Summary:

- Badger Meter's (BMI, Financial) Q1 performance surpassed expectations with a 13.2% revenue increase.

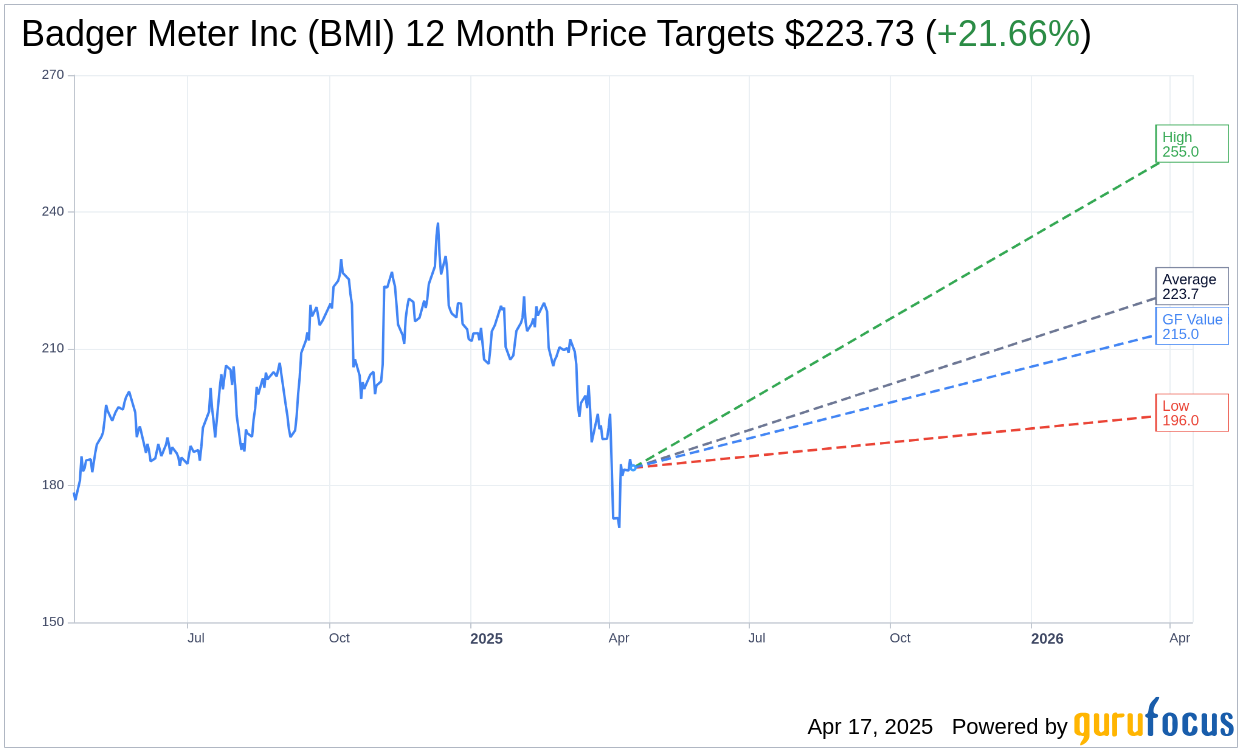

- Wall Street analysts predict an average upside of 21.66% from the current stock price.

- The company's growth potential in the water industry remains strong despite a slight tax rate increase.

Badger Meter Inc. (BMI) has reported an impressive first quarter, showcasing its solid footing in the industry. With GAAP earnings per share at $1.30, the figures exceeded expectations by $0.27. Revenue soared to $222.2 million, reflecting a notable 13.2% increase year-over-year, surpassing estimates by $1.44 million. Though the tax rate nudged upwards to 24.4%, the company is optimistic about continued growth in the water sector.

Wall Street Analysts' Forecast

According to projections from seven seasoned analysts, Badger Meter Inc. (BMI, Financial) is set for potential growth, with an average target price pinned at $223.73. Estimates range between a high of $255.00 and a low of $196.00. This target suggests a promising upside of 21.66% from the current price of $183.90. For more nuanced details, explore the Badger Meter Inc (BMI) Forecast page.

The company's average brokerage recommendation, garnered from nine brokerage firms, stands at 2.4, indicative of an "Outperform" status. This rating underscores a favorable viewpoint, where a score of 1 suggests a Strong Buy, while 5 indicates a Sell.

Leveraging GuruFocus data, the estimated GF Value for Badger Meter Inc. (BMI, Financial) in the forthcoming year is positioned at $215.04, implying a substantial upside of 16.93% from the current stock price of $183.90. The GF Value reflects GuruFocus' calculated estimation of the stock's fair trading value. This is derived from historical trading multiples, past growth metrics, and prospective business performance forecasts. For comprehensive insights, visit the Badger Meter Inc (BMI) Summary page.