EZPW reported second-quarter revenues of $306.32 million, slightly falling short of the projected $310.35 million. The company, under CEO Lachie Given's leadership, showcased remarkable operational and financial results. A record-breaking Q2 PLO contributed to substantial growth in both revenue and pawn service charges. Ongoing inflation and economic challenges are prompting value-focused consumers to seek EZPW's offerings for short-term cash solutions and secondhand products. The company's robust operational framework and exceptional customer service significantly boosted its performance, resulting in a 23% increase in adjusted EBITDA, reaching $45.1 million.

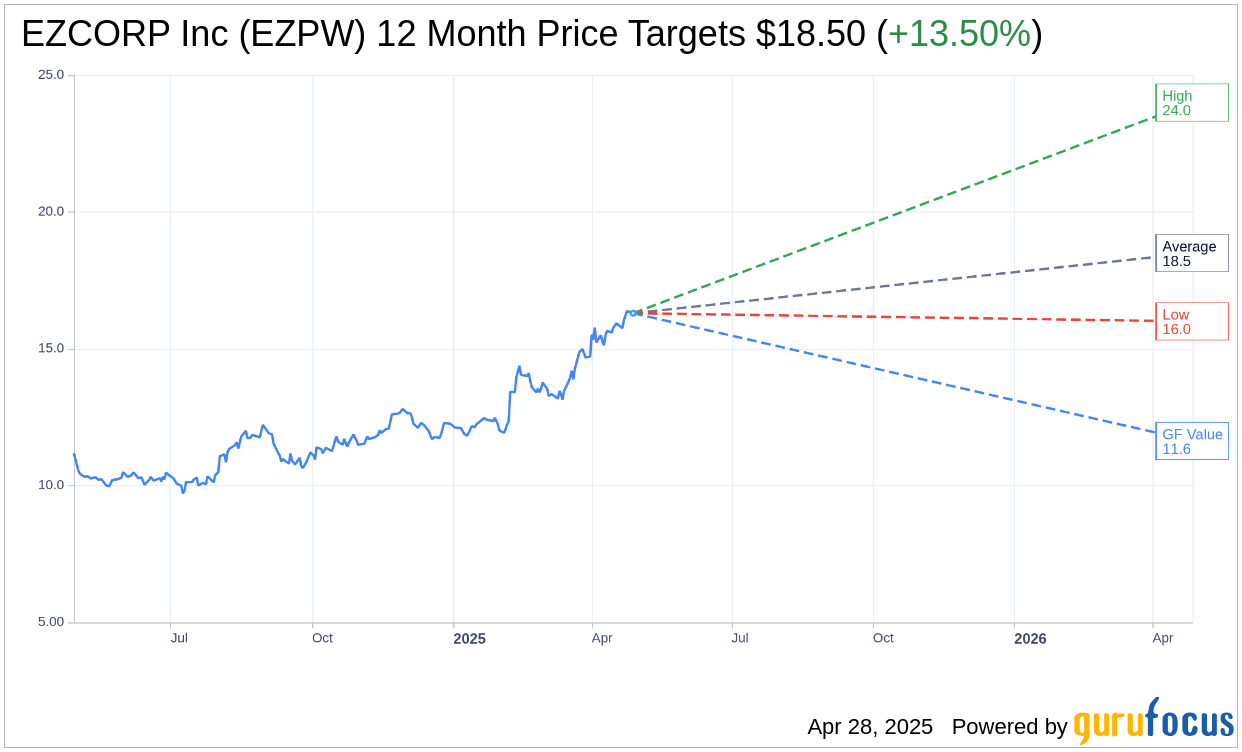

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for EZCORP Inc (EZPW, Financial) is $18.50 with a high estimate of $24.00 and a low estimate of $16.00. The average target implies an upside of 13.50% from the current price of $16.30. More detailed estimate data can be found on the EZCORP Inc (EZPW) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, EZCORP Inc's (EZPW, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for EZCORP Inc (EZPW, Financial) in one year is $11.63, suggesting a downside of 28.65% from the current price of $16.3. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the EZCORP Inc (EZPW) Summary page.

EZPW Key Business Developments

Release Date: February 06, 2025

- Total Revenue: $329.7 million, a 10% year-over-year increase.

- PLO (Pawn Loans Outstanding): $282.9 million, up 16% year-over-year.

- EBITDA: $53 million, a 12% increase.

- Diluted EPS: $0.42, up 17%.

- Store Count: 1,283 stores, including four new de novo stores.

- Cash Balance: $174.5 million, an increase of $4 million from the previous quarter.

- Merchandise Sales: $192.9 million, an 8% increase.

- EBITDA Margin: 16.1%, an increase of 35 basis points.

- US Revenue: $232.2 million, a 7% increase.

- Latin America Revenue: $97.5 million, an 18% increase.

- Inventory Turnover Rate: 2.7 times.

- US Pawn EBITDA: $55.6 million, up 11%.

- Latin America EBITDA: $14.6 million, a 20% increase.

- Convertible Notes: $333 million on the balance sheet.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- EZCORP Inc (EZPW, Financial) reported a 10% year-over-year increase in total revenue, reaching $329.7 million.

- The company achieved a 16% growth in Pawn Loan Originations (PLO), totaling $282.9 million.

- EBITDA increased by 12% to $53 million, with diluted EPS rising 17% to $0.42.

- EZCORP Inc (EZPW) expanded its store network by adding four new de novo stores in Latin America.

- The Easy Plus rewards program accounted for 77% of all transactions, indicating strong customer loyalty and engagement.

Negative Points

- Merchandise gross margin decreased by 61 basis points due to increased promotional activity and customer negotiation.

- The inventory turnover rate decreased to 2.7 times from 3 times, indicating slower inventory movement.

- The company faces potential challenges from wage increases in Latin America, impacting expenses.

- There is uncertainty regarding the impact of potential deportations on the company's customer base.

- The acquisition of Auto deniro in Mexico is still pending, indicating potential delays in strategic expansion.