low estimate of $30.00. The average target implies an upside of 34.72% from the current price of $32.81. More detailed estimate data can be found on the Simulations Plus Inc (SLP) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, Simulations Plus Inc's (SLP, Financial) average brokerage recommendation is currently 1.6, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Simulations Plus Inc (SLP, Financial) in one year is $72.33, suggesting a upside of 120.45% from the current price of $32.81. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Simulations Plus Inc (SLP) Summary page.