Badger Meter, Inc. (BMI, Financial) has surpassed market expectations in its first-quarter financial results, posting a revenue of $222.21 million. This figure exceeds the projected $220.76 million, reflecting robust customer demand and effective operational strategies that have contributed to significant revenue growth and record margins. The company attributes its success to a stable business model supported by positive industry trends driving interest in its innovative smart water solutions.

Since acquiring SmartCover in late January, Badger Meter has been focusing on integrating its new asset. The incorporation of SmartCover’s sewer and lift-station monitoring technologies into Badger Meter’s BlueEdge(R) platform has been well-received by customers, bolstering the company’s portfolio of customizable water management solutions. This strategic move is part of Badger Meter’s efforts to enhance its offerings and maintain a competitive edge in the market.

The leadership team, led by Chairman, President, and CEO Kenneth Bockhorst, credits the company’s employees for their role in achieving these impressive results. As Badger Meter continues to advance its integration process and leverages the capabilities of its expanded product lineup, it remains poised for continued success in the evolving water management industry.

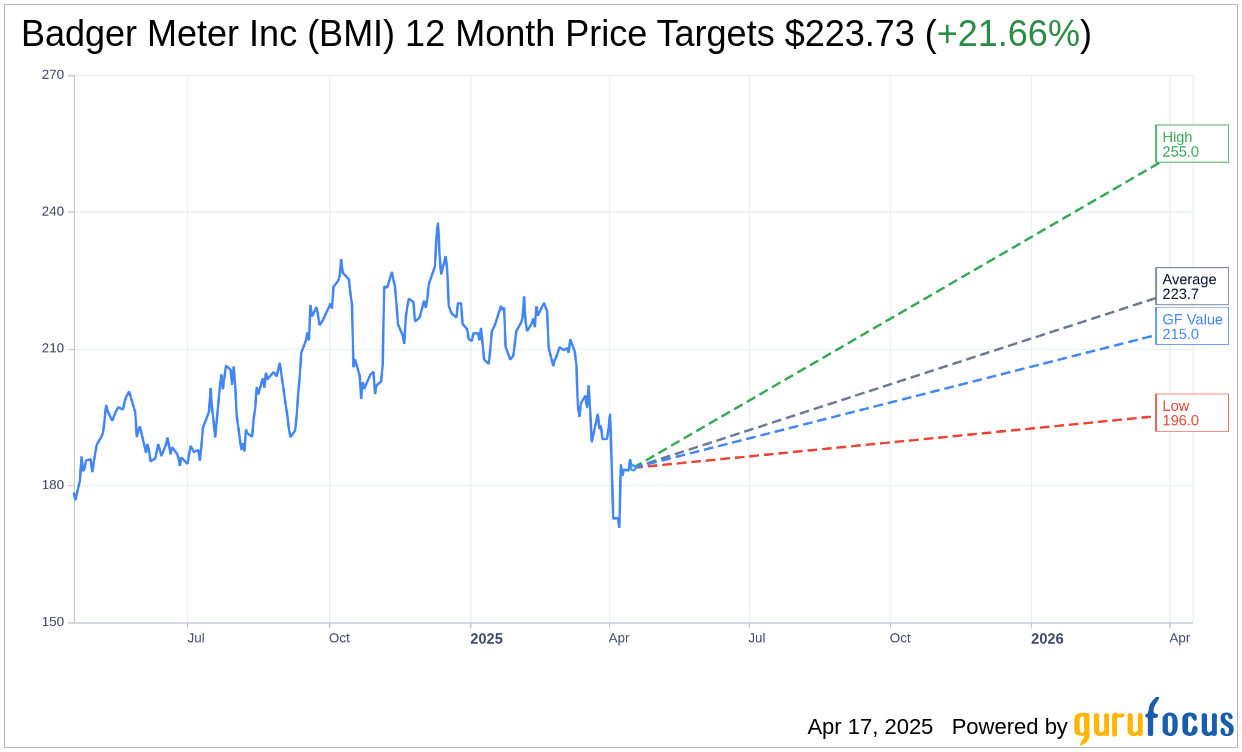

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Badger Meter Inc (BMI, Financial) is $223.73 with a high estimate of $255.00 and a low estimate of $196.00. The average target implies an upside of 21.66% from the current price of $183.90. More detailed estimate data can be found on the Badger Meter Inc (BMI) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Badger Meter Inc's (BMI, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Badger Meter Inc (BMI, Financial) in one year is $215.04, suggesting a upside of 16.93% from the current price of $183.9. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Badger Meter Inc (BMI) Summary page.