CZWI announced a minor dip in net interest income for the quarter ending March 31, 2025, totaling $11.6 million. This reflects a decrease from $11.7 million in the previous quarter and $11.9 million in the same quarter last year. Despite this decline, the company's book value per share saw a modest increase, rising to $18.02 from $17.94 at the close of 2024.

The firm is optimistic about its financial positioning for the rest of 2025, highlighting robust capital and liquidity standings along with strong credit metrics. The tangible common equity (TCE) ratio stands at 8.5%, providing a buffer against uncertainties and allowing for potential share repurchases.

With a loan-to-deposit ratio under 90%, CZWI anticipates supporting loan growth in the low to mid-single digits, focusing on quality borrowers and strategic relationships. The company expects that loan repricing and new originations will aid in expanding the net interest margin, particularly in the latter half of 2025 and into 2026.

Market conditions remain stable, with unemployment rates below the national average, and any potential exposure to tariffs appears to be indirect. This stability forms a conducive environment for CZWI's forecasted financial improvements.

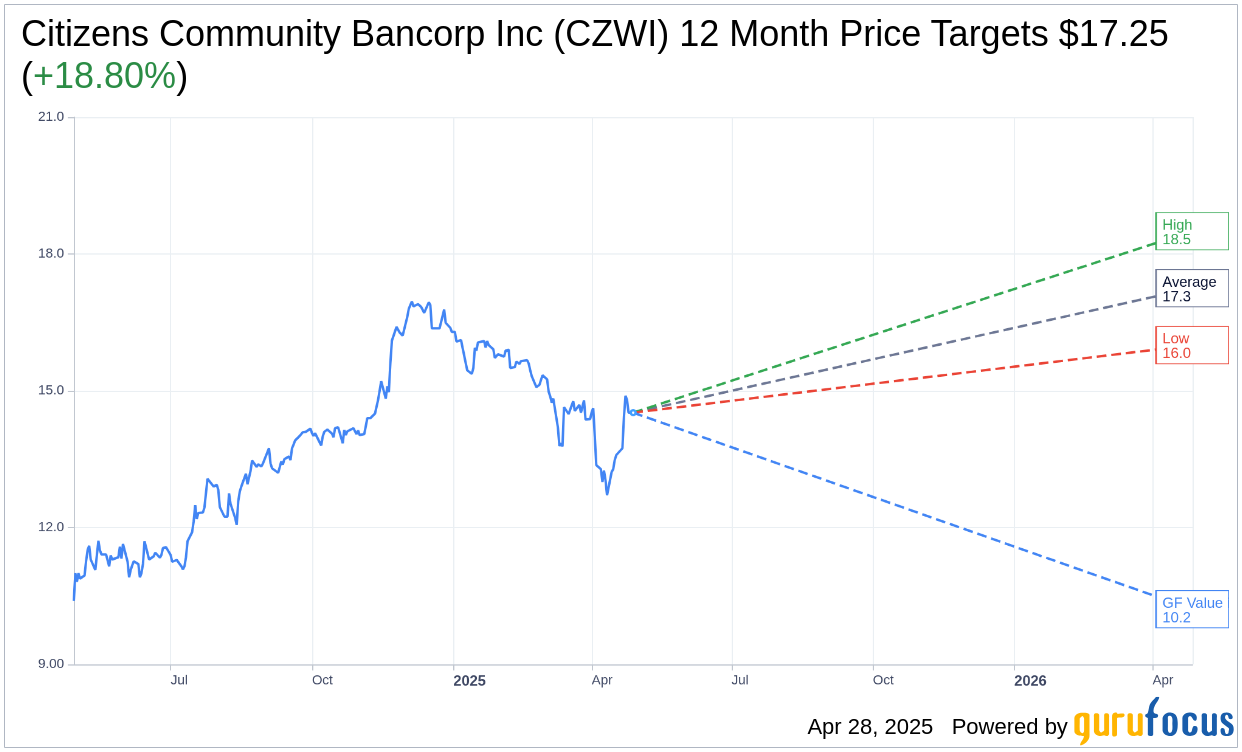

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for Citizens Community Bancorp Inc (CZWI, Financial) is $17.25 with a high estimate of $18.50 and a low estimate of $16.00. The average target implies an upside of 18.80% from the current price of $14.52. More detailed estimate data can be found on the Citizens Community Bancorp Inc (CZWI) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Citizens Community Bancorp Inc's (CZWI, Financial) average brokerage recommendation is currently 1.5, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Citizens Community Bancorp Inc (CZWI, Financial) in one year is $10.21, suggesting a downside of 29.68% from the current price of $14.52. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Citizens Community Bancorp Inc (CZWI) Summary page.